News

Rising tax revenues are key to economic development in African countries

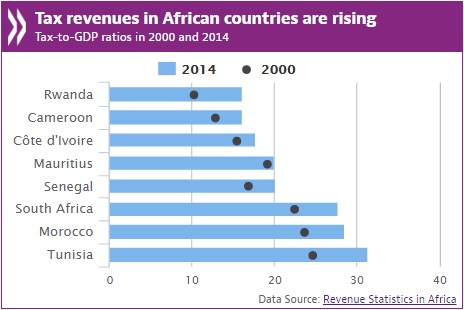

Tax revenues in African countries are rising as a proportion of national incomes, according to the inaugural edition of Revenue Statistics in Africa.

The report, containing internationally comparable revenue data for eight African countries, accounting for almost a quarter of Africa’s total GDP, was launched on Sunday 3 April in Addis Ababa during a side event in the context of the 2016 African Union (AU)-Economic Commission for Africa (ECA) Conference of Ministers.

In 2014, the eight countries covered by the report – Cameroon, Côte d’Ivoire, Mauritius, Morocco, Rwanda, Senegal, South Africa and Tunisia – reported tax revenues as a percentage of GDP ranging from 16.1% to 31.3%. Since 2000, all of these countries experienced increases in their tax-to-GDP ratios. The size of these increases ranged from 0.9 percentage points in Mauritius to 6.7 percentage points in Tunisia. Morocco, Rwanda and South Africa had increases of around 5 to 6 percentage points. In comparison, the OECD average of 34.4% was only 0.2 percentage points higher in 2014 than in 2000.

Revenue Statistics in Africa is produced jointly by the African Tax Administration Forum (ATAF), the African Union Commission (AUC), the Organisation for Economic Co-operation and Development (OECD) and the OECD Development Centre. The data has been assembled and presented in close collaboration with the governments of the participating countries. The report was conceived as part of the AUC’s Agenda 2063, which aims to “develop and implement frameworks for Policies on Revenue Statistics and Fiscal Inclusiveness for Africa.”

The increases in tax revenues in African countries reflect continuing efforts to mobilise domestic resources, as well as the result of tax reforms and modernisation of tax systems and administrations. The biggest driver of tax increases since 2000 in countries covered by the report has been rising taxes on income and profits, and more specifically increases in corporate income tax revenue. There were also substantial increases in Value Added Tax (VAT) revenues.

Some African countries are significantly dependent on non-tax revenues, and more specifically on grants such as foreign aid and resource rents together with other property income. The countries with the lowest national incomes covered by the report had relatively higher non-tax revenues, which tend to be more volatile than tax revenues, making their finances less stable and predictable.

A special chapter in the report describes the benefits and limitations of collecting comparable data and how these issues relate to Africa. The new database responds to a demand from governments, citizens and policy makers for reliable and comparable revenue data to inform fiscal policy and provide a basis for the implementation of future reforms. The eight African countries covered by the new report will be added to the existing Revenue Statistics databases, which now cover 66 countries worldwide, allowing for greater international comparison, policy dialogue and co-operation between countries in Africa, Asia, Latin America and the Caribbean and the OECD.

Key findings

Tax to GDP ratios

-

In 2014, the tax-to-GDP ratios in the eight African countries covered ranged from 16.1% to 31.3% (the OECD average is 34.4%).

-

Tunisia had the highest tax-to-GDP ratio in 2014 (31.3%), followed by Morocco (28.5%).

-

Cameroon and Rwanda had the lowest tax-to-GDP ratios in 2014, at 16.1%, followed by Côte d’Ivoire (17.8%).

-

All eight countries saw increasing tax-to-GDP ratios over the 2000-14 period. These increases ranged from 0.9 percentage points in Mauritius to 6.7 percentage points in Tunisia. Morocco, Rwanda and South Africa had increases of around 5-6 percentage points.

Tax structure

-

The share of taxes on incomes and profits in total tax revenues is highest in South Africa, at 51.2% in 2014. The share of personal income taxes in South Africa is higher than the OECD average, whereas it is lower for the other participating African countries.

-

The shares of corporate income tax revenue to total tax revenues were significantly higher than the 8.5% OECD average. In six of the eight African countries these shares ranged between 13% and 18%.

-

Consumption taxes yielded the largest share of the total tax revenue – over 55% – in Cameroon, Côte d’Ivoire, Mauritius, Rwanda and Senegal. With the exception of Côte d’Ivoire, more than half of this category of revenue is generated by VAT.

-

Tunisia and Morocco displayed a more evenly spread tax mix compared with the other countries: around 30% of tax revenues came from taxes on incomes and profits; around 35% to 40% was from consumption taxes; and 20% to 28% was from social security contributions. The share of social security contributions to total tax revenue is far smaller in the six Sub-Saharan countries, ranging from 1.5% in South Africa to 11.3% in Côte d’Ivoire.

Non-tax revenues

-

The total non-tax revenues collected as a percentage of GDP in 2014 ranged from 0.6% of GDP in South Africa to 9.5% of GDP in Rwanda.

Background

Revenue Statistics in Africa is a joint publication by the African Union Commission, the African Tax Administration Forum (ATAF), the OECD Centre for Tax Policy and Administration and the OECD Development Centre. It presents detailed, internationally comparable data on both tax and non-tax revenues for eight African countries who volunteered to be part of the first edition of the report. It examines changes in both the level and the composition of taxation plus the attribution of tax revenues by level of government between 1990 and 2014.

Its approach is based on the well-established methodology of the OECD Revenue Statistics database, which has become an essential reference source for countries in all regions of the world. Comparisons are also made with the average for OECD economies and for the economies featured in Revenue Statistics in Latin America and the Caribbean (LAC).

This work contributes to the financial chapter of the African Charter on Statistics in rolling out the Strategy for the Harmonisation of Statistics in Africa. It also supports the first ten-year implementation plan (2014- 2023) of the African Union’s Agenda 2063, which aims to “develop and implement frameworks for Policies on Revenue Statistics and Fiscal Inclusiveness for Africa.” At the global level, it will support the Sustainable Development Goals’ target 17.1 to “improve domestic capacity for tax and other revenue collection” and target 17.19 to “support statistical capacity building in developing countries.”