News

Africa Regional Integration Index: Report 2016

Integration Matters

Regional integration is a development priority for Africa. All Africans, not just policy makers and decision makers, have a role to play in making integration a reality for the continent.

Integration matters in Africa. It affects what people can buy; the variety of what is on offer at the local market; how easily citizens move between countries; where individuals travel for leisure or for work; how cost-effective it is to keep in touch; where people choose to study or look for a job; how to transfer money to family or get start-up capital for a business.

Regional integration is about getting things moving freely across the whole of Africa. This means getting goods to move more easily across borders; transport, energy and telecommunications to connect more people across more boundaries; people to move more freely across frontiers, and capital and production to move and grow beyond national limits.

Africa’s integration journey towards a more connected, competitive and business-friendly continent is underway and its roadmap is, in some areas, under construction. Africa’s Regional Integration Index is an action tool measuring the progress of an Africa on the move.

The Index

Measuring where Africa stands on regional integration gives an assessment of what is happening across the continent and is an important way of highlighting where the gaps are. It is a dynamic, evolving way to track integration by giving everyone access to verified, quality information to start a dialogue and take forward the next steps to integrate Africa.

Index Makeup

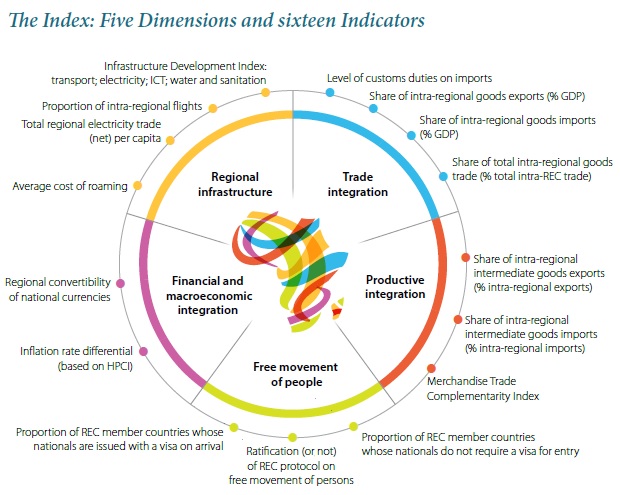

The Index is made up of five Dimensions, which are the key socio-economic categories that are fundamental to Africa’s integration. Sixteen Indicators (based on available data), which cut across the five Dimensions, have been used to calculate the Index. Further details are set out in Table 1.

The Index 2016 report covers Member Countries from the eight Regional Economic Communities (RECs) recognized by the African Union. The Dimensions and Indicators chosen for the Index are based on the Abuja Treaty and its operational framework.

Regional integration is cross-border and multi-dimensional. Indicators that have a cross-border interaction, and where verified, quality data is available, have been used to make up the Index. Future editions of the Index will grow in scope as more data becomes available.

Index Impacts

The Index aims to be an accessible, comprehensive, practical and results-focused regional integration tool that focuses on the policy level and on-the-ground realities.

-

Accessible: a centralized data system on regional integration will be made publicly available to inform policy decisions and drive policy reforms on priority areas.

-

Comprehensive: the 16 Indicators that make up the five Dimensions of the Index build an overview and dimensional view of Africa’s regional integration.

-

Practical: at-a-glance rankings and scores for RECs, and for countries within a REC, overall and by Dimension. Countries are classed as high performers, average performers or low performers within each REC.

-

Results-focused: comparative analysis within and among RECs takes into account the diversity in Africa’s integration process. A REC, and a country within a REC, can identify its strengths and gaps across each of the Dimensions.

RECs can be compared on overall integration scores and on scores in each of the five Dimensions. As the Index recognizes and uses the RECs as the building blocks for the African Economic Community, based on the Abuja Treaty, there are no overall country rankings.

A country’s classification within a REC shows (with a 95% confidence interval) when a country is a:

-

High performer – score is higher than average of countries

-

Average performer – score is within the average of countries

-

Low performer – score is below the average of countries

As some countries are members of more than one REC, they have multiple rankings/scores. To see the distance they have to travel overall, as well as in particular Dimensions, countries can be compared against the average scores of the top performing countries in a REC. For a REC with six or more countries, the reference is the average of the top four countries.

The Regional Economic Communities (RECs) are regional groupings of African states. The RECs have developed individually and have differing roles and structures. Generally, the purpose of the RECs is to facilitate regional economic integration between members of the individual regions and through the wider African Economic Community (AEC), which was established under the Abuja Treaty (1991). The 1980 Lagos Plan of Action for the Development of Africa and the Abuja Treaty proposed the creation of RECs as the basis for wider African integration, with a view to regional and eventual continental integration.

The AU recognizes eight RECs:

CEN-SAD – Community of Sahel-Saharan States

COMESA – Common Market for Eastern and Southern Africa

EAC – East African Community

ECCAS – Economic Community of Central African States

ECOWAS – Economic Community of West African States

IGAD – Intergovernmental Authority on Development

SADC – Southern African Development Community

UMA – Arab Maghreb Union

Roadmap for the Future

To get the dimensions of regional integration to work together will take a series of actions on the ground, led by well thought-out strategies, matching policy reforms and backed up by capacity building.

It will take political commitment and leadership as well as resources and networks to be mobilized. At the same time it will take engagement from Africa-wide organizations, regional bodies, governments, policy makers, business, civil society, researchers, development partners, the media and the public.

Measuring where Africa stands on regional integration gives an assessment of what is happening across the continent and is an important way of highlighting where the gaps are. It is a dynamic, evolving way to track integration by giving everyone access to verified, quality information to start a dialogue and take forward the next steps to integrate Africa.

The Index is part of a central database and system for collecting data on regional integration. It will capture additional data for indicators that are not part of the Index but that play a role in regional integration, from the movement of workers across borders to trade corridor costs.

It is over to the Index user to make use of the information in the rankings and scores, by drilling down to priority areas, to drive concrete change at policy and operational level.

Regional integration overall in Regional Economic Communities

Index findings are in line with progress being made on RECs’ regional integration agendas. The RECs score highly on areas that they have prioritized on regional integration to date. The different RECs’ performance on the Dimensions reinforces how progress is being made through a regional approach to integration in Africa rather than through a continent-wide approach.

Index findings

-

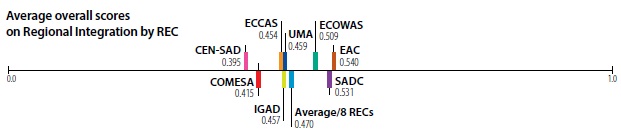

Average REC scores on Regional integration stand at 0.470 on a scale of 0 (low) to 1 (high). Average Regional integration scores for the eight RECs stand at below half of the scale from 0-1, showing that overall integration in the regions could significantly progress.

-

EAC is the top performing REC on Regional integration overall. EAC has higher than average scores across each Dimension of Regional integration, except for Financial and macroeconomic integration.

-

SADC and ECOWAS have higher than average REC scores on Regional integration overall. SADC has higher than average REC scores across the Dimensions of Regional infrastructure, Free movement of people and Financial and macroeconomic integration. ECOWAS has higher than average REC scores across the Dimensions of Free movement of people and Financial and macroeconomic integration.

Index: five Dimensions in Regional Economic Communities

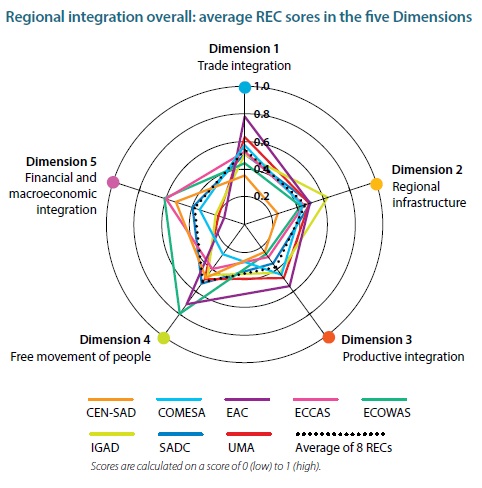

There is a strong basis for every REC to build on and address other Dimensions, which can strengthen the integration agenda and drive up a REC’s overall regional integration score. To further support integration policy reforms across the continent, the eight RECs can share lessons and insights on each of the Dimensions where they score higher than the average.

Index findings

-

Highest scores are on Trade integration, with average REC scores of 0.540. Trade integration has been a longstanding Regional integration priority across all RECs.

-

Lowest scores are on Financial and macroeconomic integration, with average REC scores of 0.381. Financial and macroeconomic integration has been limited across the RECs, including ensuring the convertibility of currencies or coordination of macroeconomic policies.

-

Average REC scores are closest together on Regional infrastructure and Productive integration. Regional infrastructure and Productive integration have recognized REC programmes and progress is ongoing across the regions.

-

Average REC scores are furthest apart on Free movement of people and Financial and macroeconomic integration. Free movement of people protocols have been signed but their application on the ground has faced challenges in different regions. Ensuring the convertibility of currencies and the coordination of macroeconomic policies at regional level has also not been consistent.

-

Every REC has higher than average scores in one or more Dimensions.

Regional integration in countries by Regional Economic Community

Integration is multi-dimensional for both RECs and for the countries within each REC. The majority of countries perform well on at least one dimension of Regional integration, even if their overall regional integration score is not high. With the exception of Somalia in CEN-SAD and IGAD, there are no countries that are marked as low performers across all the dimensions. Each country can share lessons and insights with other countries on the areas where they perform strongly and also identify how to address any gaps going forward.

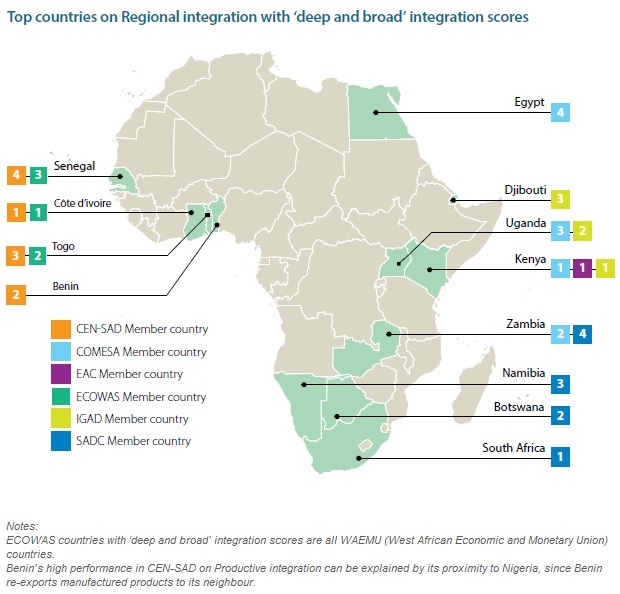

‘Deeply integrated’ countries

Top performing countries on Regional integration overall, relative to other African countries, are considered ‘deeply integrated,’ with economies that are strongly integrated with others in the REC. These countries feature in the top four performers in a REC that has more than six member countries or they feature in the top two performers in a REC that has less than six member countries.

Economically powerful countries are not necessarily better integrated in their RECs, with the exception of South Africa in SADC and Kenya in EAC. There is a strong potential for Algeria, Angola, Democratic Republic of the Congo, Egypt, Ethiopia, Libya, Nigeria, Sudan and the United Republic of Tanzania to integrate more within their RECs by steering their economies towards the region.

CEN-SAD

- Nigeria represents 37% of regional GDP but is not in the top performers on Regional integration, neither is Egypt, which represents 18% of regional GDP.

- Côte d’Ivoire, which is the top performing country on Regional integration, represents just 3% of regional GDP.

COMESA

- Egypt is the first contributor of wealth creation in the region (with 35% of regional GDP) but is in fourth place on Regional integration.

- Sudan and Libya are respectively second and third contributors of wealth creation but are not top performers.

EAC

- Kenya and Uganda are in the top three contributors to wealth creation in the region with 39% of regional GDP and 21% of regional GDP respectively.

ECCAS

- Angola and Democratic Republic of the Congo are the principal contributors to wealth creation in the region with 36% and 19% of regional GDP respectively, but are not top performers.

- Cameroon is in first place and is the third contributor of regional GDP.

ECOWAS

- Nigeria is the first contributor of wealth creation in the region (75% of regional GDP), but does not feature in the top performing countries on Regional integration.

- Côte d’Ivoire is the top performer on Regional integration but only represents 6% of regional GDP.

IGAD

- Ethiopia, Sudan and Kenya are the principal contributors to wealth creation in the region (29%, 28.5% and 27.7% of regional GDP respectively).

- Only Kenya features as the top performer on Regional integration.

SADC

- South Africa represents 61% of regional GDP and is first of the top performing countries.

- The other top performers are not strong wealth creators in the region: Botswana, 2% of regional GDP; Namibia, 1.8% of regional GDP and Zambia, 2.5% of regional GDP.

UMA

- Algeria contributes to 42% of regional GDP but is not a top performer in Regional integration, with Morocco and Tunisia ahead in Regional integration scores.

‘Broadly integrated’ countries

Countries are considered ‘broadly integrated,’ when a country is strongly integrated on three or more of the dimensions, showing a breadth of diversity in their integration agenda.

Integration is ‘deep and broad’ when a country in a REC is strongly integrated (in the top four or top two countries in their REC) and performs strongly on three or more dimensions.

19 of the top performing countries that are ‘deeply integrated,’ can also be considered broadly integrated, performing strongly on three or more Dimensions.

The Dimensions

To get the dimensions of regional integration to work together will take a series of actions on the ground, led by well thought-out strategies, matching policy reforms and backed up by capacity building. It will take political commitment and leadership as well as resources and networks to be mobilized.

At the same time it will take engagement from Africa-wide organizations, regional bodies, governments, policy makers, business, civil society, researchers, development partners, the media and the public.

Dimension 1: Trade integration

Index of four indicators –

-

Level of customs duties on imports

-

Share of intra-regional goods exports (% GDP)

-

Share of intra-regional goods imports (% GDP)

-

Share of total intra-regional goods trade (% total intra-REC trade)

Getting goods to move more freely across the continent matters for regional integration. When trade flows are faster and more cost-effective, business and consumers in the regions benefit. Trade impacts on people’s livelihoods and incomes to accelerate Africa’s development.

Trade links from Africa to the world can be more direct and efficient than trade between neighbouring regions due to infrastructure gaps or capital costs and non-tariff barriers. Facilitating Africa’s trade is in line with the AU decision on Boosting Intra-African Trade and the WTO Trade Facilitation Agreement, which puts soft infrastructure, from electronic customs systems to one-stop border posts, high up the agenda. That can start to make a significant difference for intra-regional traders through streamlining the queues of trucks at borders to supporting informal crossborder traders to go through the official channels.

The Continental Free Trade Area negotiations aim to make trade fully integrated across Africa. The Tripartite Free Trade Area (made up of COMESA, EAC and SADC) is making progress towards that bigger goal. Priority areas include connecting customs operations, liberalizing all tariff lines and making it simpler to measure how nontariff barriers are being lowered.

When trade is more interconnected Africa’s high number of small economies access larger markets and regional hubs source from the region and are able to use the imports to grow. All of this makes Trade integration a key element in the continent’s ongoing integration journey.

Index findings

-

EAC is the highest performing REC on Trade integration.

-

Trade integration has the highest score overall among RECs with a 0.546 average.

-

There are a total of 35 high performing countries across the eight RECs on Trade integration.

-

High performing countries on Trade integration in a particular REC that are not high performers on Regional integration overall in that REC:

CEN-SAD (Egypt, Sudan, Eritrea, Nigeria, Comoros, Ghana, Libya)

COMESA (Democratic Republic of the Congo, Libya)

ECCAS (Angola, Chad)

ECOWAS (Nigeria, Ghana)

UMA (Tunisia)

Dimension 2: Regional infrastructure

Index of four indicators –

-

Infrastructure Development Index: transport; electricity; ICT; water and sanitation

-

Proportion of intra-regional flights

-

Total regional electricity trade (net) per capita

-

Average cost of roaming

Infrastructure development across the continent is the most visible face of regional integration. It includes highways being built across borders, flights taking passengers from one capital to another and more people on mobile phones on city streets and at rural outposts.

Countless connections made by road, by air or increasingly by airwaves have an important impact on Africa’s integration efforts, expanding horizons and concrete realities on the ground. When regional infrastructure works better, business costs fall as transport corridors speed goods across boundaries and more customers access services as mobile phone roaming expands.

A flagship project in Agenda 2063 is to connect Africa’s capitals and commercial centres through high-speed rail. Meanwhile, programmes, such as PIDA (Programme for Infrastructure Development in Africa), are helping regions to get infrastructure projects off the ground. Information technology costs are also falling and there are plans for internet to be beamed to the continent via satellite.

Regional hubs, as well as small or landlocked countries, have a lot to gain from promoting infrastructure to boost economic growth. Both traditional and new funding partners are continuing to invest in Africa’s infrastructure at regional level. To power the continent’s energy needs and build first-class networks, regions and countries need to encourage stronger ownership and involve the private sector. Going forward it will mean focusing on

green-friendly, growth opportunities that support communities and Africa’s next generation.

Index findings

-

IGAD is the highest performing REC on Regional infrastructure.

-

Regional infrastructure has average REC scores (0.461) closest to the average REC scores on regional integration overall (0.470).

-

There are a total of 30 high performing countries across the eight RECs on Regional infrastructure.

-

High performing countries on Regional infrastructure in a particular REC that are not high performers on regional integration overall in that REC:

CEN-SAD (Libya, Sudan, Guinea, Nigeria, Egypt, Ghana)

COMESA (Libya, Burundi)

EAC (Burundi)

ECCAS (Congo, Angola)

ECOWAS (Cabo Verde, Ghana, Gambia)

IGAD (Djibouti, South Sudan)

SADC (Seychelles)

UMA (Libya)

Dimension 3: Productive integration

Index of three indicators –

-

Share of intra-regional intermediate goods exports (% total intra-regional exports goods)

-

Share of intra-regional intermediate goods imports (% total intra-regional imports goods)

-

Merchandise Trade Complementarity Index: total absolute value of the difference between share of imports and share of exports of a member country in a REC

As consumer purchasing power rises, intermediate goods that are used by a business in the production of finished goods or services will be important for Africa’s internal market.

This links to industrialization, which is a key goal in the African Union's Minimum Integration Programme. Building industrial clusters goes together with access to regional trade corridors that get goods moving and with promoting more regional electricity to power production.

Making production work better for the continent across different sectors, by being part of regional and global value chains, will be at the heart of Africa’s economic success model. Whether on agriculture or industrial production, regions need to unlock their productive potential, inject investment, overcome bottlenecks and make sectors more competitive.

Productive integration matters for creating an economic base that is more resilient to shocks and more diverse, but also for building a more skilled regional labour force that adds value to goods and services while raising people’s incomes on the ground. That includes opportunities with mining and manufacturing that are now shifting to Africa’s advantage.

The priorities for the continent and the regions, from regional hubs to landlocked least developed countries, will be to move beyond low value production and deal with non-tariff barriers to make trade work faster and cheaper. That way, when commodity prices fluctuate and financial crises are nearby, the ‘made in Africa’ brand will become part of the solution.

Index findings

-

EAC is the highest performing REC on Productive integration.

-

There are a total of 30 high performing countries across the eight RECs on Productive integration.

-

High performing countries on Productive integration in a particular REC that are not high performers on regional integration overall in that REC:

CEN-SAD (Kenya, Djibouti, Gambia, Egypt)

COMESA (Madagascar, Djibouti)

ECCAS (Burundi, Rwanda)

ECOWAS (Gambia, Ghana, Liberia, Sierra Leone)

IGAD (Djibouti)

SADC (Zimbabwe, Mozambique)

UMA (Tunisia)

Dimension 4: Free movement of people

Index of three indicators –

-

Ratification (or not) of REC protocol on free movement of persons

-

Proportion of REC member countries whose nationals do not require a visa for entry

-

Proportion of REC member countries whose nationals are issued with a visa on arrival

Getting people to move freely across Africa represents a powerful boost to economic growth and skills development.

When people can travel with ease for business, tourism or education, everyone benefits, from the country opening up their borders as well as the country whose national is on the move, as seen in the growth in remittances in recent years.

Cross-border movement supports talent mobility and competitiveness. Skills gaps can be plugged and ideas are exchanged leading to entrepreneurship and innovation spreading out beyond borders. The free movement of people is a quick win on development for countries, regions and the continent as a whole. When visa or work permit restrictions are cut, gains in time and resources open up, which supports more competitive businesses and economies.

Early progress towards an increasingly borderless Africa has been made but there are still gaps. The idea has been at the foundation of the continent’s integration journey. Political dialogue is ongoing to make the reality of the experience for Africans travelling across the continent, whether or not they need a visa or can get one on arrival, to match up to these ambitions.

Looking ahead, countries and regions need to encourage positive reciprocity, applying the treatment they are receiving from more visa-open countries, look at promoting a visa-on-arrival approach or regional bloc visas. Leaders and policy makers need to work towards the goal of every African being able to scan an African passport at immigration controls continent-wide.

Index findings

-

ECOWAS is the highest performing REC on Free movement of people.

-

ECOWAS has the highest REC score here across all of the Dimensions.

-

There are a total of 53 high performing countries across the eight RECs on Free movement of people.

-

All ECOWAS countries score 0.8, having implemented the Free movement of persons protocol, which enables ECOWAS citizens to travel to all member countries without a visa.

-

High performing countries on Free movement of people in a particular REC that are not high performers on regional integration overall in that REC:

CEN-SAD (Guinea, Gambia, Guinea-Bissau, Nigeria, Sierra Leone, Ghana, Liberia)

COMESA (Zimbabwe, Swaziland)

EAC (Rwanda)

ECCAS (Sao Tomé and Principe, Central African Republic)

ECOWAS (Benin, Burkina Faso, Cabo Verde, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Sierra Leone)

IGAD (Eritrea, Ethiopia)

SADC (Seychelles, Mauritius, Zimbabwe)

UMA (Algeria)

Dimension 5: Financial and macroeconomic integration

Index of two indicators –

-

Regional convertibility of national currencies

-

Inflation rate differential (based on the Harmonized Consumer Price Index)

When capital flows more freely across Africa, investment increases and finance is allocated where it can generate the most productivity.

In addition, the continent’s investors get higher returns. In turn, as transaction costs of doing business fall and financial institutions work more effectively, companies, micro-,small and medium-sized enterprises and start-ups will benefit.

Financial integration has been promoting knowledge and technology transfer and greater innovation. The continent’s heavyweight economies to the small-sized players can make inroads from making financial cross-border flows smoother and reach further. Forward-looking island nations and landlocked countries have already blazed a trail on financial services.

The Abuja Treaty sets out the continent’s integration pathway and puts monetary union as a key priority. Yet many of the Regional Economic Communities have not made their currencies convertible and coordinating macroeconomic convergence needs a greater push. As the global financial crisis has shown, being more capital-connected comes with a risk. More data, information and transparency build confidence among national authorities and financial institutions, as does improving regulatory frameworks, safeguards and supervision.

A series of actions can make a difference, including promoting banking across borders, increasingly outside of the regional financial centres; standardizing regional payments; putting in place multilateral fiscal guidelines; and joining up policy on inflation, public finance and exchange rate stability. In turn, the continent will see more predictable conditions for cross-border trade and investment to thrive and it will help to light up Africa’s financial future.

Index findings

-

ECOWAS is the highest performing REC on Financial and macroeconomic integration.

-

Financial and macroeconomic integration has the lowest score overall among RECs with a 0.381 average.

-

There are a total of 37 high performing countries across the eight RECs on Financial and macroeconomic integration.

-

High performing countries on Financial and macroeconomic integration that are not high performers on regional integration overall:

CEN-SAD (Chad, Central African Republic, Guinea-Bissau)

COMESA (Comoros, Djibouti, Rwanda, Libya)

EAC (Rwanda)

ECCAS (Chad, Central African Republic, Congo)

ECOWAS (Niger, Burkina Faso, Guinea-Bissau, Mali, Benin)

IGAD (Djibouti)