News

COVID-19 and trade in SSA: Impacts and policy response

COVID-19 will have a severe economic impact in Sub-Saharan Africa: Trade is the Key Channel

The COVID-19 pandemic is first and foremost a public health crisis. However, measures adopted to curtail the spread of the virus have led to a sharp contraction of the global economy and an even larger decline in global trade, with significant implications on the livelihoods of people in Sub-Saharan Africa (SSA). To date, the number of confirmed cases of COVID-19 has been relatively low in Africa when compared to other regions. However, nowhere will the pandemic hit harder, or with greater adverse impacts on the economic, social, and political life of people, than in SSA, mainly due to the inherent vulnerabilities in the region. Economic growth in SSA is expected to decline to between -2.1 and -5.1 percent in 2020, the first continent-wide recession in a quarter of a century. The economic impact will be hardest felt through trade, due to the rare mix of global shocks in demand and supply. Trade is also key to the solution, both in the direct measures to control the spread of the virus and in minimizing the economic fall out. This brief focuses on trade impacts and policy responses with respect to the latter.

The trade impacts of COVID-19 are amplified since countries most affected by the pandemic also represent a significant share of global production and trade. Countries most affected by the pandemic, mainly the United States, China, Japan, Germany, the United Kingdom, France and Italy, together account for about 60 percent of global GDP, 65 percent of global manufacturing and more than 40 percent of global manufacturing exports, while forming key parts of the global value chains (GVCs). The COVID-19 related trade collapse is expected to exceed the trade slump of the 2008-2009 financial crisis. Global goods trade is projected to plummet by 13 to 32 percent. In stark contrast to the 2008-2009 global crisis, where the impact on global trade slowdown was indirect and mainly demand driven, there is now a precipitous slump in production (supply) as well as a sharp collapse in demand. The containment measures adopted in countries most affected by the pandemic result in significant demand shocks, affecting exports and economic growth in SSA.

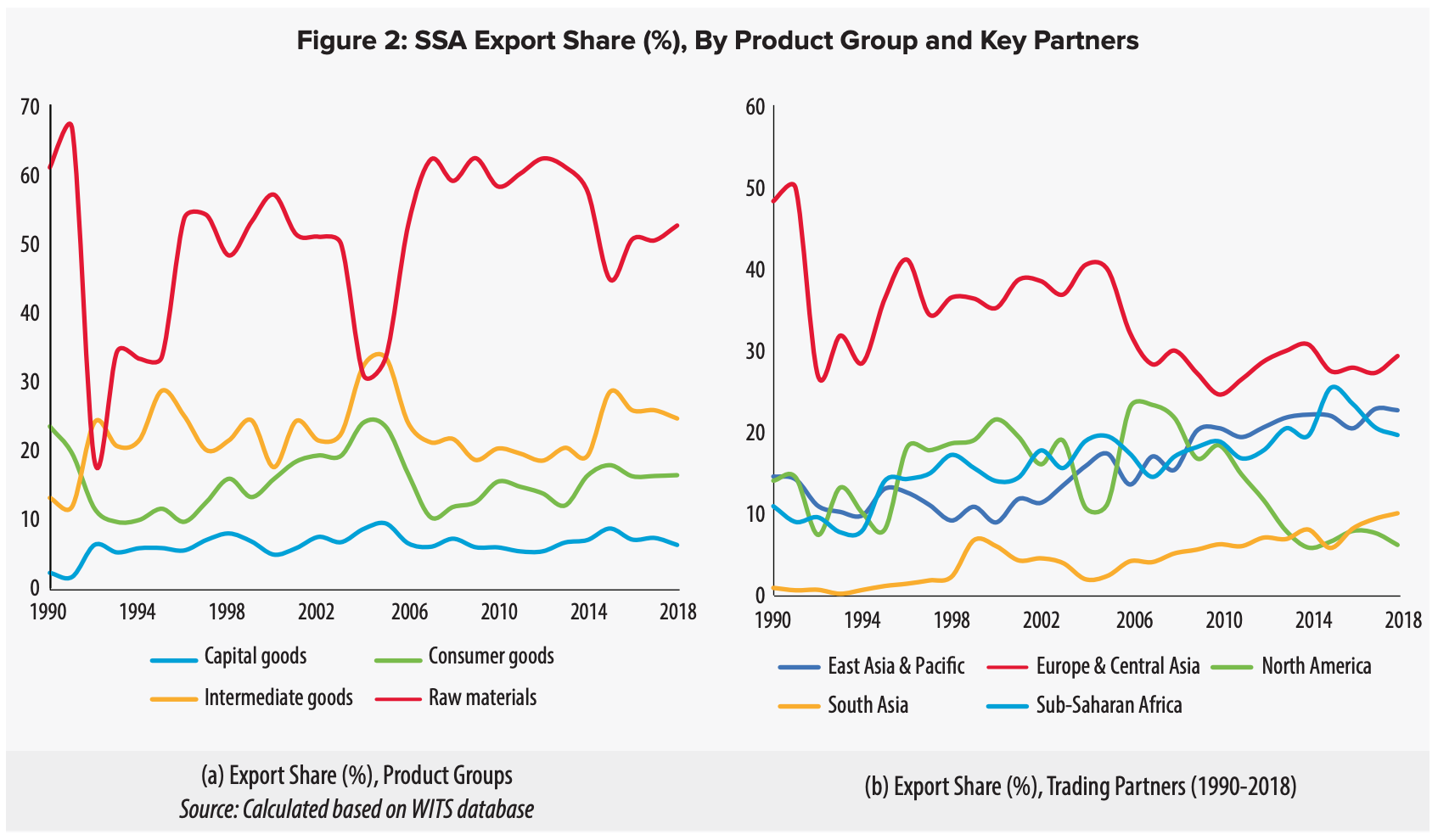

Though Africa accounts for a very small share of global trade (3 percent), the share of trade in the national income of most economies in the region is relatively large, compared to other regions. In 2017 the share of trade in GDP was 31 percent in North America, 40 percent in South Asia, 56 percent in SSA and 57 percent in EAP. Africa’s share of exports to the rest of the world ranged between 80-90 percent during 2000-2017, higher than any other region. Given that the countries most afflicted by the pandemic account for a significant share of global trade and output and are the largest trading partners of the region, the trade impacts are expected to be severe. Hence, despite a relatively low percentage of confirmed cases of COVID-19 in SSA thus far, the largest shocks to the region are going to be external. In addition, the lion’s share of foreign direct investment (FDI) to SSA comes from these regions, creating a confluence of triple shocks: falling demand for African exports; global supply shocks further curtailing production in export-oriented sectors; and a slump in FDI flows. The impact of disruptions in GVCs driven by the global demand slump would be predominant in countries with strong forward linkages – mainly exporting raw materials used in the production for export in other countries. This accounts for the largest share of the region’s trade and GVC integration.

The supply shocks introduce direct supply disruptions in African countries that are increasingly becoming more integrated into GVCs. Non-resource rich SSA countries that have been centers of robust growth in the region over the last two decades will be the most affected by these supply shocks. The largest declines in trade are likely to be in sectors with highly integrated global value chains (GVCs). The manufacturing sector will be hard-hit due to the relatively strong GVC linkages. Subsequently, exports are expected to fall due to shortage of intermediate inputs. SSA economies which have been transitioning or are well integrated into manufacturing GVC including South Africa, Kenya, Ethiopia, Lesotho and Eswatini, will be affected the most. These disruptions in production translate into closures of businesses, especially those that export, raising unemployment and poverty. This perfect storm of shocks could potentially derail early successes in economic growth and poverty reduction achieved in some countries in the region. The short-term and long-term employment and poverty impacts from the disruption in production depend on policy responses by governments and businesses on withstanding the crisis. The impact is worsened by disruptions in international transport networks, which raise the cost of trading. The impacts could be even more severe in countries where commercial services trade such as international passenger and cargo transport and international tourism represent a large share of national income. Since service trade is often complementary to goods trade, the collapse in goods trade will also be followed by a collapse in services trade.

The external trade shocks are compounded by disruptions that are internal to the region, as African countries impose restrictions on the movement of people and goods to limit the spread of the virus. These restrictions have slowed down regional trade with significant economic implications. The share of intraregional exports in total trade is the lowest in Africa; while a large share of the regional trade is informal. Intraregional trade is dominated by manufacturing exports, accounting for 457 percent of intra-African exports. Hence, lockdown measures to control the virus will have negative impacts on the manufacturing sector in the region. In addition, a large share of regional trade, often missing from official trade statistics, is informal. The nature of informal trade is that it is dominated by small-scale producers and traders, engaged in agriculture and other primary sectors. As of May 26, 2020, 43 African countries had closed their borders. Small-scale cross-border trade contributes to the income of about 43 percent of Africa’s entire population while supporting the livelihoods of significantly more people indirectly. Such trade, dominated by agricultural and livestock products, is an essential part of food security in the region. Substantial disruption to regional trade and agricultural supply chains could lead to increased risks of food insecurity and poverty in a region that is already home to the largest number of the global poor and the food insecure.

Trade Policy Responses to Mitigate the Shocks

-

The first policy action is to do no harm. Blanket Protectionist policies would do more harm than good. Open trade in both goods and services plays a key role in overcoming the pandemic and limiting its health and economic impact, especially on the poor.

-

Countries should strengthen trade facilitation to streamline and simplify regulatory and border procedures across the region by improving the efficiency of services and increasing access to trade finance.

-

Deeper regional coordination in trade and COVID-19 response is necessary, both to limit the spread of the pandemic in the region, and to minimize the immediate and long-term economic fallout.

-

Through the African Union (AU) and other regional and global forums, African countries could benefit from coordinating their responses and mobilizing support from international financial institutions.

-

African countries should position themselves to seize opportunities that may arise from the desire to diversify global supply chains and expand into new destinations.

-

States, in coordination with domestic firms, lead firms, and workers’ unions should adopt strategies to sustain businesses through the pandemic and ensure that the recovery is smooth.

The above extracts are taken from a new Africa Knowledge in Time Policy Brief from the Office of the Chief Economist, Africa Region, World Bank. The author, Woubet Kassa, is a research analyst at the World Bank. Republished here with thanks to the author.