News

IMF Executive Board 2017 Article IV Consultation with Zambia

On October 6, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Zambia.

The near-term outlook for the Zambian economy has improved in recent months, driven by good rains and rising world copper price. The economy was in near-crisis from the fourth quarter of 2015 through most of 2016, reflecting the impacts of exogenous shocks and lax fiscal policy in the lead up to general elections. Low copper prices reduced export earnings and government revenues, while poor rainfall in the catchment areas of hydro-power reservoirs led to a marked reduction in electricity generation and severe power rationing. A sharp depreciation of the kwacha fueled inflation which rose from an annual rate of 7 percent in mid-2015 to nearly 23 percent in February 2016.

Tight monetary policy succeeded in stabilizing the exchange rate and slowing down inflation to 6.3 percent in August 2017, but contributed to elevated stress in the financial system evidenced by a sharp rise in nonperforming loans and a plunge in the growth of credit to the private sector. Stress tests suggest that the banks are resilient to credit and liquidity pressures, but the financial system faces considerable risks, owing to high dependence on copper exports, rising public debt and funding pressures.

Fiscal imbalances have remained high. The fiscal deficit on a cash basis reached 9.3 percent of GDP in 2015, twice the budgeted level. On a commitment basis – taking into account accumulation of arrears and delays in paying VAT refunds – the deficit exceeded 12 percent of GDP in 2015, and remained elevated at about 9 percent of GDP in 2016. The deficit on a commitment basis is projected to decline significantly in 2017, but the cash deficit will remain elevated as the government clears arrears.

Public debt has been rising at an unsustainable pace and has crowded out lending to the private sector and increased the vulnerability of the economy. The outstanding public and publicly guaranteed debt rose sharply from 36 percent of GDP at end-2014 to 60 percent at end-2016, driven largely by external borrowing and the impact of exchange rate depreciation. Increased participation of foreign investors in the government securities market has eased the government’s financing constraint but has made the economy more vulnerable to swings in market sentiments and capital flow reversals.

The medium-term outlook for the economy is contingent on policies. Real GDP growth has picked up after a marked deceleration from 7.6 percent in 2012 to 2.9 percent in 2015. Growth is projected to reach 4 percent in 2017. However, achieving sustained high and inclusive growth requires a stable macroeconomic environment as well as policies and reforms to increase productivity, enhance competitiveness, strengthen human capital and support financial inclusion for small and medium scale enterprises. Domestic risks to the outlook include delayed fiscal adjustment which would continue to crowd out credit to private sector and entrench an unsustainable debt situation, and unfavorable weather conditions which would affect hydro power generation and agricultural output. External risks include tighter global financial conditions and volatility in the world copper price.

Staff report

Context: shocks, policies, and vulnerabilities

The Zambian economy was in near-crisis in 2015Q4 and most of 2016, reflecting the impacts of exogenous shocks and lax fiscal policy. Low copper prices reduced export earnings and government revenues, weakening the kwacha. Poor rainfall led to a contraction in agriculture output in 2015, and to a sharp drop in hydropower generation. Severe power rationing contributed to a marked slowdown in the pace of economic activity. Government spending was significantly above budget while revenues underperformed. Tightened financing conditions during 2016 and lack of expenditure restraint in the lead up to general elections in August, resulted in the government accumulating substantial arrears.

Monetary policy carried the burden of policy adjustments. Tightening of monetary policy in 2015Q4 helped to stabilize the exchange rate and lower inflation. The ensuing liquidity crunch combined with government arrears and subdued economic activity put the financial system under considerable stress. Non-performing loans (NPLs) rose sharply, credit growth plunged, and the Bank of Zambia (BoZ) took over a small bank and intervened in three nonbanks in late 2016. Since November 2016, with inflation receding and the emergence of exchange rate appreciation pressures (reflecting capital inflows and weak demand for imports), BoZ eased monetary policy considerably by unwinding administrative and quantitative measures it employed to tighten liquidity in 2015.

Public debt has been rising unsustainably. It increased from 36 percent of GDP at end-2014 to 61 percent at end-2016. External debt now accounts for 60 percent of public debt, making the portfolio highly susceptible to exchange rate risk. Government securities account for about half of domestic debt, with commercial banks and foreign investors holding about 40 percent and 17 percent of the total, respectively. Public debt is crowding out lending to the private sector and making the economy vulnerable to capital flow reversals.

The government has initiated important fiscal reforms, but is ambivalent on its commitment to debt sustainability. It has reduced regressive subsidies in the energy sector and is implementing reforms to enhance the efficiency and focus of subsidies in the agriculture sector. However, the pace and scale of contracting new loans for capital projects – sometimes before appraisals are ready – are inconsistent with stated debt sustainability objectives.

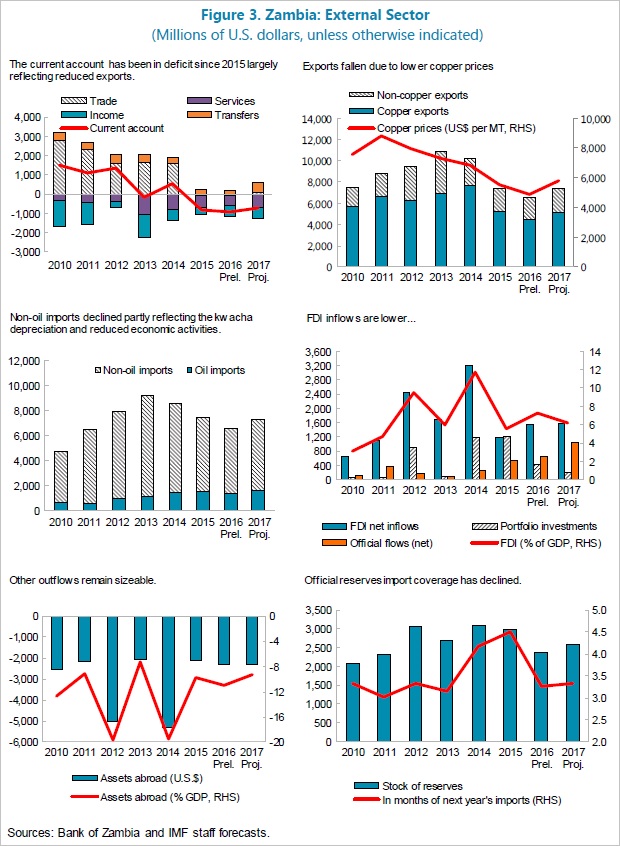

The near-term economic outlook has improved, driven by good rains and rising copper price. A bumper harvest and increased hydro power generation are expected to boost real GDP growth to 4 percent in 2017 from 3.4 percent in 2016. Inflation is projected to remain within the authorities’ target range of 6-8 percent, reflecting recent appreciation of the exchange rate. Increased foreign investor participation in the government securities auctions since late-2016 has eased the government’s financing constraint and supplied foreign exchange to the domestic market. With copper accounting for about 70 percent of Zambia’s export earnings, the recent increase in the world price – from about US$5,700 per metric ton in December 2016 to nearly US$6,500 in August 2017 – has brightened the economy’s prospects.

The government has launched its Economic Stabilization and Growth Program (ESGP) and the Seventh National Development Plan (7NDP). The ESGP (2017-2019) aims at restoring macroeconomic stability and creating conditions for sustained growth, with a heavy emphasis on public financial management: enhancing resource mobilization, refocusing public spending on core public sector mandates, scaling up social protection programs, strengthening accountability and transparency in the use of public resources, and restoring budget credibility. The 7NDP outlines the medium-term strategy for creating jobs, encouraging economic diversification, and supporting human capital development, with the overarching objectives of reducing poverty and inequality.

Rising political tensions pose risks. Following closely contested general elections in August 2016, political tensions rose between the ruling Patriotic Front party and the main opposition United Party for National Development (UPND). Tensions heightened when the UPND leader was charged with treason and jailed in April 2017. Following mediation by national religious leaders and the Commonwealth Secretariat, the UPND leader was released in August, and the treason charges have been dropped. In response to a series of arson attacks on markets and electricity infrastructure, on July 5, 2017 President Lungu declared the existence of a situation that could degenerate into a state of emergency if not addressed.

Policy discussions

External Sector Assessment

The kwacha lost half of its value against the U.S. dollar in 2015. Due to a large inflation differential vis-à-vis Zambia’s trade partners, the depreciation in the real effective exchange rate (REER) has been considerably less than that in the nominal effective exchange rate. The REER has appreciated thus far in 2017, but does not seem out of line with the recent increase in the copper price.

According to the Fund’s cost-benefit approach, Zambia’s international reserves are assessed to be below adequate levels. International reserves have taken a hit since the issuance of a US$1.25 billion Eurobond in 2015, the third issuance in a 4-year period, and is assessed as below an adequate level as at end-2016. Staff advised the authorities to build reserves to a level of at least 4-4½ months of imports over the medium-term.

The need for diversification of the economy and export base remains a serious challenge. An analysis of non-price indicators underscores significant competitiveness weakness. Attaining the diversification objective requires improvement in the business climate to boost competitiveness and help attract investment beyond copper mining. Zambia’s ranking in the World Bank Doing Business indicators has deteriorated, from 83 (out of 189) in 2014 to 98 (out of 190) in 2017. Areas in need of improvement include electricity supply, trading across borders, registering property, and policy consistency. The government needs to enhance its budget spending efficiency to support investment in human capital and physical infrastructure.

The authorities have initiated some measures towards improving the business climate. These include passage of a law on the use of moveable collateral to improve access to finance. Policy consistency in the agriculture sector such as avoiding export bans of maize and allowing prices to reflect market conditions could attract private investments to take advantage of potential market from the surrounding countries with maize deficits. In addition, the move towards cost reflective electricity tariffs would attract private investments in the sector boosting domestic power supply. Enhancing transparency in petroleum product procurement and pricing, and improving efficiency to cut the underlying cost of supplying fuels would enhance competitiveness of the Zambia’s economy. Increased consultation with stakeholders on a stable mining tax regime is expected to boost investment in the sector and promote value addition.

Facilitating More Inclusive Growth

Zambia recorded strong average annual growth in the past decade and a half. At an annual average of 6.7 percent during 2001-15, Zambia’s growth rate was higher than the Sub-Saharan Africa average (5.5 percent). The mining sector grew faster than other major sectors. Agriculture which employs by far the most people, contracted by an annual average of about 1 percent.

Income distribution is highly skewed and poverty remains high. The 2015 Living Conditions Monitoring Survey (LCMS) showed that the top 10 percent of households accounted for more than half of total national income, while the bottom 50 percent of households accounted for less than 10 percent of national income. The Gini coefficient is estimated to have worsened from 0.65 in 2010 to 0.69 in 2015. The LCMS also reported an overall poverty rate of 54 percent in 2015, with a sharp divide between rural (76 percent) and urban (24 percent) areas.

To achieve inclusive growth, the authorities should focus on stable policies, improving the investment climate, promoting productivity growth, increasing financial inclusion, and strengthening the country’s human capital. Periodic trade bans (e.g., on maize exports), and market distortions caused by FRA pricing and procurement policies in recent years have discouraged private investment in commercial maize production. The government is preparing a National Financial Inclusion Strategy to address obstacles to accessing finance, especially by small and medium-size enterprises. The World Bank is providing training to financial institutions on the use of movable collateral for credit decision making. Investments in education and health are key to prepare the labor force for productive employment. Given limited resources, increasing the efficiency of public spending would help create space for human capital development.