News

Rail Infrastructure in Africa: Financing Policy Options

The transport sector can accelerate and intensify trade in Africa. Rail transport in particular, as a result of its energy efficiency, reduced greenhouse gas emissions and lower cost per ton kilometre, is expected to play an increasingly important role in the conveyance of freight over long distances. In comparison to other means of transportation, railways are particularly useful in mass transit systems for both inter-city and urban settings.

This report proposes a broad overview of policy options to be considered in financing rail infrastructure investment and maintenance. The recommendations presented in the report are by no means exhaustive. They are expected, however, to serve as a starting point for more innovative business models in Africa's rail transport sector.

The current situation

Most African railways have suffered a strong decline during the last decades

Railways transport is a mature industry in the developed world, which is experiencing a remarkable comeback after a period of decline. The rediscovered allure of railways is underpinned by its capacity to move huge volumes of freight or passengers in an energy-efficient and environmentally friendly way. Nevertheless, in many countries railways are still struggling to transform themselves from subsidydependant legacy companies to more efficient commercial undertakings.

With a few exceptions (mainly in the RSA and Northern Africa), African railways clearly lag behind those of most other regions in the world. Rail transport has faced the same constraints and challenges as elsewhere. But, poor economic, technological and institutional conditions have further aggraveted the situation in Africa. The result is outdated infrastructure, sometimes approaching a point of no return. The operations are clearly below international standards.

Concessions introduced in the 90s, under the impulse of the World Bank and other international donors, have halted the declining trend that threatened to dismantle many rail lines. But, the entire initiative has produced mixed results: in some cases it was a blatant failure and in quite a few others, if any, it was an outright success.

The fundamentals of rail economics and operations

Some of the fundamentals of railways that need to be borne in mind, are:

-

Freight transport is typically competitive over mid to long distances but it usually loses its attractiveness in shorter journeys.

-

Rail requires high volumes to be feasible, and it is a business of high volumes with low margins.

-

Road and railway transport are both competitive and complementary. They compete over long distance but road transport is required for the “last mile.”

-

Railway infrastructure is rigid, expensive and requires an operating and maintaining.

-

The performance of the operator is highly dependent on the conditions of the infrastructure and rolling stock

-

Rail freight and rail passenger transportation are very different businesses

-

Most rail projects around the world require high levels of subsidy for the construction and/or operations to be sustainable. This subsidy should reflect the economic, social and environmental benefits of railways compared with other transport modes.

-

Including appropriate stakeholders in the concessionaire’s shareholding improves project performance in the case of PPPs

There is no single “fit for all” business model for railways. A large number of railway business models can be found worldwide with various levels of integration/separation of infrastructure and operations, and with more or less private participation. Significantly, the bigger and apparently more efficient railways in Africa (e.g. RSA or Morocco) are public sector undertakings, which is not the mainstream pattern in the Americas or in Europe.

The need for a new approach

The analysis of selected African railways confirms the need for a new approach

An in depth assessment of the railways in eight African countries has been undertaken. These eight countries are: Botswana, Cameroon, Kenya, Madagascar, Morocco, Senegal, Tanzania and Zambia. They represent a wide range of backgrounds and experiences. Most have had experience with concessions, with different results. But some (like Botswana and Morocco) have maintained a public sector approach.

The most relevant conclusions from these visits are:

-

In most countries, the introduction of concessions has proved rather unsettling to the point that two of them been terminated after a very short time. Where concessions are still operational, the terms have had to be modified, resulting in major changes to their financial base.

-

Most concessions underestimated the amount of investment required and the sums committed have had a limited impact on improving railway performance. Financial packages associated with these concessions have proved to be insufficient.

-

Railways contract holders, most of them freight driven, have been overburdened with obligations that do not sit comfortably with their core business. They had to take over a substantial share of state railways legacy and passengers' service obligations, and this has been a major issue for their operations.

-

Most concessions require operators to engage to a greater or lesser degree in infrastructure renewal or maintenance. This means that most African concessions are a hybrid that requires operators to be involved to a certain level in infrastructure and maintenance works.

-

The coexistence of passenger services, with mostly freight-driven operators, has been uncomfortable to the point that in some cases, it has been the cause of litigation. Major concession amendments has been introduced, and effected even before the service was eventually terminated. In these cases, service termination is deemed more appropriate than service cessation.

-

The competitive environment between railway and road transport modes has not been adequately addressed in most cases. Neither at the planning stage not at the implementation and enforcement stages were competitive modes of transportation appropriately considered. In too many cases, the compétitive or complementary aspects of road versus rail transportions have not properly been examined.

-

Most countries have reached the conclusion that railway management and financing have to be reviewed. But these countries are still struggling to define the adequate financial models, most notably how infrastructure maintenance should be managed and funded.

-

Most of the visited countries have several new major railway projects, targeting both freight (mostly mining) and passenger market segments. A variety of schemes at regional level have been designed as well. There is a general acceptance that PPPs can have a role to play in the funding of such projects. However, it seems of paramount importance that rail infrastructure, rolling stock and operations should be split both contractually and financially.

-

Finally, some countries seem to have opted for a public approach to their railways sector with no intention to privatize them in the short to mediumterms. Thèse countries are: Morocco, Botswana and Zambia. Zambia, the last of these countries, came to make that decision after a disppointing experience with concessioning. The countries, which opted for the public sector approach, are also countries with the greatest technical capacities and the most attractive business environments in our sample. This is an indication that well-funded and properly managed public railways may be a suitable option in some cases, provided that appropriate institutional framework and commercial structures are in place.

The challenge

There seems to be two conflicting views:

-

One opinion is based on the perception that rail transport as a losing game. The number of operations funded by International Financial Institution’s (IFIs) in Africa, in recent years, shows relatively little investment in railways as compared to other infrastructure such as roads or energy.

-

Conversely, the other opinion sees railways as an indispensable tool to foster development and take full advantage of the continent’s natural wealth. Many African countries, as well as regional groupings, are currently designiing new railway schemes. And several foreign players have become very active in promoting, lobbying government and even investing in railways. High expectations for the sector, as well as a certain amount of media hype, can now be found in the offices of many African decision-makers.

These contradictory views should not provide any excuse for either inaction or irresponsible investment decisions. On the contrary, what is required is a clear understanding of the fundamentals of the rail business, its financing and the making of sound and unbiased assessments, especially at the stage of project identification and preparation. Unfortunately, in many countries, this process is hindered by a shortage of skills and familiarity with modern railways.

The solution

There are opportunities for railway development in Africa as a consequence of the following drivers:

-

Growing urbanisation and industrialization will pose new transportation challenges that railways are well suited to handle.

-

Africa will produce large volumes of goods such as bulk minerals and commodities that are natural markets for railways.

-

The huge continental mass of Africa and the existence of many landlocked countries will encourage the development of high-capacity and efficient transport corridors.

-

Higher sensitivity towards environmental and safety issues will result in railways getting more public attention and social support

-

The reduction of the extremely high external costs (noise, pollution, congestion, accidents etc.) associated with the constant increase in the use and ownership of private vehicles.

Focus projects on what railways do best

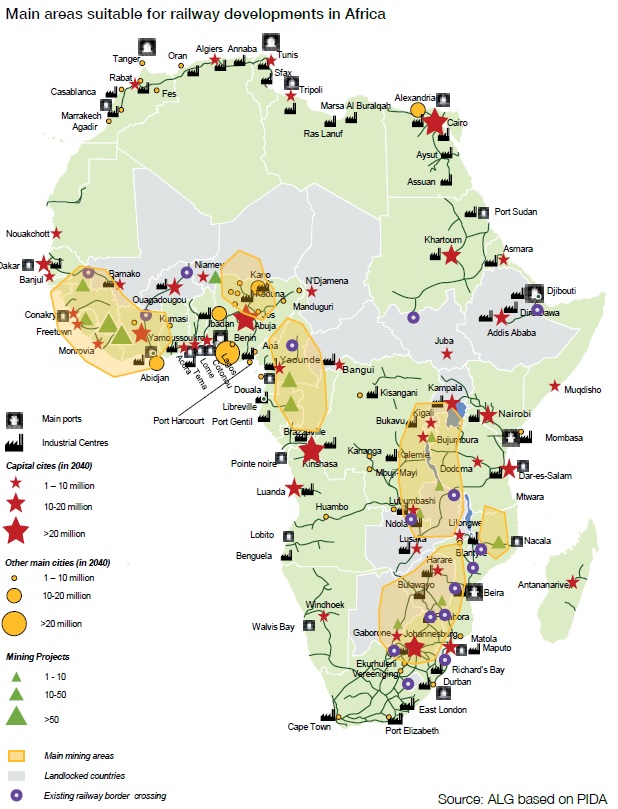

Railways are not the sole solution to all transportation challenges. Projects should be concentrated in segments where railways can effectively bring higher efficiency and lower costs than other modes: moving high volumes of persons or goods over a given distance. Accordingly the areas deemed to be most appropriate for railway projects in Africa are:

-

Major African Metropolitan Areas > Urban and suburban passenger railways.

-

Densely populated areas and corridors > High volumes for freight or passengers possible.

-

Corridors from ports to inland markets > Freight trains moving containerised or bulk materials from/to ports over long distances.

-

Major mining basins > Freight trains moving minerals and other raw materials to export ports.

Railway policy makers may have to bear in mind that new railway projects in Africa will only be sustainable provided that they are compatible with their natural markets. Projects should be driven by the “need” within the Transport Sector with a clear set of objectives. Robust and detailed feasibility assessments such as cost-benefit analysis (CBA), economic impact analysis or social return on investment analysis need to be part of the evaluation process.

The way forward

Learn from the experience of other countries

Faced with similar challenges in terms of the financing and development of railways, experiences in other developing and emerging countries are particularly valuable:

-

Countries that pioneered railways concessions, such as Argentina, provide mixed results. While freight transport has grown and proven to be profitable, longdistance passenger services have been discontinued, as the subsidies required were unsustainable. However, urban and suburban trains remain crucial to Buenos Aires mobility.

-

The quality of the institutional environment is critical to ensuring that users benefit from private sector participation. In poor institutional environments, private operators may be more interested in courting regulators and politicians (i.e. the source of subsidies), than in really engaging in the improvement of safety and service standards to users, since fares are a minor part of the operator’s revenues.

-

Big, and bureaucratic, public railways may create highly professionalized spin-offs to provide flexible, credible and creditworthy instruments to deal with the private sector under a wide range of PPP deals. This is the case of IRFC and RVN in India. This type of approach merits the support from IFI’s.

-

Public railways such as Transnet and PRASA in the RSA may provide acceptable to good service delivery and sound financial performance, under adequate institutional arrangements, and has experience with big PPP deals such as the Gautrain.

-

Although it is a politically sensitive issue, the use of a share of fuel taxes to fund railway infrastructure is possible in emerging countries, as Poland’s experience shows. This fund can eventually underwrite the issue of bonds to finance railway projects.

-

Unless there is a clear political will to push forward with liberalization and integration of national networks, it can be difficult to get agreement to a legal framework that neatly separates infrastructure, operation and regulation.

-

Partnerships between railways and logistics/transport operators have been successfully achieved in some of the leading railways in Europe and some examples already exist in Africa. The strong synergies obtained seem to favour this approach.

-

The decision to change gauge within a country has many implications. It can hinder, almost irreversibly, the development of rail traffic as has happened in some EU countries without standard gauge. Any new project, that involves the introduction of a different gauge from the one existing on the network, needs to be carefully assessed before any decision is made. The assessment needs to take into account the requirements of stakeholders in the logistics chains and all the operational and day-to-day impacts.