Blog

South Africa’s trade data update – the May 2020 data reveals the effect of eased lockdown restrictions

Since the beginning of May 2020 South Africa gradually started to ease lockdown restrictions with a consequent increase in trade reflected in pdf South Africa’s trade data for May (589 KB) which was released by the South African Revenue Services (SARS) on 30 June 2020. However, while exports show signs of improvements imports have remained relatively constant throughout the lockdown period, which is at significantly lower levels than imports in May 2019. Consequently, South Africa has a trade surplus for May 2020 after a significant trade deficit for April 2020.

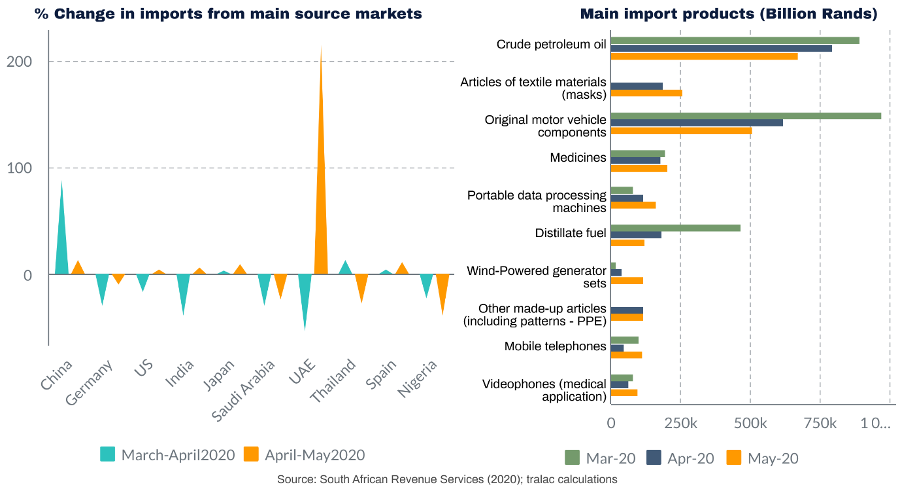

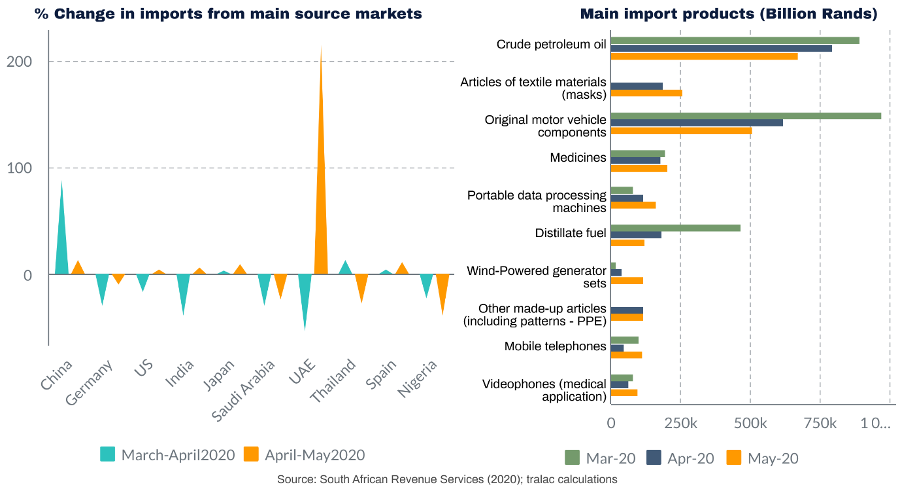

In comparison with May 2019, imports for May 2020 are 22 per cent lower, mainly due to a decline in imports from Europe, US, India, Nigeria and Eswatini. Respective imports from China, Brazil, Netherlands, Mozambique and Finland for May 2020 are 12 per cent, 5 per cent, 18 per cent, 13 per cent and 91 per cent higher than imports for May 2019. Imports from these countries are either personal protection equipment (PPE) and medical equipment (China and Netherlands (animal vaccines)) or food products including chicken (Brazil and Netherlands), rice (Brazil), oats and wheat (Finland), soybean and seed oils (Netherlands), and bananas, cashews and macadamia nuts from Mozambique.

Imports from some countries have shown a steady increase during the lockdown period; while total imports for May 2020 are 9 per cent lower than imports for March 2020, imports from countries including China, Japan, Spain, Brazil and South Korea for May exceed imports from these countries prior to March 2020. The increase in imports from China and South Korea is mainly due to imports of PPE and diagnostic reagents and equipment. The increase in imports from Brazil is food products, from Spain wind-powered generating sets and Japan original motor vehicle component parts. Since April China has surpassed Germany as the main supplying country due to imports of significant quantities of PPE and equipment with medical applications.

Imports from other African countries also started to recover during May with imports from neighbouring countries Eswatini (sugar), Mozambique (coal and nuts), Namibia (live animals, zinc, diamonds and fish), Botswana (diamonds and ignition wire sets), Lesotho (wool, trout and bread flour) and Zimbabwe (tobacco, coke of coal, tea and nuts) increasing. There has also been a surge in imports from some countries which saw imports decline to almost zero during April. These include Cameroon (imports of technical specified rubber, PPE and wood), Ivory Coast (cocoa paste and technical specified rubber), Seychelles (parts for helicopters) and Zambia (copper, manganese, cotton and animal feed).

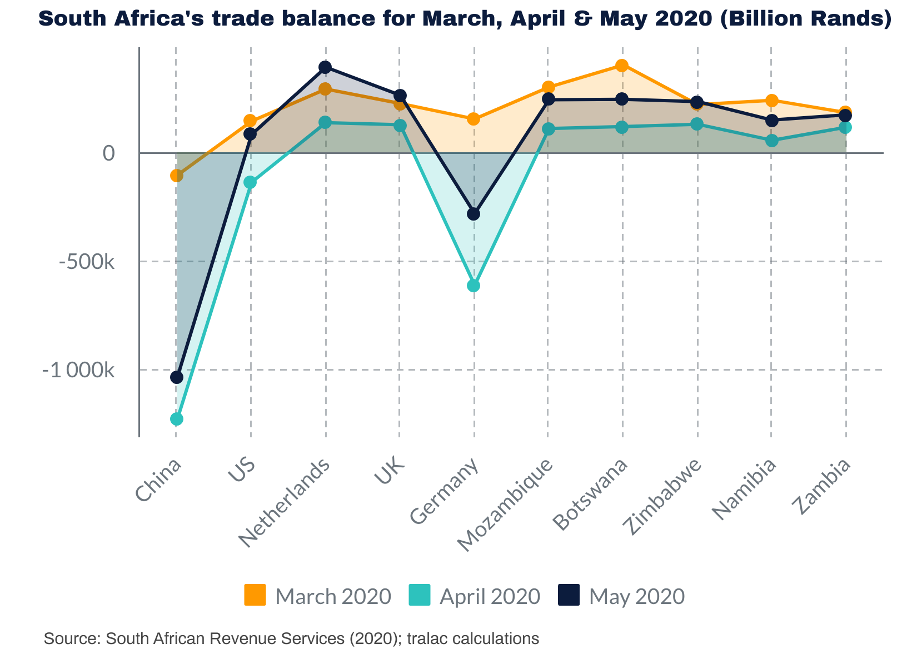

Between March and April 2020 South Africa’s world exports more than halved, but at the end of May exports were almost back up at March 2020 levels. However, exports for May 2020 are still eight per cent lower than exports for May 2019. Most of South Africa’s traditional export products (semi-manufactured gold, coal, iron ores and other ores and concentrates) recovered; most of these exports fell by more than half between March and April. Exports to most trade partners recovered to March 2020 levels although there are some exceptions, mainly due to a significant decline in exports of motor vehicles.

-

Exports to Germany have remained at a third of exports in March 2020 and half the exports in May 2019 due to a decline in exports of coins and vehicles.

-

Exports to both India and Australia remained at half the exports to each country in comparison with exports in both March 2020 and May 2019. Exports of coal, manganese ores, chemical wood pulp and engines to India, and vehicles and vehicle parts to Australia declined.

-

Exports to Botswana is half the exports for both March 2020 and May 2019 due to a decline in exports of fuel (mainly petrol) and electrical energy.

Intra-Africa exports for May are double that of April; mainly electrical energy, coal, maize, ores and concentrates and double-cab vehicles. The increase in exports is mainly due to exports of vehicles, steel structures, cigarettes, medicines and laboratory reagents. Exports are also mainly to neighbouring countries (Mozambique, Botswana, Zimbabwe and Namibia).

The data shows the significant impact of the strict lockdowns on South Africa’s industries and their inability to export. On the one side most of South Africa’s production activities were halted, but with lockdowns in most countries demand for traditional products reduced significantly at the end of March into April. As countries started to lift strict lockdown restrictions exports of traditional products to traditional trade partners have mostly resumed and recovered to pre-March 2020 levels. Although the value of imports has remained relevantly stable between March and May, the composition of imports is showing some longer-term changes with medical equipment and PPE now accounting for seven of the top ten import products.

See a related blog: Strict lockdown regulations – medical and electronic equipment flown in and cross-border road traffic reduced by two-thirds

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...