News

AfDB releases report on trade finance in Africa

Trade finance is essential for international trade. This financial intermediation helps firms to manage risks inherent in international transactions, improve their liquidity and enable them to optimally invest to enhance their growth.

It is for this reason that, in 2013, the Board of the African Development Bank (AfDB) approved a US $1-billion trade finance (TF) program to support African trade and provide financing to underserved African-based financial institutions and enterprises. Despite its importance, there is a great deal we do not know about the trade finance market in Africa. This includes the size of the market, the variations across sub-regions, the scale of financing gap, the trade finance devoted to intra-African trade, the relative importance of on-balance sheet versus off-balance sheet financing, and constraints faced by banks.

The report Trade Finance in Africa seeks to fill the above information gap. It is based on a unique survey of the trade finance activities performed by commercial banks in Africa in 2011 and 2012. Our survey questionnaire was sent to approximately 900 banks on the continent. We received a high response rate, resulting in a dataset that covers 276 banks across 45 countries. All the sub-regions on the continent are represented in the survey.

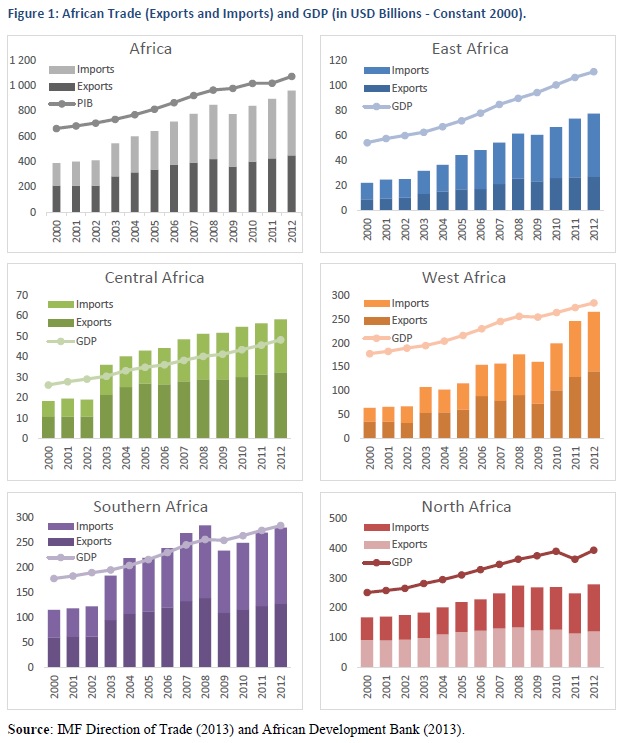

We found that the size of bank-intermediated trade finance is approximately US $330 billion to US $350 billion and approximately 93% of banks have trade finance assets. This is roughly equal to one-third of total African trade. The market is not uniformly distributed across sub-regions as the average trade finance assets per bank in Northern Africa dwarfs those of the other sub-regions. The share of bank-intermediated trade finance that is devoted to intra-African trade is limited, and comprises approximately 18% (US $68 billion) of the total trade finance assets of African banks.

It should be noted, however, that the share of intra-African trade accounts for 11% (US $110 billion) of the value of total African trade. Given the estimated rejection rates of trade finance applications reported in the survey, the conservative estimate for the value of unmet demand for bank-intermediated trade finance is US $110 billion to US $120 billion, significantly higher than estimated earlier figures of about US $25 billion. These figures suggest that the market is significantly underserved.

African banks face numerous constraints in meeting the demand for trade finance. The survey reveals that the main constraints are limited US dollar availability (by far the dominant currency in international trade, and by extension, trade finance) and insufficient limits with confirming banks for confirming letters of credit. Other constraints include small balance sheets, which tends to make single obligor limits frequently binding. These constraints also suggest that the AfDB’s trade finance program, as well as those implemented by other international financial institutions, are needed and well suited to relaxing some of the most binding constraints.

Finally, the survey shows that the outlook of banks for trade finance remains positive, with 72% expecting to increase their trade finance activities in the immediate future. However, banks foresee obstacles to their trade finance portfolio growth such as low US dollar liquidity, regulation compliance, slow economic growth in some markets, and the inability to assess the credit-worthiness of potential borrowers.

Infographics