News

Trade, finance and development: Overview of challenges and opportunities

Sustainable development is the Holy Grail of the international community, and the potential roles played by trade and finance lie at the heart of the search effort. The extremely robust positive correlation between various measures of trade and financial development on the one hand, and economic growth, on the other, is the bread and butter of thriving sub-disciplines within economics (international trade and the finance and growth literature, respectively). Evidence concerning the direction of the causal relationships is, however, less than compelling.

For example, there is increasing evidence (and the 2008 crisis may be a manifestation of this) that countries can have financial sectors that are “too large.” As such, one needs to be extremely cautious in formulating policy recommendations that rest on putative causal relationships that have not been rigorously established. Moreover, the link between trade and finance on the one hand, and various measures of development (as opposed to a narrow focus on economic growth), on the other, has attracted much less attention.

To some extent, this is because of the proliferation of measures of development: it suffices to think of the vast array of Millennium Development Goals (MDGs) or Sustainable Development Goals (SDGs). An implicit assumption is that economic growth will necessarily translate into improvements in these indicators: this is not, of course, the case. In addition, it is already difficult to establish the causal determinants of economic growth: doing so for a plethora of other development indicators increases the challenge by several orders of magnitude.

Geography and institutions

During the past twenty years, our understanding of the determinants of economic growth has been profoundly shaped by a vast corpus of cross-country empirical literature. This work was initially driven by the construction of internationally comparable measures both of economic growth and development (such as the Penn World Tables or the World Bank’s Word Development Indicators) and of country characteristics. Though it is something of an oversimplification, this literature has given rise to two broadly defined schools of thought concerning the key fetters to economic development and growth.

On the one hand, the “geography” school, often associated with Jeffrey Sachs, holds that a country’s development performance is to a large extent determined by its geographical location. For example, it is argued that a country’s level of gross domestic product (GDP) per capita is, ceteris paribus, an increasing function of its distance to the equator; similarly, landlocked countries are believed to have both a lower level and a lower rate of growth GDP per capita. There are many causal pathways that can explain geographically driven income and growth effects, including the higher burden of disease under subtropical climates or the infrastructure needed to overcome geographic isolation from world markets for landlocked countries. In a traditional growth accounting framework, both of these examples underscore the fact that geographical fetters to development affect total factor productivity (TFP), the overall efficiency with which factors of production, such as labour and capital (both human and physical), are transformed into output; the productivity of single factors of production (such as labour); and the amounts of the factors themselves that are used.

On the other hand, the “institutional” school of thought, often associated with the work of Daron Acemoglu and his collaborators, has emphasised the importance of a country’s institutional environment, where institutions are understood in their economic (and not political) sense in terms of social structures, such as the rule of law or the protection of property rights that allow economic activity to develop. As with geography, institutional factors can affect the productivity of single factors, TFP, and factor use.

One of the most important empirical regularities established by the institutional school is that there is a causal relationship linking national economic institutions (as usually measured by protection against expropriation risk) to income per capita. Moreover, a second important empirical regularity is that geography affects per capita income through its impact on institutions: once economic institutions are appropriately taken into account, geography arguably no longer has an independent impact on income levels.

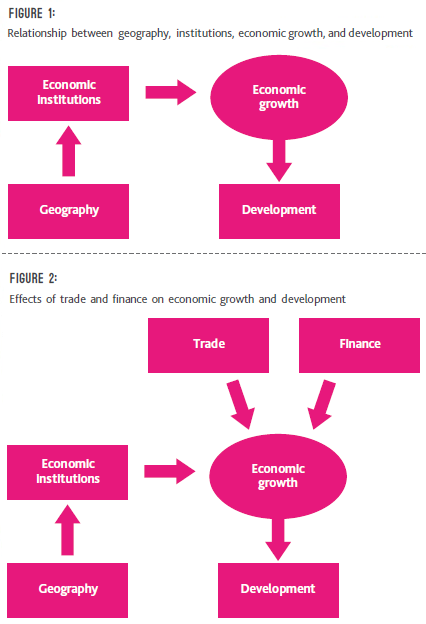

A simple diagram, based on empirical results similar to those of one of the most influential recent papers in economics (Acemoglu, Johnson, and Robinson, 2001) will render this mechanism more explicit: geography affects economic institutions, but has no direct effect on growth; economic institutions, in turn, determine economic growth. The effect of geography on economic growth is therefore mediated through national economic institutions. There is a final arrow linking economic growth to development in a broader sense.

Where do trade and finance fit into this picture? In order to organize our thoughts, let us divide the impact of trade and finance on economic growth (leaving development per se out of the picture for the time being) into two components.

Where do trade and finance fit into this picture? In order to organize our thoughts, let us divide the impact of trade and finance on economic growth (leaving development per se out of the picture for the time being) into two components.

First, there are direct effects: trade and finance, through well-established mechanisms, may enhance growth performance. Though the causal evidence at the macro level is often weak (the finance and growth or aid effectiveness literatures are cases in point), there is a corpus of microeconomic evidence that points to productivity enhancing causal effects of trade and finance. These effects are added in the following picture.

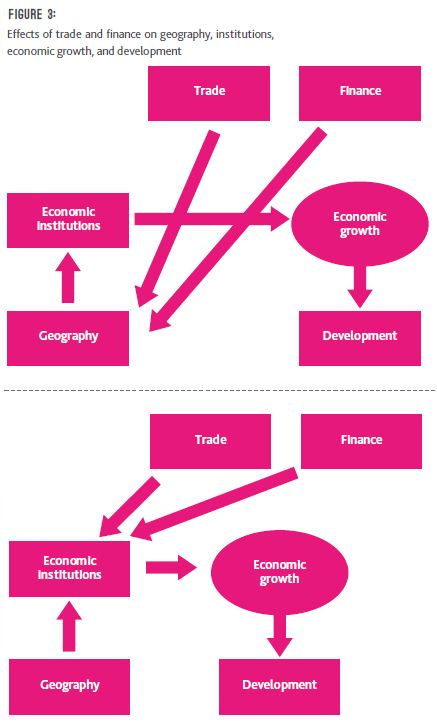

Second, there are indirect effects, which operate through either geography or economic institutions. “Geographic” effects of trade and finance include trading arrangements (such as preferences), which effectively compensate for geographical disadvantages, or financing options – such as official development assistance (ODA) or public-private partnerships (PPPs) devoted to infrastructure projects – which overturn geographic fetters, such as being landlocked. “Institutional” effects of trade and finance have been explored less. While, to take but two examples, the corruption-enhancing effects of ODA have been well documented, as has the positive impact of openness on many national bureaucracies, there are undoubtedly many other mechanisms that could, and should, be explored.

Growth versus development

Finally, there remains the vexing question of the link of all of this (as noted at the outset) with broader measures of sustainable development. Here (and I am willing to be corrected on this), the existing literature is not of much help. In an effort to wrestle a broader development indicator into the above conceptual straightjacket, I appended, as a very rough thought exercise, a third equation to the Acemoglu, Johnson, and Robinson (2001) empirical framework. The scalar measure of development that I added was the classic child anthropometrics indicator of stunting (the proportion of children in a country whose height is one standard deviation below where it should be if they were in good health).

I chose this synthetic indicator for two reasons. First, because half a century of empirical evidence has taught us that it is determined by four factors: income (and therefore economic growth); access to clean water and basic healthcare; maternal education and female empowerment. Second, this indicator is culturally neutral: in different societies, economic and social success may be measured by a bewildering number of indicators, ranging from income, to land ownership, to livestock; but the bottom line is that all inhabitants of this planet care about the welfare of their children, which also adds an intertemporal perspective to things. A remarkable empirical regularity emerges: while income per capita is (unsurprisingly) a statistically significant determinant of stunting (more precisely, a 1 percent increase in per capita GDP is associated with a 5 percent fall in the prevalence of stunting), neither geography nor institutions appear to play a role. While this regularity is merely suggestive, it does offer the hope that the above conceptual framework may be of some use in pinpointing the roles that can be played by trade and finance in enhancing development in general, and not merely economic growth.

Jean-Louis Arcand is Professor and Director of the Centre for Finance and Development at the Graduate Institute Geneva.

Implemented jointly by ICTSD and the World Economic Forum, the E15Initiative convenes world-class experts and institutions to generate strategic analysis and recommendations for government, business, and civil society geared towards strengthening the global trade and investment system for sustainable development.