News

Can Africa grow its manufacturing sector and create jobs?

Over the past decade and a half, Sub-Saharan Africa has experienced rapid economic growth at an average annual rate of 5.5%. But since 2008, the share of manufacturing in GDP across the continent has stagnated at around 10%. This calls into question as to whether African economies have undergone structural transformation – the reallocation of economic activity across broad sectors – which is considered vital for sustained economic growth in the long-run.

It is often argued that the process of manufacturing-led structural transformation results in employment growth characterized by the creation of good, high-productivity, good-paying jobs. The kind of jobs that can break the cycle of poverty and address inequality.

So if most African countries haven’t experienced manufacturing-led structural transformation, what is it that has constrained the manufacturing sector over this relatively robust period of economic growth?

Our recent working paper attempts to address that exact question by utilizing the Atlas of Economic Complexity analytical framework. The framework allows one to examine the extent of manufacturing-led structural transformation across African countries, as well as investigate what may be constraining manufacturing performance in these countries.

It has been argued that economic development involves the accumulation of productive capabilities that allow a country to produce increasingly diverse and complex products. These productive capabilities can be described as non-tradable networks such as logistics networks, finance networks, supply networks, knowledge networks, and the like. The more complex products a country produces, typically manufactured products, the more complex the economy.

On aggregate, African countries are characterized by low levels of economic complexity. This is consistent with the export structures of these economies being dominated by basic commodities or products from mining or agriculture, as opposed to more complex manufactured products. However, there is evidence of heterogeneity within the African context.African countries that exhibit relatively higher levels of economic complexity, producing (and exporting) manufactured products can be divided into two groups: 1) countries with an established manufacturing base such as South Africa, Tunisia, Morocco and Egypt; and 2) countries with emerging manufacturing sectors such as Mauritius, Kenya and Uganda.

Further insights are offered by another empirical tool available in the Atlas of Economic Complexity analytical framework: the product space. It is argued that countries shift production to related products when the manufacturing capabilities needed to produce each of the products are similar. For instance, it is easier to shift production from shirts to jackets, as opposed to shifting from shirts to catalytic converters.

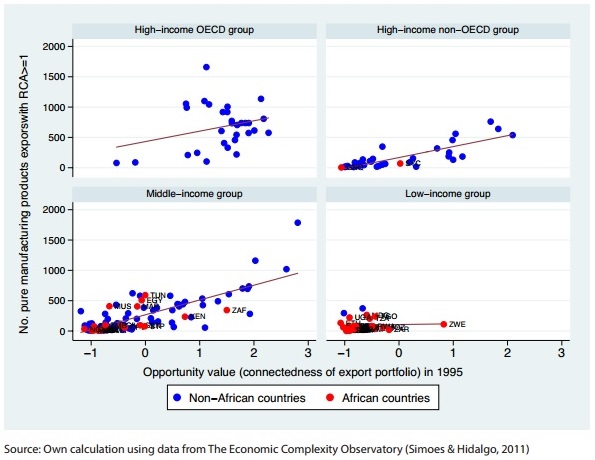

Drawing on these ideas, we predict that a country’s existing productive structure and the productive capabilities that it embodies are related to the future diversification of its manufacturing sector. In the graph below we relate the opportunity value index for a sample of African and non-African countries in 1995 against the number of manufacturing products that these countries produce in 2013, by level of development. The opportunity value index is a measure of the productive opportunities associated with a country’s export structure. It measures the difference in productive capabilities between a country’s export portfolio and the products that it does not currently export.

Figure 1: Opportunity Value Index in 1995 in Relation to Number of Manufacturing Exports (RCA≥1) in 2013

First, it is evident that for low-income countries in Africa there is no correlation between their initial opportunity value and their subsequent manufacturing performance. This indicates that a manufacturing sector in these countries is non-existent. Therefore, the productive capabilities inherent in their initial productive structure is too distant from those needed in order to easily diversify into manufacturing products.Second, we found a positive correlation between initial opportunity value and subsequent manufacturing performance in middle-income countries. This suggests that the initial export structures of these relatively more complex economies, some of which are African, allowed for subsequent diversification into manufactured products. As such, these African economies with existing and emerging manufacturing sectors have the greatest potential to undergo manufacturing-led structural transformation.

The extent to which African economies can undergo manufacturing-led structural transformation is constrained by the limited productive capabilities inherent in these economies.From a policy perspective two questions arise:First, if economic development is the accumulation of productive capabilities, can identifying requisite productive capabilities specific to an economy enable firms to successfully enter manufacturing activities? Identifying and developing such capabilities might just enable manufacturing-led structural transformation and in turn create jobs.Second, it has been argued that the global economy is changing and that manufacturing-led structural transformation may no longer be enough. In light of this, does the high productivity modern services sector offer an alternative or complementary option for African economies to undergo structural transformation? That scenario too might just create some of the jobs required to contribute to the alleviation of inequality and poverty on the continent.

Francois Steenkamp is Researcher for the Development Policy Research Unit, University of Cape Town. Christopher Rooney is Junior Researcher at the Development Policy Research Unit, UCT.