News

Boosting Intra-African Trade: Implications of the African Continental Free Trade Area Agreement – African Trade Report 2018

The 2018 edition of the African Export-Import Bank’s annual flagship report – the African Trade Report – titled “Boosting Intra-African Trade: Implications of the African Continental Free Trade Area Agreement” has been prepared at a time when concerted efforts are being made across the continent by both sovereign and corporate entities to deepen economic integration and boost intra-regional trade and cross-border investments.

The report provides an important insight on the potential benefits of the AfCFTA Agreement in terms of growth, diversification of sources of growth and exports, development of global value chain, but also in terms of integration of African countries into the global economy. In particular, the analysis carried out shows that a complete tariff removal coupled with significant reduction in non tariff barriers could lift economic growth and raise the volume of exports and imports while significantly improving the terms of trade across Africa.

The Report also undertakes a review of policy options and measures that could ensure a successful implementation of the AfCFTA Agreement and enhance the bargaining power of African sovereign entities in international trade negotiations. In particular, it is argued that transcending institutional and non-tariff barriers associated with national constructs to embrace shared institutions will enable countries to draw on economies of scale to increase efficiency and competitiveness while internalizing the costs emanating from negative externalities.

At the same time, achieving higher growth and a trade development impact under the AfCFTA will depend on the commitment and steps taken by countries to eliminate non-tariff barriers, speed up the development and modernization of infrastructure, especially trade-enabling infrastructure, and raise the level of resources allocated to the financing of intra-African trade.

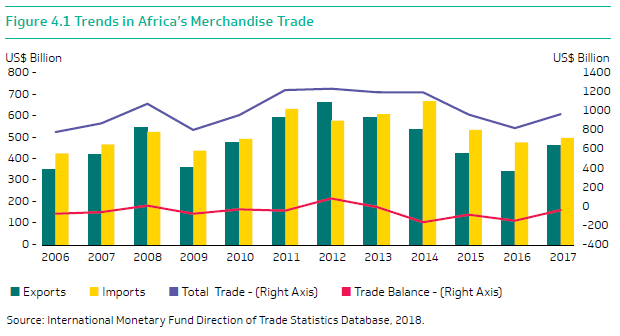

The 2018 edition of the African Trade Report also provides a comprehensive analysis of the state of global and African trade in 2017. After falling below parity in 2016, the lowest in 15 years, the ratio of trade growth to GDP growth rose to 1.5 in 2017, reflecting the strengthening of global trade. In the midst of that favorable environment of growth acceleration and global trade expansion, Africa’s total merchandise trade gathered momentum growing much faster than the world average, driven by a recovery in commodity prices and strengthening cross-border investment.

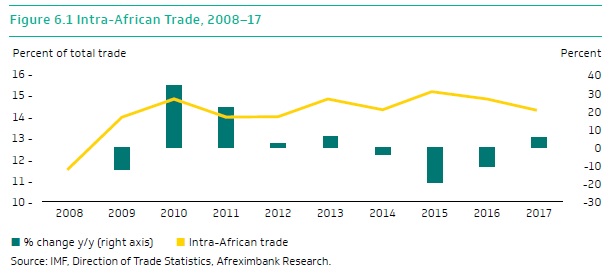

Furthermore, the Report provides a comprehensive analysis of the dynamics of intra-African trade, both at a regional and national levels as well as the composition of intra-African trade byproducts and sectors. Industrial products and manufactured goods continue to account for the lion’s share of intra-African trade. At the same time, and interestingly, manufactured products traded within the continent are increasingly dominated by medium to high-skill technology intensive manufactures.

Looking ahead, Africa is expected to remain on a strong economic growth path, with improving trade performance in 2018 and beyond, riding on the global momentum of synchronized global growth led by increased investment and fiscal expansion. However, in the medium term, downside risks to global growth and trade include a contraction in global demand, especially if the ongoing transition and re-balancing in China leads to acute growth deceleration; sharp tightening of financial conditions could further stress highly-indebted sovereigns and corporates and, in the process, affect business confidence and investment decisions;and the rise of protectionist policies, most notably reflected in the escalating cycle of trade restrictions and retaliations, could derail the current growth momentum.

Trade and the Trading Environment: Africa’s Trade

Africa’s total merchandise trade gathered momentum, growing by 10.6 percent in 2017, to US$907.63 billion, up from US$820.76 billion in 2016. The recovery and expansion of African trade was in line with global trade and reflected continued tightening of trade links between developing economies in the South and Africa, the resilience of intra-African trade, and dynamics in the commodity market. In effect, the sustained recovery in commodity prices, especially those with export interests to Africa, were also key factors behind the remarkable turnaround in Africa’s merchandise trade in 2017.

Intra-African trade

The promotion of intra-African trade is the first pillar of the Bank’s Fifth Strategic Plan, informed by the view that intra-African trade offers tremendous potential as a mitigant against adverse external shocks and global volatility. The potential is evidenced by the experience of countries such as Kenya, where greater intra-African trade intensity has cushioned the country from exogenous shocks. Informed by these developments, but also by the still low level of intra-African trade, there is a growing awareness on the continent of the transformational impact of intra-regional trade, with a number of strategic initiatives championed by the region’s business and political leaders and development finance institutions, including Afreximbank.

Indeed, one of the core tenets of the African Continental Free Trade Area is the Boosting Intra-African Trade (BIAT) initiative, indeed reflecting its tremendous potential for raising intra-regional and cross-border trade and stimulating opportunities for industrialisation, and diversification while creating much needed employment opportunities for the continent’s growing population. More specifically, in 2017, the Bank supported growth of intra-regional trade through increased financing of, and investment in, trade supporting infrastructure to expand light manufacturing industries, transform the structure of African economies and diversify exports.

The Bank’s investment recognises the importance of intra-African trade in driving the process of industrialization and creating a business environment that is more conducive for African entrepreneurs to move up the value chain – by producing and supplying more manufactured goods,Industrial production and manufactured goods largely dominate intra-African trade in contrast to extra-African trade.

The African Trade Report 2018 has been made available to download courtesy of the African Export-Import Bank (Afreximbank).