News

Kenya Vision 2030: Mega projects well under way but growth remains elusive

Kenya’s ambition of becoming a middle-income economy with per capita income of between $1,045 and $12,736 hangs in the balance as the government struggles to meet key growth targets under its long-term development plan called Vision 2030.

Latest data from the Kenya Vision 2030 Delivery Secretariat paints a grave picture of the achievements made in the past eight years with concerns over low levels of economic growth, domestic savings, national investments and employment figures.

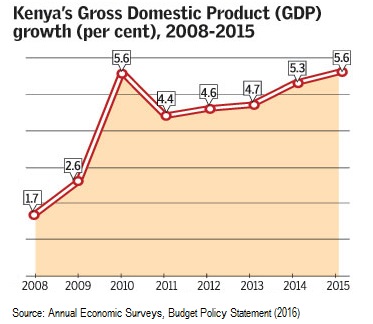

Kenya’s economy has grown at an average rate of four per cent in eight years against a planned 10 per cent, thanks to the poor performance of key economic sectors such as agriculture, manufacturing and tourism.

“We are still at the lower end with respect to national savings as compared with the other East African countries. This can partly be explained by the high cost of living in Kenya,” Prof Gituro Wainaina, the acting director general of Kenya’s Vision 2030 Delivery Secretariat, told The EastAfrican.

According to the latest World Bank classification criteria, middle-income countries are those with a gross national income (GNI) per capita of more than $1,045 but less than $12,736 while low-income economies are those with GNI per capita of $1,045 or less. High-income economies are those with a GNI per capita of $12,736 or more.

Kenya’s regional counterparts have also developed their own development blueprints – Uganda has formulated Vision 2040, Tanzania Vision 2025, Burundi Vision 2025 and Rwanda has Vision 2020 – but there are plans to align all of them to the EAC Vision 2050.

Official government data shows that Kenya is lagging behind in achieving its key objectives under the development plan.

During the first five years (2008-2012) of the plan, Kenya’s economy grew at an average rate of 4.18 per cent against a target of 8.66 per cent while investment averaged 20 per cent of gross domestic product (GDP) compared with a target of 27 per cent.

An annual average of 511,000 jobs against a target of 740,000 jobs were created during the period of which about 80 per cent were in the informal sector. This is against a target of 3.7 million new jobs for the five years.

Gross national savings during the 2008-2012 period fell to an average of 12 per cent per annum against a target of 22 per cent per annum. According to data from National Treasury, gross national savings stood at 12.7 per cent, 14.5 per cent and 15.9 per cent in 2013, 2014 and 2015 respectively.

“We have not met our investment targets because of our ambitious investment, especially in infrastructure. In addition to foreign direct investments, we need to focus on mobilising the domestic savings through pension funds, saccos, and the insurance industry,” said Prof Wainaina.

In the second medium-term plan (2013-2017), national investment is expected to grow from 24.7 per cent of GDP in 2013 to 30.9 per cent in 2017 while gross national savings are expected to grow from 16.4 per cent to 25.7 per cent over the same period. But data from the National Treasury shows that national investments as a percentage of GDP for the years 2013, 2014 and 2015 stood at 21.7 per cent, 23.5 per cent and 23.5 per cent respectively.

Gross international reserve coverage is expected to increase from 4.1 months of import cover to six months. Currently, foreign exchange reserves stand at $7.37 billion (equivalent to 4.7 months of import cover) according to data from the Central Bank of Kenya.

The debt to GDP ratio is projected to decline to 39.2 per cent by 2017/2018 from 43.9 per cent in 2013/14. Currently the debt ratio stands at 43.7 per cent.

In the second medium-term plan under the Vision 2030, the government projected growth to gather pace from about 6.1 per cent in 2013 to 8.7 per cent in 2015 and reach 10.1 per cent in 2017.

Challenges to growth

Treasury Cabinet Secretary Henry Rotich, however, said the economy grew by 5.3 per cent in 2014 and is projected to expand by 5.6 per cent in 2015, six per cent in 2016 and 6.5 per cent in the medium term.

According to the Kenya Vision 2030 Delivery Secretariat, challenges related to lack of funding, lengthy procurement processes and litigation on tender awards, land acquisition and compensation issues as well as high transaction costs have worked out to stifle implementation of flagship projects.

During the second MTP, the government is expected to create one million new jobs annually to address youth unemployment and improve skills training.

A total of 5,170 employment opportunities were to be created over the five-year period (2013-2017) translating into an average of 1,034 jobs – 1,513 formal and 3,657 informal – per year.

Kenya’s Vision 2030, which was officially launched in July 2008, aims to transform Kenya into a newly industrialising globally competitive and middle-income country providing a high quality of life to all its citizens by 2030.

The key flagship projects under the plan include paving of 10,000 kilometres of roads by 2017 and generation of over 5,000 MW of power in 40 months. The current generation stands at 2,298 MW – of which 65 per cent is from renewable sources.

Other flagship projects include the Lamu Port Southern Sudan-Ethiopia Transport Corridor project, the Konza Techno City, modernisation of Jomo Kenyatta International Airport (Greenfield terminal and second runway), expansion of the port of Mombasa, and the standard gauge railway (SGR).

Currently there are 164,000 kilometres of road network in the country of which 13,000 kilometres are paved.

An additional 10,000 kilometres had been earmarked to be paved by next year, of which, 80 per cent will be rural roads and 20 per cent urban roads.