News

Africa’s Pulse: Global economic weakness continues to be a drag on Africa’s economic growth

Low commodity prices continue to impede growth

Amid falling commodity prices and continuing weakness in global growth, Sub-Saharan Africa’s gross domestic product (GDP) growth decelerated to an estimated 3.0% in 2015 from 4.5% in 2014, according to the latest World Bank projections. This low pace of growth, which translates into an increase in the region’s GDP per capita of less than 0.5%, was last seen in 2009 following the global financial crisis, and contrasts sharply with the robust 6.8% average annual GDP growth in Sub-Saharan Africa (SSA) from 2003-2008.

These figures are outlined in Africa’s Pulse, the World Bank’s twice-yearly analysis of economic trends and latest data for the region. The 2016 growth forecast remains subdued at 3.3 percent, way below the robust 6.8 percent growth in GDP that the region sustained in the 2003-2008 period. Overall, growth is projected to pick up in 2017-2018 to 4.5 percent.

The fall in commodity prices – particularly oil, which fell 67 percent from June 2014 to December 2015 – represents a significant shock for the region, as fuels, ore and metals account for more than 60% of the region’s exports. The impact is seen most in oil-exporting countries, where average growth is estimated to have slowed from 5.4% in 2014 to 2.9% in 2015. Growth fell sharply in Nigeria, the Republic of Congo, and Equatorial Guinea. Activity also weakened significantly in non-energy mineral-exporting countries, including Botswana, Sierra Leone, South Africa and Zambia. In several commodity exporters, adverse domestic developments, such as electricity shortages, severe drought conditions, policy uncertainty, and security threats, exacerbated the direct impact of declining commodity prices.

There were some bright spots, mostly among oil importers, where economic activity remained robust. Côte d’Ivoire saw broad-based growth, supported by a favorable policy environment, rising investment, and increased consumer spending. Ethiopia and Rwanda continued to post solid growth, supported by public infrastructure investment, private consumption, and a growing services sector. Elsewhere, growth remained buoyant in Kenya, amid improving economic stability; Tanzania registered strong growth, underpinned by expansion in construction and services sectors.

The external environment confronting the region is expected to remain difficult. In a number of countries, policy buffers are weaker, constraining these countries’ policy response. Delays in implementing adjustments to the drop in revenues from commodity exports and worsening drought conditions present risks to Africa’s growth prospects.

“As countries adjust to a more challenging global environment, stronger efforts to increase domestic resource mobilization will be needed. With the trend of falling commodity prices, particularly oil and gas, it is time to accelerate all reforms that will unleash the growth potential of Africa and provide affordable electricity for the African people,” says Makhtar Diop, World Bank Vice President for Africa.

Several countries are expected to see moderate growth. Among frontier markets, growth is expected to edge up in Ghana, driven by improving investor sentiment, the launch of new oilfields, and the easing of the electricity crisis. In Kenya, growth is expected to remain robust, supported by private consumption and public infrastructure investment.

The projected pickup in activity in 2017-2018 reflects a gradual improvement in the region’s largest economies – Angola, Nigeria, and South Africa – as commodity prices stabilize and growth-enhancing reforms are implemented.

With commodity prices expected to remain low for longer amid a gradual pickup in global activity, the Pulse forecasts that average growth in the region will remain subdued at 3.3% in 2016. For 2017-18, growth is projected to average 4.5%. The projected pickup in activity in 2017-18 reflects a gradual improvement in the region’s largest economies – Angola, Nigeria, and South Africa – as commodity prices stabilize and policies become more supportive of growth.

“With external conditions likely to remain less favorable than in the past, African countries need to accelerate the pace of structural reforms aimed at boosting competitiveness and diversification,” said Punam Chuhan-Pole, World Bank Africa acting chief economist and author of the report. “In most countries this will mean improving the business climate, reducing the cost of cross-border trade, reforming the energy sector to ensure affordable, reliable, and sustainable energy services, and making the financial sector more inclusive.”

African Cities as Engines of Growth

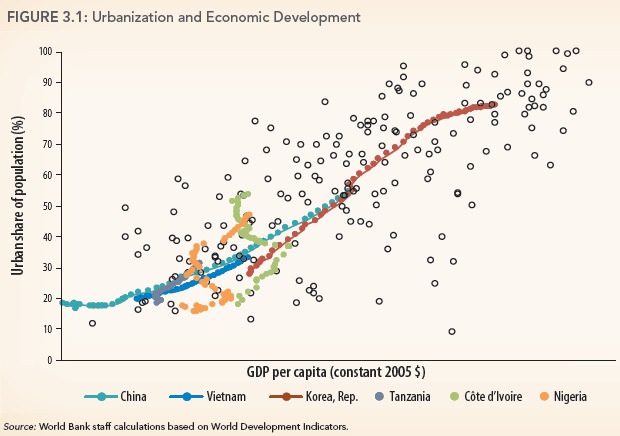

As Africa undergoes rapid urban growth, there is a window of opportunity to harness the potential of cities as engines of economic growth. The rapid decline in oil and commodity prices has adversely affected resource-rich countries and signaled an urgent need for economic diversification in Africa. Urbanization and well managed cities provide a major opportunity to offer a springboard for diversification.

The growth of cities, when well managed, can spur economic growth and productivity. But African cities are currently not delivering agglomeration economies or reaping urban productivity benefits. Today cities in Africa are crowded, disconnected, and costly for families and for companies, according to World Bank research. They suffer from high housing and transport costs, in addition to the high cost of food that takes up a large share of urban household budgets.

Housing and transport are particularly costly in urban Africa. Housing prices are about 55 percent higher in urban areas of African countries relative to their income levels. Urban transport, which includes prices of vehicles and transport services, is about 42 percent more expensive in African cities than cities in other countries. Like households and workers, firms also face high urban costs. Cross-country analysis confirms that manufacturing firms in African cities pay higher wages in nominal terms than urban firms in other countries at comparable development levels.

To build cities that work – cities that are livable, connected, and affordable, and therefore economically dense – policy makers will need to direct attention toward the deeper structural problems that misallocate land, fragment development, and limit productivity.

“To ensure growth and social development, cities need to become less costly for firms and more appealing to investors,” says Punam Chuhan-Pole, Acting Chief Economist, World Bank Africa and the report’s author. “They must also become kinder to residents, offering services, amenities. All of this will require reforming urban land markets and urban regulations and coordinating early infrastructure investment.”

Terms of trade

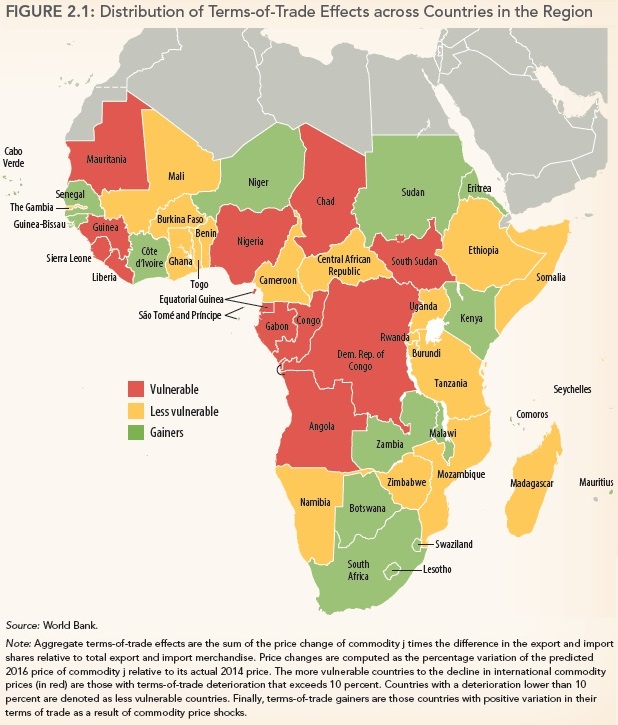

Africa’s Pulse finds that the recent commodity price drops have deteriorated the region’s terms of trade in 2016 by an estimated 16%, with commodity exporters seeing large terms-of-trade losses. Across the region in 2016, the impact of this shock is expected to lower economic activity by 0.5 percent from the baseline, and to weaken the current account and fiscal balance by about 4 and 2 percentage points below the baseline, respectively.

Some 12 countries, housing nearly 36% of the region’s population and representing about half of its economic activity, are considered vulnerable in terms-of-trade losses that are expected to exceed 10%. About 17 countries with more than 25% of SSA’s population, fall into the group of countries with terms-of-trade gains.

Moving Forward

Sub-Saharan Africa countries will continue to face low and volatile prices in global commodity markets. The rapid decline in oil and commodity prices has signaled an urgent need for economic diversification in Africa. Governments must take steps to adjust to a new, lower level of commodity prices, address economic vulnerabilities, and develop new sources of sustainable, inclusive growth. Africa’s growing urban centers offer a springboard for diversification. But they need better institutions for effective planning and coordination that can raise urban economic density and productivity, and spur the region’s transformation.

The Report’s Key Messages

-

Global growth has been weak, and the external environment facing Sub-Saharan Africa is expected to remain difficult in the near-term. Commodity prices are expected to remain low and volatile and external financing conditions are expected to tighten.

-

Key policy challenges to the region’s economies include adjusting to a new, lower level of commodity prices, addressing economic vulnerabilities, and developing new sources of sustainable, inclusive growth.

-

Africa now has a narrow window of opportunity to harness the power of cities as engines of economic growth. But for urbanization to bring the benefits that it should, governments should reform land markets and urban regulations to enable investment and development, and coordinate early infrastructure investments. Cities must offer services, amenities, and housing for the poor and the middle class.

-

Successful urbanization will also support Africa’s agricultural and rural transformation by effectively absorbing the labor being released by these sectors; by providing a market for agricultural produce; and by financing further transformation and commercialization.

-

For most countries in the region, the adjustment to the low commodity prices will need to include stronger efforts to strengthen domestic resource mobilization to reduce overdependence on revenue from the resource sector.

-

Sharp commodity price drops have deteriorated the region’s terms of trade in 2016 by an estimated 16%, with commodity exporters seeing large terms-of-trade losses.

Recent Developments: Sub-Saharan Africa

Outlook

The external environment confronting SSA is expected to remain difficult in the near term. Commodity prices are expected to remain low, amid a gradual pickup in global activity, especially in emerging markets and developing economies, and external financing conditions are expected to tighten.

The prospects for a significant pickup in private consumption growth in oil exporters remain weak for the near term. The removal of subsidies to alleviate pressure on budgets has resulted in higher fuel costs in Angola, which, coupled with currency depreciation, will weigh on consumers’ purchasing power. By contrast, lower inflation in oil importers, owing in part to lower fuel prices, should continue to boost consumer spending. However, food price inflation caused by ongoing droughts in several countries, high unemployment as in South Africa, and the price level impact of currency depreciation, combined with interest rate increases, could moderate these effects.

Gross fixed capital formation is expected to slow across the region, driven by weak investment growth among oil exporters and large mineral exporters. China’s rebalancing, lower commodity prices, and deteriorating growth prospects in many commodity exporters are expected to result in further declines in FDI flows. Domestic policies also weigh on private investment. In Nigeria, the central bank’s foreign exchange control measures are tightening credit conditions and curtailing private investment. In South Africa, policy uncertainty and low business confidence could weigh on investment flows. By contrast, in several low-income, non-oil commodity exporters, governments are expected to continue with their public infrastructure investment program, drawing in part on public-private partnerships, donor aid, and, in some cases, financing from Chinese entities. Some countries are also turning increasingly to domestic borrowing through the issuance of treasury bills. Nevertheless, the pace of investment growth in low-income countries is expected to slow somewhat. Already, countries, such as Mozambique, Tanzania, and Uganda are experiencing delays in inward investment in their resource sectors, caused by the decline in commodity prices. Moreover, the tightening of global financing conditions has prompted many countries to delay tapping the international bond market.

The fiscal policy stance in commodity exporters is expected to remain tight in 2016 as commodity prices remain low. But in some countries, further fiscal adjustment may be necessary unless commodity prices pick up swiftly or external resources are available to smooth the adjustment. With fiscal deficits widening across the region, other countries, including the low-income non-oil commodity exporters, are also increasingly facing the need for fiscal consolidation to build buffers and resilience.

Net exports are expected to make a negative contribution to real GDP growth in the near term, despite currency depreciations. Low commodity prices will depress export receipts, especially among oil exporters, even as export volumes rise in some countries. The pull from advanced economies is expected to remain modest, given their moderate prospects for medium-term growth. Among oil importers, current account balances are expected to deteriorate in many countries on account of continued strong import growth, driven by capital goods imports for infrastructure projects.

Against this backdrop, the region faces the following expectations:

-

Activity is expected to remain weak in the region’s three largest economies in 2016. In Nigeria, foreign exchange restrictions (if maintained) will continue to weigh on economic activity, exacerbating the effects of low commodity prices. In South Africa, the deterioration of the business environment will depress investment growth, while high unemployment and interest rate hikes will limit private consumption. In Angola, low oil prices, a weak investment climate, and rising inflation will weigh on real GDP growth.

-

Among the region’s frontier markets, growth is expected to rise moderately in Ghana, driven by improving investor sentiment, launching of new oilfields, and overcoming the electricity crisis. Real GDP growth is expected to remain subdued in Zambia, because of low copper prices and power shortages, and as higher interest rates and food costs stemming from the weakening currency weigh on private consumption. However, growth is expected to remain robust in Kenya, supported by private consumption and public investment. In Côte d’Ivoire, improved investment climate and strong domestic demand will help to keep growth high.

-

The outlook for the region’s low-income countries is expected to include a modest pickup in growth in oil and mineral exporters in 2016 as they continue to adjust to low commodity prices. In Mozambique, delayed investment in the liquefied natural gas sector and rising inflation will weigh on real GDP growth in 2016.Growth is also expected to slow in the Democratic Republic of Congo as the copper sector continues to struggle and political uncertainty weighs on investor sentiment. Post-Ebola recovery, aid-driven infrastructure investment and some limited growth in iron ore exports should help boost activity in Guinea, Liberia, and Sierra Leone. However, political and security uncertainties are expected to remain a drag on economic growth in Burundi, Burkina Faso, Mali, and Niger, and drought could adversely impact activity in Ethiopia. For most other countries, growth is projected to remain robust, supported by domestic investment and lower oil prices.

Risks

The balance of risks to the outlook remains tilted to the downside.

-

On the external front, a sharper than expected slowdown in China through the rebalancing of growth toward consumption and services would lead to a further decline in commodity prices and investments that could lead to a cancelation of planned investment projects in resource sectors, and further weaken activity in commodity exporters. Weaker than expected growth in the Euro Area could further weaken the external demand for exports, and reduce investment flows as well as official aid. Tighter global financing conditions would result in higher borrowing costs that could affect the region through higher risk premia and reduced sovereign bond access for emerging and frontier countries.

-

On the domestic front, delays in adjustment to external shocks in affected countries would create policy uncertainties that could weigh on investor sentiment and weaken the recovery. A worsening of drought conditions would dampen growth in agriculture, reduce hydroelectricity production, and accentuate inflationary pressures. Boko Haram insurgencies and terrorist attacks remain a concern in West Africa and Kenya, while the risks of political upheavals are substantial in Burundi and South Sudan.

Policy Challenges

Commodity exporters across the region face a new, lower level of commodity prices to which they need to adjust. Furthermore, with commodity markets, and external conditions more generally, likely to be less supportive than in the past, the region will also need to focus on developing new sources of growth. Meanwhile, widening fiscal and current account deficits have increased economic vulnerabilities, which are reflected in depreciating currencies and rising inflation. This has prompted central banks in many cases to raise interest rates, even as the economy was slowing, further undermining growth. Responses to these challenges will vary, depending on country-specific conditions.

-

For most countries in the region, the adjustment to the low commodity prices will need to include stronger efforts to strengthen domestic resource mobilization, to reduce overdependence on revenue from the resource sector. In particular, resource-rich countries would benefit from improving their non-resource tax systems. Although tax revenues as a share of GDP have increased in SSA since the 1980s, much of the improvement was driven by growth in commodity revenues. Excluding resource-based revenues, there has been limited improvement in the domestic mobilization of tax revenues in the region. Stronger efforts to broaden the tax base and strengthen tax administration would help increase domestic revenue.

-

Exchange rate flexibility could help the adjustment to the low commodity price environment. In countries where exchange rates are flexible, policy makers may need to tighten their macroeconomic policy stances, and strengthen their monetary policy frameworks, to prevent inflation induced by currency depreciation from becoming a constant threat.

-

The increased vulnerabilities across the region point to the need for greater efforts to build policy buffers and resilience to external shocks. This will require measures to rationalize current expenditure, particularly the wage bill, and improve public financial management and the quality of spending. In oil-exporting countries, in particular, measures would be needed to increase public investment efficiency. Countries where a deeper and faster fiscal adjustment is required as a result of the commodity price shocks may face a difficult trade-off between boosting development spending and building buffers. In these countries, to the extent possible, fiscal adjustment should be designed to minimize the impact on growth and on vulnerable populations. In this context, provision of countercyclical financial support could help to build policy space for essential expenditures and ease adjustment.

-

Accelerating the pace of structural reforms aimed at boosting competitiveness and diversification will be critical for raising growth prospects and reducing extreme poverty (box 1.2). In most countries this will require greater efficiency of infrastructure investment, energy sector reforms, a more inclusive financial sector, and improvements in the business climate.

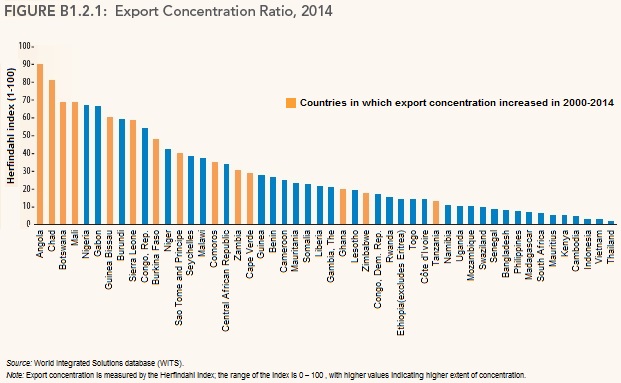

BOX 1.2: Driving Diversification in Africa through Trade and Competition

African countries experienced some of the fastest growth rates in exports in the decade and a half since the turn of the century. This was mostly driven by rising prices for commodity exports such as oil and metals, with limited impacts on local economies. As a result, the exports of many African countries are highly concentrated in a few commodities. There has been some progress toward diversification in some countries (Ethiopia and Rwanda, for example), but others have become even more dependent on just a few products (Chad, Sierra Leone).

The global economy is more challenging, but opportunities to drive diversified growth through exports are important for Africa. Falling demand in key markets, such as China, and the resulting decline in commodity prices are undermining Africa’s immediate growth prospects. The dominant commodity exports are sold on global exchanges and cannot be simply diverted to other markets.

Nevertheless, there is an opportunity for Africa to exploit its comparative advantages in agriculture, low production costs in manufacturing, and services to drive more inclusive export-led growth. Integration into regional and global value chains offers a route for African firms and individual services providers to provide their goods and services to the global market. These opportunities are enhanced by the duty preferences that African producers can receive in key markets, such as the United States under African Growth and Opportunity Act, the European Union through Economic Partnership Agreements or Everything but Arms, China, and other African countries through regional agreements.

High trade logistics costs and limited domestic competition undermine the ability of African entrepreneurs to exploit new export opportunities. Africa’s infrastructure constraint is beginning to be addressed, but trade logistics costs remain high relative to other regions. In some cases, such as apparel, trade preferences can offset these high costs and are allowing new exports to emerge.

Maintaining a competitive exchange rate is essential, but reducing trade costs is necessary to scale up and sustain these new activities for long-term job creation and poverty reduction. Importing (materials, machinery, technology, knowledge, and skills) to export is indispensable to be able to enter modern value chains and diversify exports more broadly. Hence, attention must be given to reducing the costs to import as well as export by reducing those tariffs that remain relatively high, rationalizing procedures, including electronic submission of documents, disciplining the use of permits and licenses and other regulatory measures that create barriers to trade, improving access to trade-related information, and increasing coordination between agencies involved in the trade process. Competitive and efficient input and output markets are essential to support trade development, but African markets lack competition. The level of competition is lower in African countries than in competitors and in many cases a single firm accounts for more than 50 percent of the market in key sectors, such as trucking services and fertilizer distribution.