News

Measures to promote foreign direct investment increased in 2014, UNCTAD Report says

An increase in measures taken by Governments to liberalize foreign direct investment, combined with a fall in restrictions, led to enhanced conditions for foreign direct investment promotion in 2014 according to the UNCTAD World Investment Report 2015.

Thirty-seven countries and economies adopted at least 63 policy measures – of these, 47 were related to liberalization, promotion and facilitation of investment while just 9 introduced new restrictions or regulations on investment (mostly related to national security concerns and strategic industries). The share of liberalization and promotion increased from 73 per cent in 2013 to 84 per cent in 2014 (figure 1).

“In 2014, more than 80 per cent of investment policy measures were aimed at improving entry conditions and reducing restrictions, with the focus on investment facilitation and sector-specific liberalization,” UNCTAD Secretary-General Mukhisa Kituyi said. “However, UNCTAD notes that relatively few measures – 8 per cent since 2010 – were specifically targeted at increasing private sector participation in key sustainable development sectors such as infrastructure, health, education and climate change mitigation.”

Developing countries were particularly active as regards investment liberalization. For example, Ethiopia opened the electricity generation and distribution sector to private investment, India liberalized foreign investment in railway infrastructure and raised the foreign direct investment cap in the defence sector, and Indonesia increased the foreign investment cap in several industries including for pharmaceuticals, venture capital operations and power plant projects. As regards new investment restrictions or regulations, for example, France, Italy and the Russian Federation amended their security-related review mechanisms.

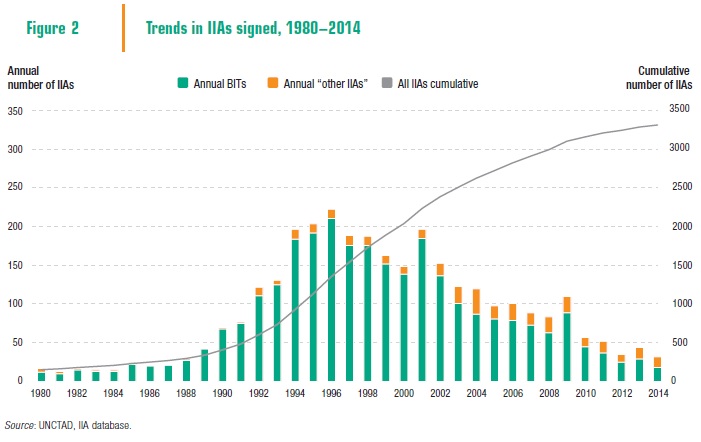

With the addition of 31 international investment agreements in 2014, the international investment agreement regime comprised a total of 3,267 treaties of which 2,923 were bilateral investment treaties and 345 were other types of international investment agreements (figure 2).

The number of new international investment agreements continued to slow down in 2014, following a steady trend since the end of the 1990s. The report also reviews international investment agreements concluded in 2014 and finds that they include provisions geared towards safeguarding the right to regulate for the public interest, including for sustainable development objectives. For example, the new agreements tend to incorporate general exceptions, clarifications to key protection standards, clauses that explicitly recognize that the parties should not relax health, safety or environmental standards in order to attract investment, limits on the scope of treaties and carefully crafted investor-State dispute settlement provisions. All these provisions are important elements in the current debate over international investment agreement reform.

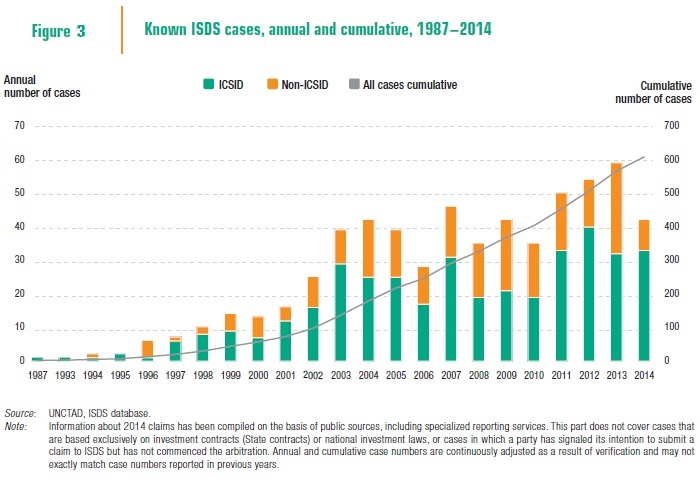

Also, the report reveals that in 2014, investors initiated 42 known investor-State dispute settlement cases pursuant to international investment agreements (figure 3), representing an important drop from the level initiated in the three previous years and more on a par with the average number of disputes in the years 2003-2009. In 2014, investors challenged, among other things, government measures in utilities, energy and renewables such as the revocation of licences for the supply of electricity and gas, the regulation of energy and water tariffs, and the cancellation of investment incentives schemes in solar energy.

World Investment Report 2015: Reforming International Investment Governance

This year’s World Investment Report, the 25th in the series, aims to inform global debates on the future of the international policy environment for cross-border investment.

Following recent lackluster growth in the global economy, this year’s Report shows that Foreign Direct Investment (FDI) inflows in 2014 declined 16 per cent to $1.2 trillion. However, recovery is in sight in 2015 and beyond. FDI flows today account for more than 40 per cent of external development finance to developing and transition economies.

This year’s Report is particularly timely in light of the Third International Conference on Financing for Development in Addis Ababa – and the many vital discussions underscoring the importance of FDI, international investment policy making and fiscal regimes to the implementation of the new development agenda and progress towards the future sustainable development goals.

The World Investment Report tackles the key challenges in international investment protection and promotion, including the right to regulate, investor-state dispute settlement, and investor responsibility. Furthermore, it examines the fiscal treatment of international investment, including contributions of multinational corporations in developing countries, fiscal leakage through tax avoidance, and the role of offshore investment links.

The Report offers a menu of options for the reform of the international investment treaties regime, together with a roadmap to guide policymakers at the national, bilateral, regional and multilateral levels. It also proposes a set of principles and guidelines to ensure coherence between international tax and investment policies.