Blog

Angela Merkel’s state visit to South Africa: its significance amid the current Germany-South Africa trade relationship

On Thursday 6 February 2020, German Chancellor Angela Merkel landed in South Africa as part of a brief visit to Southern Africa, which also includes a visit to Angola. This is her second official trip to South Africa following a previous State visit in 2007 and only the third time a German chancellor has visited South Africa, former chancellor Helmut Kohl (her predecessor, who oversaw Germany’s reunification) having been the first in 1995 shortly after South Africa’s transition to democracy.

Merkel’s visit follows that of the German president Frank-Walter Steinmeier late in 2018, who reciprocated president Cyril Ramaphosa’s State visit to Germany earlier that year.

There is clear significance to this visit and South Africa and Germany’s historic political and economic relationship is complex, and long. During, by now, distant past periods of conflict the two countries sometimes found themselves on opposite sides (for example in North Africa during World War II where South African troops fought alongside the British against Erwin Rommel’s Afrika Korps, and even here in South Africa, where German nationals were declared ‘enemy subjects’ during that period, many rounded up and kept in internment camps for years on end while the war elsewhere in the world raged on). Then shortly after the conclusion of the war, South African pilots assisted with airlifts to and from West Berlin during the Soviet Union instigated ‘Berlin blockade’, but now essentially in support of Allied-backed ‘West’ Germany.

During the apartheid years Germany was sometimes seen as a more reluctant participant in the global political, economic and trade boycott of South Africa, and remained significantly invested in South Africa. It was of course dealing with its own issues, and Cold War dynamics were ever-present in Germany and also impacted the German relationship with South Africa, given the West/East German country split (the former, open and democratic dispensation being allied with the West, and East Germany, under a communist regime, the direct opposite), and the ideological dynamics within South Africa.

Consequently, support for South Africa’s liberation movement (and now government) was initially mainly from East Germany while West Germany favoured a somewhat more open, constructive dialogue with the apartheid regime to pressurise and bring about change, and where South Africa’s liberation movement was seen with a measure of distrust. When former president Nelson Mandela visited Germany shortly after his release from long-term incarceration he was not officially received by then-chancellor Helmut Kohl, and it was only during a later visit along with an address to the German Bundestag where the need for social and economic unification in South Africa was a central theme (itself so relevant in Germany’s own context at the time), that Germany’s political and business leadership began to embrace South Africa more wholeheartedly.

Merkel’s visit to South Africa time around is noteworthy in its own right and will have been driven by a number of political and economic factors quite different from the early post-Apartheid and Germany reunification context. According to 2018 EU trade data, for example, South Africa was Germany’s 13th largest non-EU supplier of goods and its 15th largest non-EU export destination. At current exchange rates, bilateral goods trade between the countries was worth R280 billion during that year, with Germany consistently enjoying a trade surplus with South Africa, although in 2018 this was recorded at its narrowest (in current exchange terms) since 2002.

Many other factors can be considered with regard to the timing of this trip, and what it might aim to achieve. Germany is South Africa’s most important trade partner from the EU and a major investor in South Africa.German companies are heavily invested in South Africa, with more than 600 German companies employing over 100,000 South Africans. These include well-known brands such as BASF, Bayer, DHL, Deutsche Bank, SAP, Siemens, ThyssenKrupp, and vehicle manufacturers including BMW, Mercedes Benz, Volkswagen and MAN, with current and emerging opportunities in the energy, cleaner technology, telecommunications and healthcare sectors considered to be attractive future markets for German investors. That is, if South African can continue to offer the necessary stability along with the undoubtedly vast opportunities.

Yet under former president Zuma this bilateral relationship – long considered as having become near-unbreakable and particularly strong economically and politically – suffered some harm and cooled off somewhat, especially at the political level. Consequently, during his 2018 visit to South Africa, Germany’s president Steinmeier called for a “new start“ with South Africa.

South Africa’s cancellation in October 2014 of its bilateral investment treaty with Germany (along with a raft of other similar ones with for example Belgium, Switzerland and Luxembourg), which had been in force for most of the post-Apartheid era, was considered in some quarters as a hostile act, and symptomatic of a more protective investment environment in South Africa where numerous domestic laws – for example updated mining rights legislation or labour laws and broad-based black economic empowerment (BEE) – being possibly considered as being at odds with these treaties).

A dispute between Italian mining investors and the South African government appears in part to have triggered South Africa’s (re)action, and while this case related to BEE regulations and the mining charter (incidentally, this case was later also brought before an arbitration panel in The Hague where the complainants lost), the South African government’s position was that the BITs (should not) remove the government’s ability to implement policies and undertake regulatory change that it deemed to be in the public interest. Meanwhile, South Africa started more openly courting for example the BRICS countries, and appeared to, at least to an extent, abandon its old partners and allies.

Yet following the accession of President Ramaphosa to South Africa’s highest office the political winds of change began picking up speed and a new direction emerged, the government pitching to rekindle some of the previously strong economic and political relationships that had cooled off somewhat over the past decade. But with South Africa battling to undo the economic regression of the Zuma era, and a complicated political landscape creating frustration with slow progress on reforms and economic regeneration (at one point, an open letter by leading countries – including Germany – voicing their concerns even resulted in a formal démarche by South Africa, clearly having struck a nerve), there are warning signs that the era of ‘Ramaphoria’ is turning into one of ‘Ramaphobia’, at least in some quarters.

The latest visit by Merkel and affirmation of the important strategic, economic and political partnership is thus a timely shot in the arm for bilateral relations but also for South Africa’s political leadership, and is likely to help support the repair and reform efforts underway in South Africa.

South Africa and Germany’s paths and strategic interests intersect at many other junctions too. Both countries are currently non-permanent members of the UN Security Council (2019-2020 term) and a further strengthening of the bilateral relationship will be considered as being of great importance. Both countries are also influential members of the G20 group (which counts among its membership Germany individually, the EU bloc as a whole, the United States, Canada, China, Brazil etc.), and with South Africa as the sole African representative.

But for Germany, a strong strategic partnership with South Africa is critical, particularly in the context of the broader African continent and ongoing developments. Regional economic integration and the ambitious African Continental Free Trade Area (AfCFTA) – formally launched last year and intended to be operational mid-2020 – are important milestones for Africa (including South Africa) and remain important issues on the continental agenda. These developments in Africa potentially benefit Germany too. This is in terms of new trade opportunities between Germany and a more integrated continental market that may offer greater potential for new and stronger value chains (intra-African, as well as global linkages), but also presents new opportunities for economic opportunity, prosperity and peace.

And this also links with issues around migration, long a concern not just for Africa but very much a serious concern for Europe in terms of inward migration – with Germany being particularly impacted in recent years, having demonstrated strong and compassionate leadership in managing and absorbing migrants from the Middle East and from Africa (migration based on economic, social, political, safety factors). Net immigration into Germany in recent years has numbered around 500,000 annually, reaching a peak of over 1 million in 2015 (albeit mostly as a result of the Syria conflict) and the issue remains to this day a sensitive and important one for Germany. The country will therefore likely be counting on working more closely with Africa – and the African Union – on this particular issue, and here another important timing aspect emerges.

South Africa – and Cyril Ramaphosa – takes over the chairmanship (from Egypt’s Abdel Fattah el-Sisi) of the African Union in February 2020, and thus becomes a particularly important strategic partner to Germany at this juncture. Of significance too is that Germany itself takes on a new leadership role within the European context later this year, assuming the presidency of the Council of the European Union.

Germany has acknowledged for example that many issues around conflict (and migration) cannot be resolved by it or the EU in isolation of Africa’s input, collaboration and support, and no doubt Germany will be leaning on South Africa’s chairmanship of the AU to play a meaningful role in supporting numerous peace processes, and economic integration, in Africa (the AU’s current priority theme is ‘silencing the guns‘). Germany hosted the Berlin conference on Libya in January aimed at finding solutions to the political, security and humanitarian situation in Libya.

For African integration significant groundwork has already been undertaken, and apart from the very significant efforts towards economic integration (and the emergence of the world’s largest free trade area), the continent is also home to some of the fastest growing economies in the world. This represents unique opportunities for Africa and the African integration agenda, but potentially also for Germany. Economic Partnership Agreements (EPAs) with various African regions have already strengthened the economic and trade relationship between the EU (and Germany), and participating African regional blocs in recent years. The trade provisions of the SADC EPA have replaced those of the bilateral FTA (TDCA).

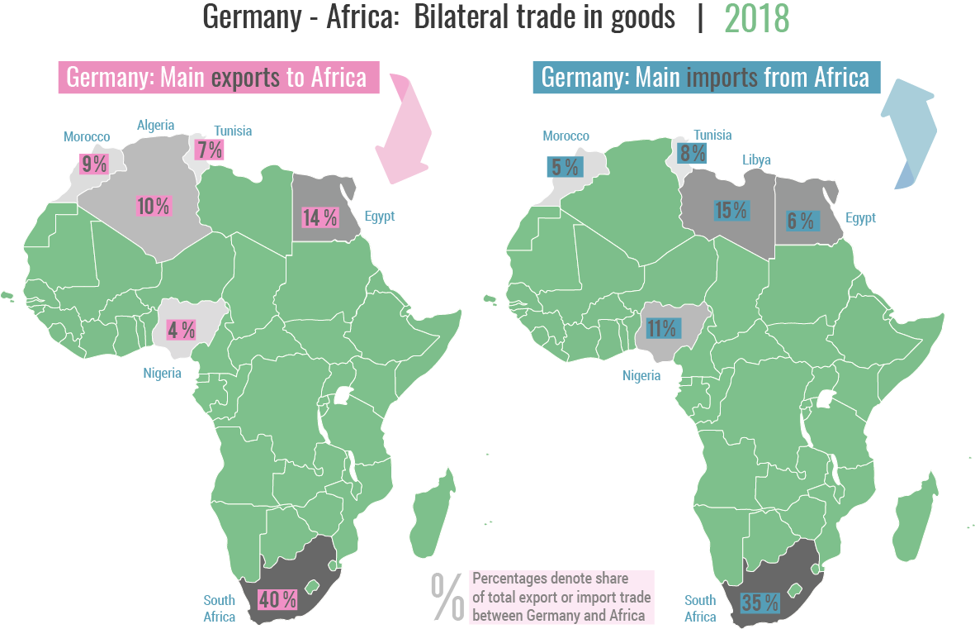

In terms of trade, South Africa is Germany’s most important trade partner in Africa, as noted earlier (see link to trade data at the end of this article). While the continent as a whole accounted for only 1.7% of Germany’s global exports (in 2018, and 2% of Germany’s global imports, South Africa accounts for 40% of Germany’s exports to Africa and is the source of 35% of Germany’s African imports. Apart from South Africa, the majority of trade takes place with North African countries, and to a lesser extent with Nigeria.

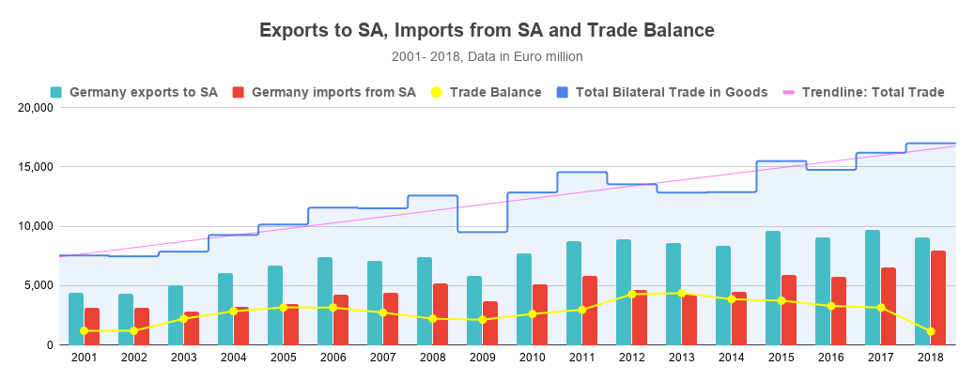

Two-way trade between Germany and South Africa has also been increasing steadily over the past two decades. Germany however enjoys a trade surplus with South Africa, and this has been the case throughout the period under review (see following chart). What is notable though is that over the past few years, South Africa’s exports to Germany have increased while Germany’s exports to South Africa have remained relatively stable, leading to increased total trade yet a declining trade surplus for Germany, and therefore more balanced trade overall. In 2018, trade data shows that Germany exported € 9.1b worth of goods to South Africa while importing goods worth € 7.9b.

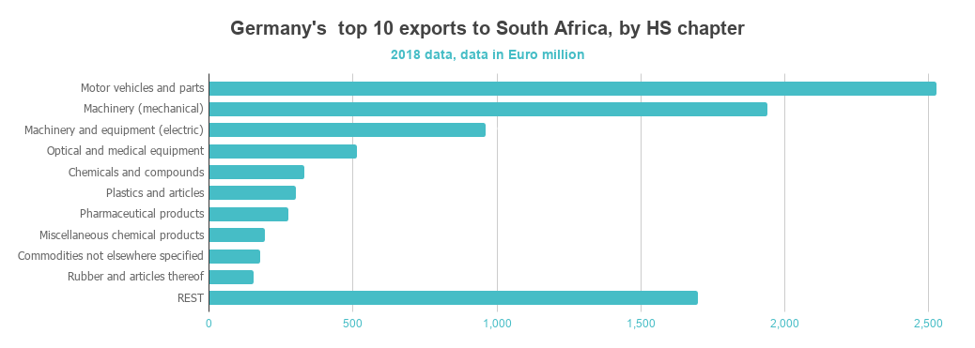

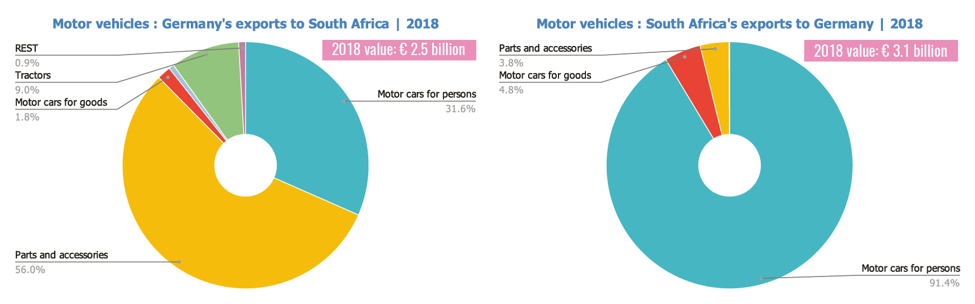

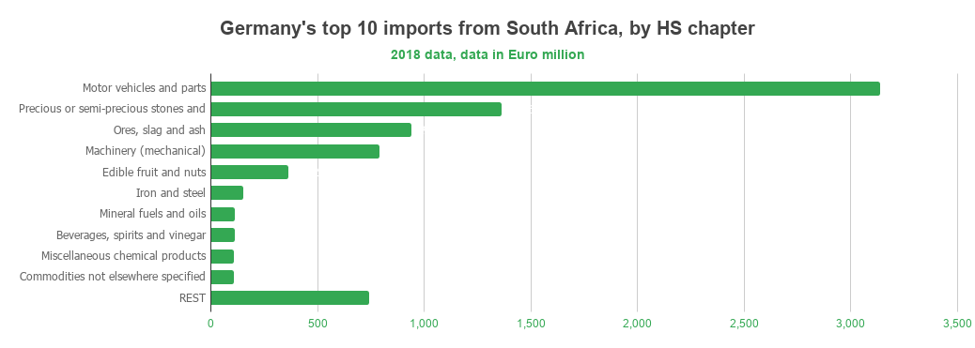

The composition of Germany’s exports to South Africa (and incidentally imports from South Africa) reveals that the automotive sector leads – at the HS2 digit disaggregation – with € 2.5b worth of exports in 2018 (notably, in this sector Germany is a net importer from South Africa, with imports of € 3.1b in the same year). Leading sectoral exports are mechanical and electrical machinery and equipment, at a combined value comfortably exceeding automotive exports to South Africa (€ 3bn). Overall, industrial goods dominate Germany’s exports to South Africa, which generally are also more diversified than imports from South Africa.

South Africa’s exports to Germany also sees automotive goods as the leading export category at the HS2 level, exceeding € 3bn in 2018. Most of this trade comprises built-up motor vehicles, while a fraction (albeit less than 4%) of parts – mainly suspension parts, followed by clutches, bumpers, silencers, radiators and steering components. These goods qualify for preferential market access to the EU under the EU-SADC Economic Partnership Agreement (EPA) and even before then under the bilateral FTA (TDCA).

Comparing for example the value of Germany’s motor vehicle (Chapter 87) exports to South Africa with imports from South Africa, it becomes evident that not only is this the leading export for each country (at the HS Chapter level) but the composition of these exports shows the role South Africa plays as a base for motor vehicle manufacture (assembly), relying on parts and accessories imported from Germany. Within the sector, built-up vehicles form a much smaller share of Germany’s exports to South Africa (within Chapter 87) than vice versa, and the opposite applies to parts and accessories. This is also reflective of the close manufacturing value chain ties between the two countries within this sector, with leading brands (such as VW, BMW, Mercedes, MAN trucks) each having significant production bases in South Africa, relying inter alia on parts sourced from Germany.

Overall, however, South Africa’s exports to Germany more broadly consist of resources (minerals, ores, metals), and agricultural exports (mainly grapes, followed by citrus, apples and pears), as shown in the following chart. Significant growth overall can be seen since 2016, and especially from 2017 to end 2018.

In summary, Merkel’s short visit was timely (if not overdue) and provides further recognition not only to the important economic relationship that has always been in place between Germany and South Africa, but also recognises the inter-woven and complex political and strategic ties between the countries especially at this important juncture, coming at a time when both countries face immense challenges either domestically, politically or regionally.

Both countries are clearly accepting of the fact that they need each other in more ways than just economic terms, and wish to increasingly rely on each other in the various international fora that they currently play important roles in and which at some level impact one another. In some respects though, the current windows of opportunity where each country can play an even more meaningful role and be supportive of the other, are relatively short. Sometimes, though, the mutual signaling of intent and overtures towards a deeper and more meaningful collaboration and promises of reciprocal support can in itself achieve much, which is both in the national and broader international interest.

To access the trade data, follow this link: http://bit.ly/DataGermanySA

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...