News

Africa’s Pulse: Committed leaders, well-coordinated policies essential for facing the skills balancing act in Sub-Saharan Africa

Tackling Africa’s Skills Gap to Build More Robust and Diversified Economies

Sub-Saharan Africa’s economies are experiencing a modest recovery, with gross domestic product (GDP) growth in the region expected to rise to 2.4% in 2017 from 1.3% last year, according to the new Africa’s Pulse, a bi-annual analysis of the state of African economies conducted by the World Bank.

This moderate pace remains below population growth, making it difficult for countries to make a significant dent in poverty unless greater efforts are undertaken to increase efficiency of investment and to pursue new drivers of sustainable growth.

The rebound is led by the region’s largest economies. In the second quarter of this year, Nigeria pulled out of a five-quarter recession and South Africa emerged from two consecutive quarters of negative growth. Improving global conditions, including rising energy and metals prices and increased capital inflows, have helped support the recovery in regional growth. However, the report warns that the pace of the recovery remains sluggish and will be insufficient to lift per capita income in 2017.

Growth continues to be multispeed across the region. In non-resource intensive countries such as Ethiopia and Senegal, growth remains broadly stable supported by infrastructure investments and increased crop production. In metal exporting countries, an increase in output and investment in the mining sector amid rising metals prices has enabled a rebound in activity.

The findings of the sixteenth edition of the Africa’s Pulse reveal a challenging economic outlook for the region. According to World Bank Chief Economist for Africa, Albert Zeufack, “recovery is weak in several key dimensions, notably, low investment growth and falling productivity growth. This calls for more sweeping structural reforms that can help ensure that economic growth is anchored on a strong footing.”

Analysis shows that rising capital accumulation has been accompanied by falling efficiency of investment spending in countries where economic growth has been less resilient to exogenous shocks. This suggests that the inefficiency of investment – which reflects insufficient skills and other capabilities for the adoption of new technologies, distortive policies, and resource misallocation, among other things – will need to be reduced if countries are to capture fully the benefits of higher investment.

As African countries seek new drivers of sustained inclusive growth, attention to skills building is growing. The Africa’s Pulse report dedicates a special section to analyzing how African countries, through smarter investments in foundational skills for children, youth, and adults, can leverage spending to achieve better learning outcomes that will simultaneously enhance productivity growth, inclusion, and the adaptability of Africa’s workers to the demands of today’s markets and those of the future.

In most countries, skills-building efforts must strive to make spending smarter to ensure greater efficiency and better outcomes. Countries face two hard choices in balancing their skills portfolios: striking the right balance between overall productivity growth and inclusion, on the one hand, and investing in the skills of today’s workforce and tomorrow’s workforce, on the other hand.

Investing in the foundational skills of children, youth, and adults is the most effective strategy to enhance productivity growth, inclusion, and adaptability simultaneously. Thus, all countries should prioritize building universal foundational skills for the workers of today and tomorrow.

Investing in skills to reduce poverty and boost economic inclusion

As Sub-Saharan Africa seeks to boost innovation, adopt new technologies, and disrupt ‘business as usual’ practices, it will be critical that African governments continue to tackle the skills gap that spans all demographics.

There have been some impressive achievements. More African children are in school today than ever and over the past fifty years, primary completion rates have more than doubled while completion of lower secondary school has increased five-fold

And yet, big challenges still remain. Almost one in every three children fail to complete primary school. In most countries, less than 50% of children complete lower secondary education, and less than 10% make it to higher education.

“When you compare the levels of public spending on education to the fact that millions of African children are still not acquiring basic skills for productive participation in the labor force, you realize that the root of the problem lies in the quality of investment,” emphasized Punam Chuhan-Pole, World Bank Lead Economist and lead author of the report.

Going forward, Sub-Saharan African governments will need to strike the right balance between investing in overall productivity growth and inclusion, on the one hand, and investing in the skills of today’s and tomorrow’s workforce, on the other.

Achieving strong economic growth means investing in foundational skills for the entire population, not just upcoming generations. Far too many youth across Sub-Saharan Africa emerge from school without the basic skills to advance in their lives. At the same time, countries cannot afford to ignore the needs of the current working-age generation where in many places, fewer than half of adults can read and write.

Employing an inclusive approach to investing in foundational skills means simultaneously addressing child stunting and building the literacy, numeracy, and socioemotional skills of children, young people, and adults. It also means investing in labor market training for disadvantaged youth, workers in low-productivity areas, workers in farm and nonfarm rural activities, and the urban self-employment.

“Sustained economic growth is unattainable if the population does not have fundamental literacy and numeracy skills that allow them to function as citizens and to work towards their dreams,” says David Evans, World Bank Lead Economist and one of the authors of the analysis on skills development in African countries.

According to the report, investing in fundamental skills for all is a win-win approach that would allow African governments to enhance productivity growth, promote greater inclusion, and ensure the adaptability of the workforce to the markets of the future.

Special attention should also be paid to science, technology, engineering, and mathematics (STEM) skills in addition to creating the right policy environment to allow for investments in technology and innovation to pay off.

Following a sharp slowdown over the past two years, a recovery is underway in Sub-Saharan Africa. Gross domestic product (GDP) growth in the region is expected to strengthen to 2.4 percent in 2017 from 1.3 percent in 2016, slightly below the pace previously projected. The rebound is being led by the region’s largest economies.

In the second quarter of 2017, Nigeria exited a five-quarter recession and South Africa emerged from two successive quarters of negative growth. Economic activity has also picked up in Angola. Elsewhere, an increase in mining output along with a pickup in the agriculture sector is boosting economic activity in metals exporters. GDP growth is stable in non-resource intensive countries, supported by domestic demand. But the recovery is weak in several important dimensions. Regional per capita output growth is forecast to be negative for the second consecutive year, while investment growth remains low, and productivity growth is falling.

External conditions are more favorable, with a stronger trend in global growth, robust growth in global goods trade, rising energy and metals prices, and supportive global financing conditions. Higher commodity prices are helping to narrow current account deficits in the region, especially of oil exporters. International bond and equity inflows in the region are rising, helping to finance the current account deficits and cushion foreign reserves. Sovereign bond issuance has rebounded in 2017, with Nigeria, Senegal, and Côte d’Ivoire selling bonds on international capital markets, indicating improving global sentiment toward emerging and frontier markets.

Headline inflation slowed across the region amid stable exchange rates and lower food price inflation due to higher food production. Reduced inflationary pressures have prompted some central banks to ease monetary policy. Lower inflation and a more accommodative monetary policy is providing an impetus to domestic demand. Fiscal deficits are projected to narrow slightly in the region in 2017, but will continue to be high, as fiscal adjustment measures remain partial at best. Across the region, additional efforts are needed to address revenue shortfalls and contain spending. Government debt remains elevated, reflecting the limited progress made in reducing the fiscal deficit.

Fiscal space has narrowed significantly for most countries in the region in recent years amid rising debt burdens. The (median) increase in general government debt to GDP in 2015-16 compared with 2010-13 was about 15 percentage points. Over the same period, fiscal conditions tightened for 36 (of 44) countries in the region. In these countries, the (median) number of tax years needed to repay the debt fully has increased by 1.1 years; in the Central African Republic, The Gambia, Mozambique, and the Republic of Congo, the increase in this indicator exceeded 2.5 years.

Analysis of fiscal sustainability gaps shows that the pattern of debt sustainability in Sub-Saharan Africa is comparable to that of other commodity-exporting regions. Fiscal balances in the region fluctuate with the commodity price cycle. Prior to the global financial crisis, the region recorded primary surpluses, thanks to rising commodity prices. Although debt levels remain below those in the late 1990s – when several international debt relief initiatives were implemented – they have been rising more rapidly than in other regions since 2009. The primary sustainability gap, on average, has been negative in the post-crisis period, reflecting the current debt sustainability challenges facing the region.

Looking ahead, Sub-Saharan Africa is projected to see a moderate pickup in activity, with growth rising to 3.2 percent in 2018 and 3.5 percent in 2019. These forecasts are unchanged from April, and assume that commodity prices will firm and domestic demand will gradually gain ground, helped by slowing inflation and easing monetary policy. The uptick in the region’s growth forecast reflects gradually improving conditions in the large economies as they implement measures to address economic imbalances. The ongoing recovery in metals exporters is likely to continue with steadily rising metals prices expected to spur further investment in the mining sector. By contrast, growth prospects will remain weak in Central African Economic and Monetary Community countries, as most of them continue to struggle to adjust to low oil prices amid depressed revenues and elevated debt levels.

The economic expansion in West African Economic and Monetary Union (WAEMU) countries is expected to proceed at a solid pace on the back of robust public investment, led by Côte d’Ivoire and Senegal. Elsewhere, growth is projected to recover in Kenya, as inflation eases, and firm in Tanzania on a rebound in investment growth. Ethiopia is likely to remain the fastest-growing economy in the region, although public investment is expected to slow down.

The outlook for the region remains challenging, however, with economic growth remaining well below the pre-crisis average, and also below the average growth recorded in 2010-14. The moderate pace of growth will translate into only slow gains in per capita income and will be far from sufficient to promote broad-based prosperity and accelerate poverty reduction. u Moreover, although risks to the outlook appear to be broadly balanced in the near term, they remain skewed to the downside in the medium term. On the upside, stronger-than-expected activity in some large economies could strengthen further the anticipated pickup in exports, mining and infrastructure investment, and growth in the region. On the downside, the main risks include, externally, lower commodity prices and a faster-than-expected normalization of monetary policy in the United States, and, domestically, delays in implementing appropriate policies to improve macroeconomic stability, heightened policy and political uncertainty, rising security tensions, and inadequate rainfall.

The challenge for the region remains to achieve high and inclusive growth. In the near term, measures are needed to strengthen the ongoing recovery. Fiscal space remains tight in most countries, and should be enlarged through appropriate fiscal policies that support growth. In the medium term, structural measures will be needed to boost productivity and investment and promote economic diversification. Analysis of the region’s growth dynamics shows that in economically less resilient countries, rising capital accumulation has been accompanied by falling efficiency of investment spending, but not in resilient ones. This suggests that the inefficiency of investment – which reflects insufficient skills and other capabilities for the adoption of new technologies, distortive policies, and resource misallocation, among other things – will need to be reduced if countries are to capture fully the benefits of higher investment.

As African countries seek new drivers of sustained, inclusive growth, attention to skills building is growing. The region’s growing working-age population represents a major opportunity to reduce poverty and increase shared prosperity. But the region’s workforce is the least skilled in the world, constraining economic prospects. Building the skills – cognitive, socio-emotional, and technical – of today’s workers and future generations will be vital for realizing the development potential of the region.

Countries in Sub-Saharan Africa have invested heavily in skills building, and public expenditure on education absorbs about 15 percent of total public spending and nearly 5 percent of GDP, the largest spending ratios among developing regions. Although more children are in school today than ever before, almost one in every three children fails to complete primary school. In most countries, far less than 50 percent of all children complete lower secondary education (the equivalent of middle school in some countries), and under 10 percent make it to higher education.

In most countries, skills-building efforts must strive to make spending smarter to ensure greater efficiency and better outcomes. But smart investing in skills is more difficult than it looks. Sub-Saharan African countries face two hard choices in balancing their skills portfolios: striking the right balance between overall productivity growth and inclusion, on the one hand, and investing in the skills of today’s workforce and tomorrow’s workforce, on the other hand. u Investing in the foundational skills of children, youth, and adults is the most effective strategy to enhance productivity growth, inclusion, and adaptability simultaneously. Thus, all countries should prioritize building universal foundational skills for the workers of today and tomorrow. This is more pressing in countries with low basic educational attainment and poor learning outcomes among children and youth.

In skills training, countries must be selective and ruthlessly demand-driven. For productivity growth, support should target demand-driven technical and vocational education and training, higher education, entrepreneurship, and business training programs tied to catalytic sectors. Such support should incentivize more on-the-job training, especially in smaller firms. Special attention should be paid to science, technology, engineering, and mathematics fields, focusing on the transfer and adoption of technology in economies with an enabling policy environment for these skills investments to pay off. Economic inclusion requires investing in labor market training programs focused on disadvantaged youth and improving the skills of workers in low-productivity activities.

External Sources of Financing in Sub-Saharan Africa

Capital flows to Sub-Saharan Africa slowed in 2015-16 on weaker global trends. This slowdown underpinned a deceleration in investment growth in the region. World Bank (2017) points out that investment growth in the region slowed from about 8 percent in 2014 to 0.6 percent in 2015 – which is significantly lower than the 1990-2008 average of 6 percent and the rapid growth in investment of 11.6 percent during 2003-08. The deceleration is evident in public and private investment.

Capital flows into the region’s only emerging market (South Africa) decelerated to 4.2 percent of GDP in 2015, after posting an annual average amount of 6.6 percent of GDP in 2011-14. The reduction in the amount of capital flows into South Africa was mainly driven by reduced FDI – which explains about half the drop in total inflows. This decline reflects not only lower international commodity prices, but also labor market problems that may have deterred investment. Total flows of foreign capital into the region’s frontier markets, by contrast, grew from 5.8 percent of GDP in 2011-12 to 7.4 percent of GDP in 2015, boosted by an increase in other investment inflows (say, cross-border bank lending, private and official sector lending, or others). Finally, foreign capital flows into other countries in Sub-Saharan Africa slightly increased, from 7.3 percent of GDP over 2011-14 to 7.7 percent of GDP in 2015 – and this increase is primarily explained by a small increase in FDI.

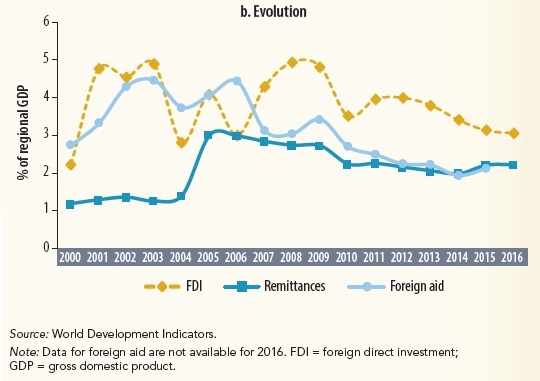

Figure 1B.1: Safer Financing Flows: FDI, Remittances, and Foreign Aid in Sub-Saharan Africa

For the region, FDI inflows fell from 3.8 percent of GDP in 2011-14 to 3.1 percent in 2015-16. Relative to other safer forms of financing, regional inflows of FDI are larger than those of workers’ remittances and foreign aid. Although remittance inflows to Africa remained slightly invariant (2.1 percent of GDP in 2011-14 and 2.2 percent in 2015-16), foreign aid edged lower, from 2.2 to 2.1 percent of GDP. Finally, there has been a retrenchment in all safer forms of external financing to countries in Sub-Saharan Africa after the global financial crisis. Since 2008, FDI inflows to the region declined by about 2 percentage points of GDP; foreign aid was reduced by 1 percentage point of GDP. Finally, remittances dropped by half a percentage point of GDP from 2008 to 2016.

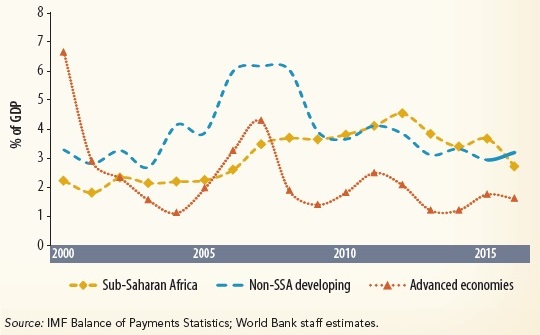

Figure 1B.2: FDI into Sub-Saharan Africa and Other Regions

The downward trend in FDI is also observed in other regions of the world. FDI inflows as a percentage of GDP fell in 2015-16 relative to 2010-13 for all regions (figure 1B.2). The largest decline took place in Sub-Saharan Africa, where FDI inflows slowed from 4.2 percent of GDP in 2010-13 to 3.2 percent of GDP in 2015-16 (a drop of about 1 percentage point of GDP). Developing countries outside SubSaharan Africa experienced a drop from about 0.6 percentage points of GDP in 2010-13 to 3.1 percent of GDP in 2015-16. Finally, FDI inflows to advanced countries declined from 1.9 percent of GDP in 2010-13 to 1.7 percent of GDP in 2015-16.

Going beyond the aggregate trends, there is some heterogeneity across countries in the region. In 2015-16, FDI flows into the region were about 3.1 percent of GDP – of which 1.3 percent of GDP flowed into non-resource rich countries, 1.5 percent into oil-rich countries, and 0.3 percent into non-oil-rich countries. Although FDI declined for all these groups, the pace of decline varied.

The sharpest decrease in the ratio of FDI inflows to GDP was experienced by the non-oil resource rich countries, to 5 percent of GDP in 2015-16 (from 9.4 percent in 2010-13). FDI inflows to oil-rich countries declined from 4.3 percent of GDP in 2010-13 to 3.9 percent in 2015-16. Finally, non-resource rich countries saw a decline of 0.5 percentage points of GDP in 2015-16, to 2.4 percent (down from 2.9 percent in 2010-13). The distribution of FDI inflows across country groups by growth performance is uneven.

Again, the FDI inflows that the region received during 2015-16, valued at 3.1 percent of GDP, went mostly to the less resilient countries: 1.9 percent of the regional GDP is accounted for by the bottom tercile; 0.8 percent of the regional GDP was invested in the middle tercile. The evolution of FDI inflows relative to each group’s GDP shows that this ratio has declined for all groups – although at a faster pace for the least resilient countries, especially those in the middle tercile. FDI flows into the middle tercile countries declined to 4.3 percent of GDP in 2015-16, from 6.4 percent in 2010-13. This was followed by a decline in the bottom tercile countries, from 3.4 percent of GDP in 2010-13, to 2.9 percent in 2015-16. Finally, FDI inflows to resilient countries declined slightly, from 2.7 percent of GDP in 2010-13, to 2.5 percent in 2015-16 – despite rising FDI flows into Ethiopia and Rwanda.

This report was prepared by the Office of the Chief Economist for the Africa Region. by a team led by Punam Chuhan-Pole.