News

South African Treasury predicts growth pickup as confidence returns

With a new leader at the helm and confidence improving, growth in South Africa, Africa’s most-industrialized economy, may accelerate to levels last seen in 2014, according to National Treasury forecasts.

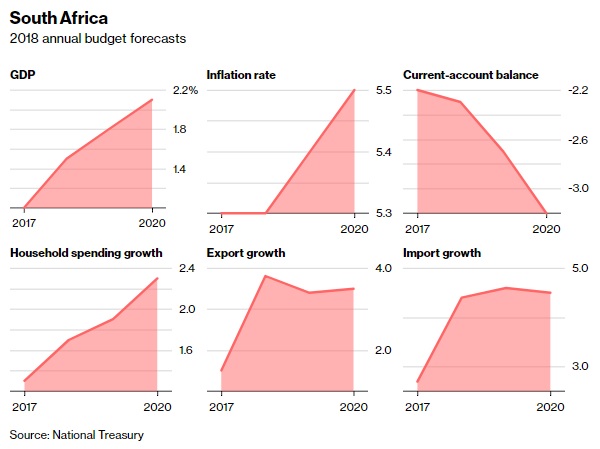

South Africa’s economy is forecast to expand 1.5 percent this year, compared with the previous projection of 1.1 percent and an estimated 1 percent in 2017, National Treasury said in its 2018 Budget Review. Growth will probably accelerate to 2.1 percent in 2020 as measures aimed at creating policy certainty and attracting investment pay off, it said.

The government is battling to return public finances to a sustainable path and stave off another credit-rating downgrade, following years of stagnant growth and policy missteps that left a gaping hole in the budget. It will reconsider mining-sector policies that deterred investment, introduce telecommunications reforms, lower barriers to entry by addressing anti-competitive behavior and provide support for labor-intensive sectors, the Treasury said.

New Leader

Investor confidence started creeping back after the ruling African National Congress elected Cyril Ramaphosa as its new leader in December, paving the way for him to take over from Jacob Zuma when he resigned as the country’s president last week. The rand climbed and bond yields dropped to levels last seen in 2015.

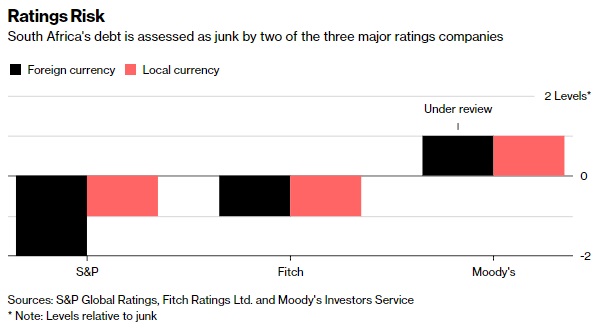

South Africa’s foreign- and local-currency credit ratings dropped to non-investment grade last year as Fitch Ratings Ltd. and S&P Global Ratings lowered their assessments, citing policy uncertainty and concerns about the management and finances of state-owned companies.

Moody’s Investors Service has the country on review for a downgrade to junk and may make an announcement on March 23. Should Moody’s reduce the local-currency debt to non-investment grade, South Africa will exit the Citibank World Government Bond Index, sparking forced sales by investors who track the gauge and leading to outflows of as much as 100 billion rand ($8.5 billion) in the nation’s bond market, according to Citigroup estimates.

“We believe we have done enough, we have taken the tough decisions” to avoid another ratings downgrade, Finance Minister Malusi Gigaba told reporters before his budget speech. “We believe the decisions we took create a positive narrative that will improve the ratings agencies’ outlook for South Africa.”

Charts show the tough decisions taken in South Africa’s Budget

South Africa unveiled a budget that will raise taxes and cut spending as it seeks to fend off a third junk credit rating. These charts show the tradeoffs the National Treasury has had to make to steer the fiscal ship away from a debt downgrade.

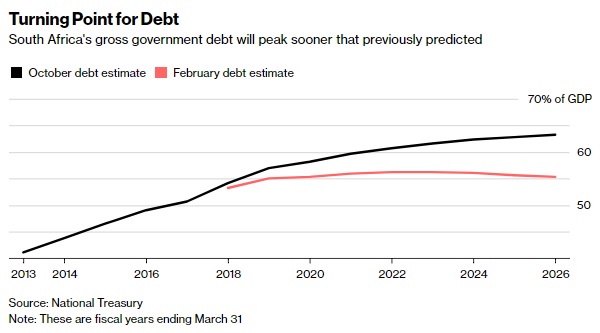

A smaller-than-projected budget deficit will mean slower growth in borrowing. Finance Minister Malusi Gigaba forecast in October that gross government debt will exceed 60 percent of gross domestic product from 2022 onward. The Treasury has now trimmed the projection to reach a turning point of 56.2 percent in that year.

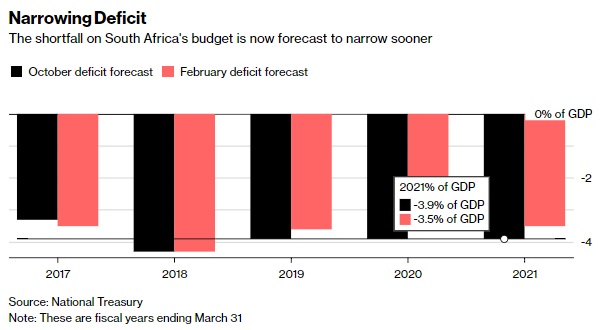

The budget shortfall is projected to narrow to 3.5 percent of GDP by 2021, compared with the October estimate of 3.9 percent, due to improved economic growth and revenue collection.

Moody’s Investors Service put South Africa’s debt on review for a downgrade to junk last year, the only major ratings company to still assess the bonds as investment grade. Improved economic growth forecasts and plans to narrow the fiscal deficit may placate Moody’s, which said in November its review would consider the budget plans.

The above charts were prepared by Rene Vollgraaff and Ana Monteiro, with assistance by Michael Cohen. View the full selection on the Bloomberg website.

Budget Review 2018

The 2018 Budget arrives at a moment of opportunity for South Africa. A renewed sense of optimism has provided a much-needed boost to confidence and investment. The economic outlook has improved. And government has expressed a new resolve to strengthen policy coordination.

Yet this positive turn of events should not blind us to the enormous economic and fiscal challenges facing our country. Economic growth is far too low to reduce alarmingly high unemployment and inequality. Revenue collection, on which government depends to fund social and economic spending programmes, will fall short of projections by R48.2 billion in 2017/18. The finances of several stateowned companies are in a precarious state.

The 2017 Medium Term Budget Policy Statement (MTBPS) pointed out that extraordinary measures would be needed to stabilise the public finances. Without such measures, we would only delay the debt reckoning, and a growing share of spending would be absorbed by interest payments.

The 2018 Budget proposals address these concerns with resolve. The budget sets out a programme of expenditure cuts identified by a Cabinet subcommittee amounting to R85 billion over the next three years, and reprioritises spending. Several tax measures, including a value-added tax increase and maintaining the top four tax brackets with no inflationary adjustment, will raise an additional R36 billion in 2018/19, enabling government to narrow the revenue gap. Social grant payments will increase faster than inflation to offset the effect of higher taxes on poor households.

The budget also responds to new policy initiatives. This includes an allocation of R57 billion for fee-free higher education and training over the medium term, as announced in December 2017.

The fiscal measures in this budget entail a difficult adjustment. They will require increased spending discipline in government and resilience from the people of South Africa. Nonetheless, these measures will protect the government’s ability to meet its constitutional obligations over the long term, and ensure that we retain fiscal sovereignty.

As a result of these steps and the improved growth outlook, the budget deficit is projected to narrow to 3.5 per cent of GDP in 2020/21. Gross loan debt, which in the MTBPS projections was set to breach 60 per cent in 2021/22, is now projected to stabilise at 56.2 per cent by 2022/23.

Government is committed to setting the country on a new path of growth, employment and transformation. In the months ahead, we will end policy limbo in key areas and address governance concerns with renewed vigour. We will build a social compact with business and labour to speed up investment and job creation. And we will continue to improve planning for major infrastructure projects to ensure value for money.

Economic overview

South Africa’s economic growth outlook has improved in recent months, following a year marked by recession and policy uncertainty. GDP growth of 1 per cent is expected for 2017, up from 0.7 per cent projected in the 2017 Medium Term Budget Policy Statement (MTBPS), and is forecast to reach 2.1 per cent by 2020. The improved outlook flows from strong growth in agriculture, higher commodity prices and an incipient recovery in investor sentiment.

Although global risk factors remain elevated, the world economy continues to provide a supportive platform for South Africa to expand trade and investment. World economic growth is at its highest level since 2014 and continues to gather pace. GDP growth is rising across all major economies. The International Monetary Fund (IMF) forecasts global growth of 3.7 per cent in 2017 and 3.9 per cent in 2018.

To create large numbers of jobs, build an inclusive and transformed economy and reduce inequality, South Africa needs a strong, sustained expansion. Yet in contrast to many of its developing-country peers, South Africa has experienced a period of protracted economic weakness, mainly as a result of domestic constraints. This is reflected in low levels of private investment, persistently high and rising unemployment, and declining real per capita income. These factors in turn have undermined the sustainability of the public finances and narrowed the scope for economic transformation.

Structural reform, confidence, investment and jobs

Confidence and investment are mutually reinforcing. When businesses are confident about their growth prospects and certain about the policy environment, they invest and hire staff. In South Africa, private investment has been contracting since 2015, mainly as a result of low levels of business and consumer confidence. Growth has remained stuck below 2 per cent and unemployment remains high at 26.7 per cent. The National Development Plan (NDP) outlines the structural reforms required to boost investment, expand employment and remove constraints to economic growth.

The 2018 Budget is introduced as government has an opportunity to reinforce confidence and contribute to a recovery in growth and investment. A renewed sense of optimism is driven by the expectation that government will finalise many outstanding policy reforms, act decisively against corruption, and swiftly resolve governance and operational failures at state-owned companies. Investor sentiment has improved, leading to a strengthening rand exchange rate and lower government borrowing costs.

South Africa’s stable macroeconomic environment provides a strong platform to attract much-needed foreign savings that can fund additional investment. The country’s prudent macroeconomic policies are highly regarded by international investors, as are its well-developed and wellregulated financial markets. Government remains committed to fiscal discipline, a flexible exchange rate and inflation targeting.

While macroeconomic policies provide a stable environment for growth, attracting higher levels of investment that create jobs requires government to finalise outstanding policy reforms.

Domestic outlook

Balance of payments

The current account deficit narrowed to 2.3 per cent of GDP during the first three quarters of 2017, from 3.8 per cent over the same period in 2016. This is largely due to a higher trade surplus, as South Africa’s terms of trade – the ratio of export prices to import prices – improved in the first three quarters of 2017 relative to the same period in 2016. The deficit in 2017 is expected to average 2.2 per cent of GDP – the smallest since 2010. Since 2013, the current account deficit has steadily declined, largely as a result of slower import growth. As import growth accelerates and some terms of trade gains are reversed, the deficit is expected to widen to 3.2 per cent of GDP in 2020 in line with higher economic growth.

The value of total exports increased by 4.8 per cent in the first three quarters of 2017, while the value of total imports fell by 1.2 per cent. Certain agricultural exports have shown encouraging growth in recent years, particularly in new markets. The value of citrus exports to China, for example, increased by 59.2 per cent in 2017 compared with the prior year. Over the same period, the value of citrus exports to Asia as a whole grew 14.1 per cent, while exports to Europe increased 6.1 per cent.

In contrast, the value of manufacturing exports declined by 3.9 per cent in the first three quarters of 2017 compared with the corresponding period in 2016. Exports of vehicles, machinery, and food and beverages contracted.

South Africa relies on foreign inflows to fund investment because of a low domestic savings rate, as shown by a persistent current account deficit. South Africa received capital inflows equivalent to 1.7 per cent of GDP in the first three quarters of 2017, compared with 4.9 per cent in 2016.

In the first three quarters of 2017, net foreign direct investment outflows increased to R65.2 billion, compared with net outflows of R3.3 billion over the same period in 2016. This was driven by a large acquisition of foreign financial assets. Lower foreign direct investment increases the country’s reliance on more volatile portfolio flows, which remained strong through 2017.

Sector performance

South Africa’s muted economic performance over the past year was reflected across all major sectors, apart from agriculture and mining.

Agriculture

Real value added in the agriculture, forestry and fishing sector grew by 21.9 per cent in the first three quarters of 2017 compared with the same period in 2016, contributing 0.5 percentage points to overall GDP growth. Good summer rainfall led to a broad-based recovery in production following a severe drought, which caused agriculture to contract in 2015 and 2016. Maize production is expected to reach 16.7 million tons in 2017 – a 115.3 per cent increase from the 2016 crop. Soybean production is expected to increase by 77.4 per cent to 1.3 million tons.

Growth is expected to continue at a more moderate pace in 2018. Ongoing drought in the Western Cape – which contributes about 22 per cent of agricultural value-added and is a key producer of wheat, horticultural products and wine – will restrict growth in 2018.

Mining

In the first three quarters of 2017, real value added in the mining sector grew by 4.3 per cent. Over this period, the sector contributed 0.3 percentage points to overall GDP growth. After a contraction in 2016, mining output is recovering, supported by higher commodity prices. Improved demand has boosted iron ore, manganese and chromium production.

Mineral sales increased by 9.4 per cent in the first nine months of 2017 compared with the same period in 2016, driven largely by coal and iron ore. Gold and platinum sales fell by 11.6 per cent and 3.4 per cent respectively over the same period, weighed down in part by a strong US dollar.

Manufacturing

Real value added in manufacturing declined by 1.2 per cent during the first three quarters of 2017, reducing GDP growth by 0.2 percentage points. Poor performance was the result of weak domestic demand and low levels of business confidence. Production decreased by 1.4 per cent over the first three quarters of 2017. This was true across most subsectors, apart from food and beverages, and metals, which respectively grew by 0.8 per cent and 4 per cent over the year.

Investment and transformation for inclusive growth

Government’s economic policy is focused on inclusive growth. The benefits of a growing economy should be shared more widely and more equitably through transformation and job creation. Government, the private sector and organised labour all play a part in creating decent and sustainable employment, supporting transformation and boosting productivity. In outlining a range of structural reforms needed to raise long-term economic growth, the NDP identifies three priorities:

-

Raising employment through faster economic growth

-

Improving the quality of education, skills development and innovation

-

Building the capability of the state.

Progress in these areas requires a long-term coordinated effort, complemented by a number of steps being taken over the medium term.

Eliminating policy uncertainty to catalyse investment

Immediate measures are needed to establish policy certainty in key areas to rebuild trust and create an enabling environment for investment.

-

In telecommunications, government will end the delay in licensing spectrum, which limits access to stable, affordable information and communications technology.

-

Bottlenecks in finalising the Mineral and Petroleum Resources Development Act and the Mining Charter will be addressed to improve the attractiveness of the mining sector for investment.

-

The Interim Rail Regulator is an important first step in building regulatory capacity. Government is finalising the Single Transport Economic Regulator Bill, which will improve efficiency in the transport sector.

Government’s approval of six special economic zones to benefit from lower corporate tax rates for qualifying firms, and employment tax incentives for all workers, will encourage investment and help overcome inefficient spatial legacies in production. Recent amendments to the venture capital company tax incentive have resulted in investment of R650 million in qualifying small businesses – increasing the pool of funding available to support enterprise development.

Strengthening competition law to promote economic transformation

South Africa’s economy has historically been characterised by concentration, cartels and price fixing in major sectors, making it difficult for small and new businesses to compete. Competition authorities have been successful in tackling anti-competitive practices covering a wide range of products, including bread, steel, cement, concrete, plastic pipes and HIV/AIDS drugs. Anti-competitive practices in banking and telecommunications have also been penalised. The World Economic Forum’s Global Competitiveness Report 2017-2018 ranks South Africa 28th of 137 countries on the effectiveness of its anti-monopoly policy.

From its inception in 1999 to 2017, the Competition Commission has levied administrative penalties of about R6.4 billion against various firms. According to a 2016 World Bank report, the authorities’ success in breaking up cartels in white maize, poultry, wheat and flour, and pharmaceuticals resulted in a reduction in overall poverty of 0.4 percentage points.

Proposed amendments to the Competition Act (1998), which would strengthen the competition authorities’ powers, have been published for public comment. The amendments would enable the authorities to investigate the general state of a specific market, rather than the conduct of particular firms. In addition, they would obligate the authorities to consider structural issues of economic concentration and transformation when considering mergers and acquisitions, and in adjudicating abuse of dominance complaints.