News

IMF Executive Board 2017 Article IV Consultation with Mauritius

On November 21, 2017, the Executive Board of the International Monetary Fund concluded the Article IV consultation with Mauritius, and considered and endorsed the staff appraisal without a meeting.

Mauritius is seeking to become a high-income economy within the next 10 years. In the past 30 years, political stability, a sound macroeconomic environment and a strong track record of implementing economic reforms allowed Mauritius to successfully transform itself from a monocrop economy into a diversified services-based middle income country with low levels of poverty. To achieve advanced economy status, the government intends to pursue an ambitious growth strategy anchored on significant public investments in infrastructure and improvements in the business environment.

Growth in 2017 is projected at 3.9 percent in 2017, and about 4.0 percent over the medium term. International reserve buffers have improved substantially. The authorities have taken steps to mitigate financial stability risks and are well-advanced in modernizing financial sector regulation. However, the vibrant Global Business Sector faces pressure from international antitax avoidance initiatives. Fiscal space is limited, fiscal risks are increasing, and there are signs of building inflationary pressures.

Executive Board Assessment

The macroeconomic policy stance needs to be recalibrated to address the growing imbalances. Evidence is mounting that the business cycle has shifted phase: the output gap is closing, core inflation is increasing, and demand for credit is rising. Accommodative fiscal and monetary policies have contributed to a weakening external position and the overvaluation of the real exchange rate has increased. A countercyclical policy mix is required to safeguard external stability.

Further revenue mobilization efforts to build fiscal space, support the fiscal anchor and preserve debt sustainability are required. While staff supports the revised debt anchor, indications are that under current policies, the debt target would be missed. A tighter fiscal stance would then be required for Mauritius to meet its goals of improving infrastructure, and promoting inclusive growth while preserving debt sustainability. Higher tax efficiency could yield additional revenues of about 0.8 percent of GDP. Continued improvements in public investment management, and identifying pressure points in debt management should also be elements of the fiscal strategy. Moreover, a tighter fiscal policy would contribute to safeguard external stability, and curb real appreciation pressures.

A tightening of monetary policy is warranted to address growing underlying inflationary pressures. While current inflation trends may partly be reflective of a changing seasonal pattern, the expected increase in international oil and controlled prices and the anticipated introduction of the minimum wage policy by the Ministry of Labor in 2018 are likely to have second round effects, and increase inflation expectations. A tighter monetary policy stance should be implemented by mopping-up excess liquidity in sufficient quantities so as to bring interbank rates in line with the policy rate and regain control of money market conditions.

Clarifying the monetary policy framework will help increase policy coherence. While the primary objective of the central bank is to maintain price stability and promote “orderly and balanced” economic development, there appears to be no consensus on the definition of price stability and on the role of the nominal exchange rate in the conduct of monetary policy. The perceived multiplicity of objectives risks overburdening monetary policy, can result in policy inconsistencies, and potentially undermines the credibility of the BOM’s capacity to anchor inflation expectations.

Announcing a medium-term inflation objective will prove instrumental in the implementation of a new policy framework. An inflation objective of about 3 percent could serve as the foundation for the BOM’s policy actions and communication. More fundamentally, setting price stability as the overriding policy objective in the medium-term will allow the BOM to better navigate the inevitable policy trade-offs that are set to arise. Strengthening the operational independence of the central bank will improve its capacity to deliver on the price stability mandate; while allowing more flexibility of the exchange rate will help address the emerging inflationary pressures and improve resilience to shocks.

Staff welcomes the substantial improvement in international reserve buffers, in line with past Fund advice. As reserve buffers now stand inside the optimal range of international reserves, the FX intervention policy should be geared towards maintaining reserve coverage at least at 100 percent of the adequacy metric, opportunistically building reserves and curbing excess volatility.

The authorities are well-advanced in modernizing financial sector regulation and should now address salient banking sector issues. Having implemented many recommendations of the 2015 FSAP, the authorities should take additional steps to shore up financial stability. These include lowering the still-high stock of NPLs through a more stringent approach to writing-off legacy exposures, and safeguarding the longer-term FX funding needs stemming from banks’ swift expansion abroad. In addition, a formal macroprudential body could be established.

Efforts to address the concerns raised by the OECD and the EU about the tax regime should be prioritized. The GBC sector, to which banks remain highly exposed, will need to adjust its business model as Mauritius transitions to a jurisdiction of higher value-added, and ensure compliance with FATF standards, particularly on AML/CFT supervision and entity transparency. A significant decline of GBC activity could pose risks to external and financial stability if not properly managed.

Further reforms are necessary to meet emerging cost competitiveness challenges. While recent reform efforts will likely bolster Mauritius’ position in the Doing Business rankings, broader structural reforms in areas such as the labor market, higher education, innovation, governance and anti-corruption (e.g. effective use of AML tools and strengthened asset declaration system) policies will be key drivers of Mauritius’ economic transformation going forward. Simplifying the wage-setting mechanism will improve competitiveness, while strengthening current efforts to boost the labor supply of youth and women will contribute towards closing gender gaps and reduce inequality.

Attaining the next level of economic development will require Mauritius to overcome the variety of policy challenges outlined above. A bold, coordinated, strategic vision, guided by strong and independent institutions, is necessary to guide the economic transition. Early signs are promising, with both the pending formation of the National Economic Development Board and the drafting of the Financial Services Sector Blueprint, important welcome steps towards harmonizing the policy direction and implementation across sectors. Considering Mauritius’ track record of reinventing its economic model, there are grounds for optimism that the country will successfully manage the reform process.

Staff encourages the authorities to phase-out the Exchange Rate Support Scheme (ERSS), and to expedite work on other measures to support the export-oriented sector. In staff’s view, there are less distortionary avenues to support the export-oriented sector, and removing the structural bottlenecks that hinder competitiveness should be the focus of work currently underway to address the sector’s problems. Staff recommends approval for the temporary retention of the Multiple Currency Practice (MCP), on the basis that the ERSS is temporary, does not materially impede the member’s balance of payments adjustment, does not harm the interests of other members, and does not discriminate among members.

Staff Report

Context and recent developments

Mauritius is seeking to become a high-income economy within the next 10 years. In the past 30 years, political stability, a sound macroeconomic environment and a strong track record of implementing economic reforms allowed Mauritius to successfully transform itself from a monocrop economy into a diversified services-based middle income country with low levels of poverty (9.8 percent). However, average GDP growth has fallen in recent years, on the back of a maturing demographic transition and the erosion of competitiveness gains. To achieve advanced economy status, the government intends to pursue an ambitious growth strategy anchored on significant public investments in infrastructure and improvements in the business environment. The authorities envision medium term growth at about 4.3 percent.

Growth recovered in 2016, on the back of higher investment, and strong dynamism in tourism and financial services, which offset falling exports of goods. The unemployment rate fell to 7.3 percent, from 7.9 percent in 2015. The real exchange rate remained stable, while reserve buffers increased significantly as the Bank of Mauritius’ (BOM) foreign reserves increased by $700 million to $4.9 billion in 2016. In 2016, Mauritius and India agreed to major amendments to their Double Taxation Avoidance agreement (DTA), introducing capital gains taxes on Mauritius’ based investments in India. The revisions triggered a temporary surge in FDI to India from Mauritius from flows seeking to take advantage of the grandfathering clause. The country’s credit rating remains at Baa1 (stable).

Outlook and risks

Economic activity is expected to remain robust. Growth is projected at 3.9 percent in 2017 (in line with the authorities’ estimates). Economic activity would be driven by dynamism in the construction sector. Tourism and financial intermediation activities would continue to provide support, though at a slower pace. Falling sugar production and subdued exports would weigh down on agriculture and manufacturing activity. Domestic demand will be sustained by recovering business and consumer confidence, and increased investment (mainly from the public sector). The negative output gap is estimated to close over the next year, and the current account deficit is projected to widen to about 5.8 percent of GDP in 2017. Over the medium-term growth would stabilize at about 4 percent, broadly in line with potential output growth.

Policy discussions: Climbing the income ladder in a challenging environment

The policy discussions focused on the main challenges to the country’s macroeconomic and financial stability. The key elements of the policy dialogue included: (a) rebuilding the credibility of the fiscal anchor and creating fiscal space; (b) tackling inflationary pressures and modernizing the monetary policy framework to strengthen the policy response to shocks; (c) addressing financial stability risks; and (d) improving competitiveness.

External Stability Assessment: Safeguarding External Balance

Mauritius’ external position at end-2016 was weaker than implied by medium-term fundamentals and desirable policies, as suggested by the EBA-lite methodology and other indicators (Annex IV). While the overall current account deficit narrowed to 4.4 percent of GDP in 2016, reflecting strong tourism receipts and net income balances, both looser-than desirable fiscal policy and the credit gap resulted in a higher current account gap (up from 1.2 percent in 2015 to 3.5 percent of GDP in 2016). Furthermore, the current account is expected to widen over the medium term, due to increasing domestic demand, the high import component of the government’s PIP, and planned aircraft purchases.

The real exchange rate gap has increased, reflecting the emerging economic imbalances. Staff’s analysis suggests that relative to medium-term fundamentals and desirable policies, the real effective exchange rate gap was about 10 percent at end-2016, up from 3 percent a year earlier. The higher estimated gap is a by-product of an increased differential between the actual current account balance and the level of the current account suggested by country-specific variables that affect savings and investment decisions in the economy. In staff’s view, a tighter fiscal policy stance and addressing structural bottlenecks to competitiveness will help restore external balance.

International reserve buffers have improved substantially and stand inside the optimal range suggested by the reserve adequacy assessment (Annex IV). In line with previous recommendations to improve international reserve buffers to safeguard from the risks emanating from the GBC sector, international reserves reached $5.2 billion in May 2017 from $4.2 billion at end-2015, equivalent to 115 percent of the adjusted ARA metric. The updated reserve adequacy assessment suggests that the current level of international reserves is within the advisable range, which should allow the economy to better withstand shocks associated with disruptions in FX funding and liquidity of commercial banks’ assets. Staff advised maintaining reserve coverage at least at 100 percent of the ARA metric to help safeguard external stability.

The Exchange Rate Support Scheme gives rise to a Multiple Currency Practice (MCP) under Article VIII, Section 3. On September 11, 2017, the authorities introduced the Exchange Rate Support Scheme (ERSS), which aims to provide a temporary subsidy to exporters (excluding sugar exporters) in light of the depreciation of the US dollar. The amount of the subsidy is determined by the difference between a reference rate (US$1 dollar = MUR 34.50) and the rate at which the exporter has converted its export proceeds to domestic currency at its commercial bank, subject to a maximum of MUR 2.50 per dollar. The scheme will run over a period of six months, will be administered by the Ministry of Industry, Commerce and Consumer Protection, and is expected to cost about 0.1 percent of GDP (to be covered with the appropriated budget for contingencies). The ERSS gives rise to an MCP subject to Fund approval under Article VIII, Section 3 as the difference between spot market rates and the effective exchange rate received by exporters, taking into account the subsidy provided by the government, can potentially exceed 2 percent.

The authorities agreed with staff’s assessment on the degree of overvaluation of the exchange rate, and expressed satisfaction with the level of international reserves. Regarding international reserves, they expressed their intention to maintain reserve coverage at about 9 months of prospective imports. They noted that this would imply continued reserves accumulation over the medium term, to take account of higher capital goods imports associated with major infrastructure projects. With respect to the MCP, the authorities noted that the measure seeks to provide temporary safeguard to the export-oriented sector until they finalize work on measures to ensure that the sector remains viable. This, including protecting employment in the sector, will also help safeguard social cohesion and stability. In light of this, the authorities are requesting approval for the temporary retention of the MCP. In staff’s view, the authorities should support the sector by removing the structural bottlenecks that hinder competitiveness rather than adopting distortionary measures. Staff acknowledges, however, that the measure is temporary, is not discriminatory in nature, and is expected to have a minimum impact on the country’s fiscal and external accounts.

Structural Policies: Addressing Eroding Competitiveness

Mauritius has made great strides over the last decade to top the competitiveness rankings in Sub-Saharan Africa (SSA), but still lags emerging market peers. Over the last decade, Mauritius has climbed 15 spots on the World Economic Forum’s Global Competitiveness Index rankings to become the most competitive economy in SSA. The country’s competitiveness strengths are chiefly in the provision of infrastructure, higher education and training, as well as goods markets efficiency. Mauritius’ overall competitiveness position has also benefited from improvements in the macroeconomic environment and technological readiness.

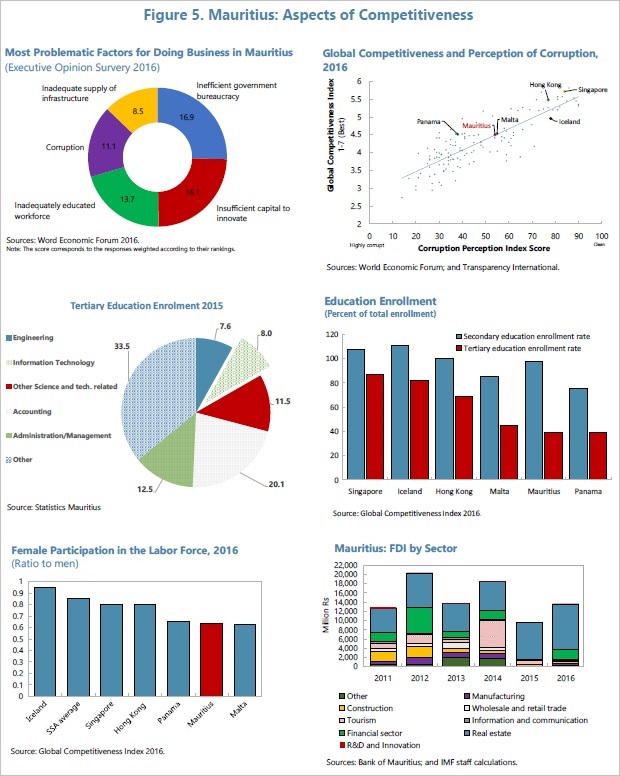

Lackluster productivity and rapid real wage growth in recent years has reduced cost competitiveness. The rate of wage increases has outstripped productivity growth in some sectors, leading to rising unit labor costs. This is partly explained by a complex wage-setting mechanism that does not adequately link productivity to wages. Furthermore, increased competition from other lowwage jurisdictions (e.g. Madagascar) has hit manufacturing export-oriented activities hard. Competitiveness gaps are also emerging vis-àvis emerging market comparator countries in additional areas: most notably higher education and training, innovation and technological readiness. Obstacles to doing business also pose challenges (see Special Issues Paper).

Mauritius dropped seven places in the 2017 Doing Business rankings, driven largely by difficulties in starting a business. Other factors affecting Mauritius’ competitiveness in the survey-based World Economic Forum’s rankings include an inadequately educated workforce, an inefficient government bureaucracy, low female participation in the workforce, and insufficient capital to innovate.

The recently-adopted Business Facilitation Act is a welcome step to improve Mauritius’ business environment. The Act includes provisions to amongst other things simplify starting a business through a one-stop e-licensing platform for official permits, as well as streamlining tax administration, and facilitating international trade and commerce.

Nevertheless, further reforms are necessary to meet emerging cost competitiveness challenges, and give Mauritius the impetus to graduate to a higher level of development. While recent reform efforts will likely bolster Mauritius’ position in the Doing Business rankings, broader structural reforms in areas such as the labor market, higher education and innovation policies will be key drivers of Mauritius’ economic transformation going forward. There is also a negative relationship between perceptions of corruption and global competitiveness rankings. This highlights the potential benefits for reinforcing anti-corruption measures, such as the asset declaration system and anti-money-laundering tools.

The pending introduction of the National Minimum Wage must be carefully managed and could be used as an opportunity to revisit the entire wage-setting mechanism. Introduction of the National Minimum Wage in 2018 could form part of a broader effort to simplify the wage-setting mechanism to tighten the link between pay and productivity. Yet, care should be taken that the new minimum wage does not adversely affect enterprise competitiveness, job creation, and distort sectoral wage relativities. At the same time, it is important that the new scheme also safeguards social objectives. In this context, strengthening current efforts to boost the labor supply of youth and women are welcome steps, and would also contribute to closing gender gaps and reduce inequality.

Addressing the skills-mismatch and boosting innovation policy will prove instrumental to unleash the new growth sectors. Tackling the imbalance between the supply and demand of skills in some sectors would require better aligning post-secondary education curriculums with the economy’s needs, encouraging tertiary enrolment in STEM subjects, and encouraging foreign skilled labor where necessary. These efforts could form part of a comprehensive innovation policy to facilitate development of the new generation growth sectors.

The authorities broadly concurred with the analysis. They broadly agreed that Mauritius has fallen behind emerging market comparator countries in several areas affecting competitiveness. They highlighted that Mauritius’ recent drop in the Doing Business rankings – which may not accurately reflect the country’s competitiveness strengths – was a wakeup call to improve the business environment and develop a more strategic competitiveness vision. They also underscored that competitiveness concerns were behind the recent adoption of the Business Facilitation Act. Further, the authorities noted the important strategic role of the soon-to-be created National Economic Development Board, which will promote exports and inward investment, and guide Mauritius’ graduation to a higher stage of economic development.

Selected Issues paper

Boosting International Competitiveness

Boosting international competitiveness is an integral component of the Mauritian authorities’ ‘Vision 2030’, which foresees Mauritius joining the ranks of higher-income countries before 2030. The authorities’ ambitious economic development strategy seeks to transform Mauritius into an inclusive high-income economy by 2030. The plan involves a fundamental transformation of the economy and a move up the economic value chain to boost growth and position Mauritius as a services and investment hub for mainland Africa. Boosting Mauritius’ international competitiveness and business environment to attract new high value-added industries is a key component of this strategy.

In this light, this paper analyses three key issues. First, we present recent developments pertaining to Mauritius’ international competitiveness, in a regional and global context. Secondly, we highlight the competitiveness challenges facing Mauritius. Thirdly, we propose policies that may be adopted to boost Mauritius’ international competitiveness and help the country graduate to the next level of economic development.

Recent Competitiveness Developments

The latest available international benchmark data on international competitiveness show that Mauritius is the most competitive economy in SSA. Per the latest edition of the World Economic Forum’s Global Competitiveness Report (2016-2017), Mauritius ranked 45th out of 138 economies in terms of overall competitiveness, two places ahead of South Africa. The aspects of competitiveness on which Mauritius tops the region are the provision of infrastructure, health and primary education and training, higher education and training, and goods markets efficiency.

Much progress with respect to competitiveness has been made over the last decade to bring Mauritius to the top of SSA’s competitiveness rankings. A suite of reforms was put in place over the last decade, which have accompanied and facilitated Mauritius’ structural economic transition, allowing the country to climb 15 places on the competitiveness ranking within a decade. Apart from rapid improvements in the areas in which Mauritius currently leads the SSA region, Mauritius’ overall competitiveness position has also benefited from improvements in the macroeconomic environment and the readiness to adopt new technologies, particularly the more widespread usage of internet and mobile-broadband. Although the offshore financial sector is of large economic significance, Mauritius has regressed in the competitiveness rankings on certain aspects of financial market development, chiefly related to trustworthiness and confidence.

Despite the impressive gains of the last decade, competitiveness gaps vis-à-vis comparators remain in several areas. Although Mauritius is streets ahead of the SSA region in the competitiveness rankings, the country is lagging in certain areas vis-à-vis emerging market peer countries.

Competitiveness gaps are especially apparent in relation to innovation, institutions, infrastructure, higher education and training, labor market efficiency and technological readiness.

Symptomatic of emerging competitiveness gaps is the recent stagnation in productivity across sectors, which may undermine the hard-won competitiveness gains of the last decade. For the overall economy, growth in average labor productivity declined in the second half of the last decade. This trend was evident both in the manufacturing sector, as well as by firms operating in the Export Processing Zone sector. While at the same time capital productivity in manufacturing picked up, export oriented enterprises (EOEs) experienced declines in both capital and multifactor productivity (even negative in the case of non-textile EOEs).

The above unfavorable productivity trends have, alongside rising wages, induced increases in economy-wide unit labor costs. Data show an increasing disconnect between pay and productivity outcomes. Average compensation exceeded productivity, especially in the latter half of the last decade, leading to increased unit labor costs. This is especially the case for export-oriented enterprises in the non-textile sector.

A contributing factor to the unfavorable trends in productivity and unit labor costs may be inefficiencies in the labor market resulting from the complex wage-setting mechanism. The wage-setting mechanism is complex, consisting of several competing systems that review wages and conditions in the public and private sectors. While productivity considerations do to some extent figure in wage negotiations, recent trends in unit labor costs reflect the importance of a tighter linkage between pay and productivity outcomes.

Competitiveness Challenges

Part of Mauritius’ competitiveness challenge is to address the most problematic aspects for doing business in the country. Per the 2016 Executive Opinion Survey, the most pervasive problems for doing business in Mauritius are an inefficient government bureaucracy (about 17 percent of respondents), followed by insufficient capital to innovate (16.1 percent), an inadequately educated workforce (13.7 percent), followed by corruption (11.1 percent). Recent reforms introduced in the Business Facilitation Act of 2017 are a step in the right direction and may address some of these concerns, through eliminating regulatory and administrative bottlenecks.

That an inadequately educated workforce is an important hindrance for business in Mauritius reflects concerns surrounding the ‘skills mismatch’ problem. Mauritius rates well in international comparison regarding secondary education enrollment rates. However, it is not clear that the fragmented technical and vocational education and training (TVET) system, characterized by a range of private providers, produces the right skills for the economy (World Bank 2015). At the tertiary level, enrollment rates are comparatively low, and the proportion of students enrolled in science and technology related degrees forms a relatively small share of the total. The share of graduates in industries associated with the offshore financial sector (e.g. accounting, law) is comparatively high.

There also appears to be a negative correlation between corruption perceptions and competitiveness. Data suggest that perceptions of corruption are strongly negatively correlated with a country's overall competitiveness ranking. It has been shown that depending on its pervasiveness, corruption affects factors such as total factor productivity, public and private investment, and human capital accumulation (IMF 2016a). These factors tend to also be associated with competitiveness outcomes.

Female participation in the labor force is also comparatively low. Mauritius ranks poorly in international comparison on female participation in the labor force (108th out of 138 economies). Closing the gender gap in labor force participation is not only an important factor for boosting growth in Mauritius (IMF 2016b), but also an efficient mechanism to optimize deployment of the economy’s labor resources necessary to boost the country’s global competitiveness.

Foreign Direct Investment (FDI) in Mauritius has been skewed towards real estate, rather than more productive investments. Over time, FDI has been concentrated in the real estate sector, rather than in research and development and innovation. This trend has limited the opportunities for technological transfer, and helps explain Mauritius’ challenges related to a weak capacity for innovation. Moreover, the above-mentioned labor market rigidities and skills mismatches may also have kept investors in more productive sectors at bay and skewed investment away from more productive sectors and into those sectors where qualified talent is available (e.g. the financial sector).

Policies to Boost International Competitiveness

A new wave of economic reforms is necessary to meet the key economic task of graduating to a higher level of economic development. Boosting competitiveness and moving up the economic value chain are key economic tasks currently faced by Mauritius. Some sectors, for example the offshore financial sector, are being remodeled to deal with external challenges, with for example a greater emphasis on encouraging companies to put down concrete roots (creating ‘substance’) in the country through tax incentives (see Annex on BEPS).

Recent reforms aimed at enhancing the business climate contained in the Business Facilitation Act of 2017 are an important welcome step in the right direction. The reform package contained in the Business Facilitation Act (2017) is designed to create a more hospitable business climate, through for example streamlining official procedures and tax administration via a one-stop e-licensing platform, and facilitating international trade and commerce.

Moreover, creating the National Economic Development Board (NEDB) and adopting the draft Financial Sector Services Blueprint will help coordinate the strategic vision needed to guide Mauritius’ economic transformation. The NEDB has three core functions: i) export marketing and business development, ii) coordinate licensing and regulatory activities, and iii) guide the future strategic economic direction. In addition, the draft Financial Sector Services blueprint will guide the transition of the GBC sector from a system based largely on tax incentives to one that provides higher value added services.

However, further action is also needed to address bottlenecks in areas where Mauritius is lagging compared to higher income peers in the global competitiveness rankings. Areas in which further reforms are required are the relatively rigid labor market (57th place in labor market efficiency); skills mismatch (a relatively low tertiary education enrollment rate of 38.7 percent, or 73rd rank); and a relatively weak capacity for innovation.

Making progress on reforms to the labor market and wage-setting mechanism. To arrest the unfavorable trends in productivity and unit labor costs that are negatively affecting Mauritius’ cost competitiveness, attention needs to be paid to reforming Mauritius’ labor market and wage-setting mechanism. Currently, Mauritius’ labor market is characterized by, amongst other things, a lack of flexibility in wage determination by companies (102th rank). Care should be taken to avoid backsliding on previous reform efforts. Moreover, the wage-setting mechanism could be altered to more tightly link wages to productivity outcomes in individual sectors, for example by increasing the coverage of collective agreements in the total workforce.

The pending introduction of the National Minimum Wage in 2018 should be carefully managed and form part of a holistic approach to labor market reform. Implementation of the National Minimum Wage, which will be calculated as a proportion of the median wage, is scheduled for 2018. It is not yet clear whether the minimum wage would lead to an overall simplification of the already complex wage-setting mechanism. Also, while negotiations regarding the minimum-wage level are still underway, caution should be taken to ensure that its introduction does not adversely affect enterprise competitiveness, job creation, and induce sectoral wage spill overs by distorting wage relativities. Introducing the minimum wage may also provide a window of opportunity to streamline the labor market architecture and ensure that the wage-setting process contributes to enhanced competitiveness outcomes. At the same time, it is important that the new scheme also safeguard social objectives. In this context, current efforts to close gender gaps and reduce inequality by boosting the labor supply of youth and women could be bolstered.

Addressing the skills mismatch. Both the quality and quantity of education need to be improved to better serve the industries of today and encourage the development of those of the future. While overall secondary education enrollment rates are high, the portion of TVET enrollments in the total is small (World Bank 2015). A more active and comprehensive approach by government to the delivery, monitoring and evaluation of technical training programs could ensure that market demands for skills are better fulfilled. Furthermore, encouraging tertiary enrollment in STEM subjects, and encouraging foreign skilled labor where necessary, will help to develop a pipeline of human capital suited to working in higher value-added sectors in the future, also complementing innovation policy.

A comprehensive innovation policy, which could follow comparator country experiences in the area, would promote economic diversification and enhance growth over the medium-to longer term. A more active innovation policy could, in concert with higher education reforms, boost the availability of scientists and engineers, while also allocating more tertiary education funds towards the development of research. To boost technology absorption in the economy and facilitate the growth of new industries, greater incentives for R&D could be offered to companies, while government could also foster greater collaboration between universities and industry on R&D. A revamped innovation policy could for example adopt the approach of Singapore, which promotes technology transfer through attracting multinational corporations, and has an emphasis on building domestic R&D capacity, also with strong government support for promoting venture capital.