News

Priority trade policy actions to support the 2030 Agenda, transform African livelihoods and contribute to gender equality

Priority Trade Policy Actions to Support the 2030 Agenda and Transform African Livelihoods

In September 2015, world leaders adopted the 2030 Agenda for Sustainable Development, including 17 Sustainable Development Goals, with the first calling for the eradication of extreme poverty. This new transformative agenda took effect in 2016. The Agenda 2063: The Africa We Want was adopted in 2013 and provided the basis of Africa’s input into the SDGs. The result is a global development agenda that is mutually supportive and consistent with Africa’s own development agenda.

The Millennium Development Goal of halving poverty between 1990 and 2014 was met for all developing regions except for Africa, where the absolute number of people living in poverty increased. At the same time, the continent as a whole recorded impressive growth significantly above the global average, albeit mostly driven by a commodity boom. Africa’s key challenge is to make its relatively high growth inclusive and employment-intensive so that it does not worsen inequality and helps lift people out of poverty. With the subsequent fall in commodity prices and a more uncertain outlook for growth, current projections suggest that the region is unlikely to eliminate poverty by 2030. A new approach is needed.

This think piece focuses on the transformative role trade policy offers in this regard. Trade performance in Africa has to date been suboptimal. Intra-African trade – which has significant potential to facilitate successful economies of scale, diversification and value addition – is underperforming. The think piece identifies the main challenges in building poverty-reducing trade – these include high trade costs, commodity dependence, weak productive capacities, slowing global trade and economic growth, and a global trade regime that falls short of what is needed for Africa.

The piece recommends a set of priority trade policy actions that are needed to address these challenges and shape trade so that it contributes to poverty reduction in Africa. National actions call for agricultural transformation, industrial development and integration of African firms into global value chains through reducing constraints to trade for small and medium-sized enterprises (SMEs); trade facilitation measures; efficient and effective services; and lowering protection on imported intermediate products. These actions are needed to provide the supportive domestic microeconomic conditions for Africans to benefit from trade opportunities. At the regional level, the piece highlights the potential diversification, employment and income gains from intra-African trade and the need for timely implementation of the African Union’s Boosting Intra-African Trade Action Plan, Continental Free Trade Area and Continental Customs Union. Internationally the call is for assistance to mobilise African’s productive capacity to compete and trade under preferential agreements and to increase Aid for Trade allocations to regional projects, trade facilitation and services, which are all key to unlocking structural transformation and poverty reduction in Africa.

Challenges to ensuring poverty-reducing trade and growth in Africa

Having not achieved the MDG on poverty reduction, Africa is starting on the back foot. Attaining the poverty-related objectives of the 2030 Agenda will be even harder. This reflects challenges to ensuring poverty-reducing trade and growth on the continent related to the national, regional and global context, but also specific policy challenges.

National and Regional Challenges

Poverty reduction in Africa has been constrained by domestic and regional factors such as rapid population growth, high unemployment (particularly for youth and women), inadequate access to energy and cross-border infrastructure (particularly in rural areas), high levels of inequality, including gender disparities, and in some instances prolonged episodes of political instability. The continent is also susceptible to shocks that have reversed development gains and significantly hit productive capacities and potential economic activity. The Ebola outbreak in Liberia, Sierra Leone and Guinea, for example, is expected to result in serious reversals in efforts to reduce poverty and generate decent jobs and food security for at least the next five years (UNECA et al. 2015). These challenges are reflected in a range of SDGs, demonstrating how deeply embedded the poverty challenge is within the 2030 Agenda but also in national realities.

Trade policy is key to overcoming these challenges. High population growth is expected to continue over the SDG-period, but expanding trade can help African countries to harness the demographic dividend through creating productive externally oriented job opportunities. Closer trade ties can help to incentivise political stability, peace and productivity. Gender-sensitive trade policies are key to securing productive opportunities and decent incomes for women. Regional trade holds particular promise. Intra-African trade is the lowest of all intracontinental trade, but bold regional integration plans are expected to reduce intra-African trade constraints, helping to boost trade on the continent, and diversify Africa’s production and export base.

Global Challenges

Global trends and trade and investment partnerships impact poverty outcomes. Recent estimates suggest that 44 percent of the output fluctuations of Africa excluding North Africa since 1998 are explained by external factors – namely gross domestic product (GDP) growth in G7 countries and China, oil and non-oil commodity prices, and borrowing costs for emerging economies in international capital markets (Brookings Institution 2016).

For much of the MDG period, Africa maintained high growth rates, even in the face of large external shocks such as the 2008 global financial crisis. However, this was largely fuelled by high commodity prices, which intensified commodity export dependence and inequalities. The narrowing of the economic base in many commodity-dependent countries, combined with recent developments in the global economy, suggest Africa’s rate of growth will slow in the years ahead. The World Bank revised its 2016 growth projection for Africa down from 4.2 percent in January 2016 to 2.5 percent in June 2016 (World Bank 2016a).

Global growth is expected to moderate due to slower growth in emerging markets and stagnation in Europe. This will constrain Africa’s foreign exchange inflows from exports and remittances, and may trigger protectionist measures. The World Trade Organization (WTO) projects growth in the volume of world trade to remain sluggish in 2016 at 2.8 percent (WTO 2016). Conditions in international financial markets are tightening, which risks reducing investment and business activity in Africa. Interest rates in the United States are anticipated to increase on expectation of inflationary pressures. This has already exerted pressure on African countries’ balance of payments and currencies. Weak demand has contributed to broad reductions in commodity prices since 2011, and they are expected to remain low in the short to medium term. This has negatively impacted Africa, as a heavily commodity-dependent continent, and contributed to additional currency depreciation pressures.

These global trends make poverty reduction in Africa more difficult – not only through the immediate effects of reduced export earnings and incomes, but also through the long-term impacts of reduced capital accumulation and business investment on growth and employment. They also present opportunities, however. Low commodity prices will make it more challenging for African countries to earn export revenues unless they diversify, providing incentives for value addition and a more inclusive trade and growth model. Export diversification will be aided by the export competitiveness effect of weak currencies.

The Changing Trade Policy Landscape

The international trade landscape will influence how well Africa can take advantage of welfare-enhancing trade opportunities. Very little has been achieved under the multilateral Doha Development Agenda trade negotiations and there is a broad consensus that, overall, the outcomes of the 2015 WTO 10th Ministerial Conference were suboptimal.

Slow progress in multilateral negotiations has contributed to a significant increase in the number of regional trade agreements (RTAs) and an emergence of mega-regional trade agreements (MRTAs) between large trading powers over the last decade. Modelling exercises by UNECA indicate that, if implemented as currently planned, the three main MRTAs – the Trans-Pacific Partnership (TPP), the Transatlantic Trade and Investment Partnership (TTIP) and the Regional Comprehensive Economic Partnership (RCEP) – will result in loss of market share by African countries through preference erosion and competitiveness pressures.4 Africa would see its total exports reduce by US$3 billion (0.3 percent) by 2022 compared to the baseline scenario without MRTAs, as exports to RCEP countries decrease by over US$10 billion while exports to other regions would increase by about US$7 billion. Although this trade diversion effect is relatively small, impacts beyond trade diversion could cause a bigger hit to African countries. For example, Africa’s exports to RCEP (essentially India and China) would fall by 5.4 percent, with the reductions concentrated in exports of industrial products, creating an additional challenge to efforts to establish stable supply relationships with rapidly growing markets and structurally transform African economies (Mevel and Mathieu 2016).

Shifts towards greater reciprocity in trade agreements are also expected over the next decade. The recently agreed Economic Partnership Agreements (EPAs) between the European Union (EU) and regional African groupings call for the partial and gradual asymmetric opening of African markets to EU imports. The liberalisation is asymmetric, involving more EU access to African markets, given that EU markets are already relatively open to African products. Some EU-originating goods would be granted more favourable treatment in African countries than products from other African countries, since average tariffs on intra- African trade remain high. In 2025, the African Growth and Opportunity Act (AGOA) covering preferential trade between Africa and the United States is also expected to be succeeded by an agreement with a more reciprocal structure.

UNECA’s modelling suggests that implementation of new EPAs in West Africa and the Eastern and Southern Africa (ESA) region would see a significant influx of EU exports to African countries in almost all sectors (especially in industrial goods), a reduction in intra-African trade, and tariff revenue loss (19.3 percent in West Africa). The agreements could have both positive and negative effects: cheaper industrial inputs from the EU would reduce local manufacturing production costs and help to drive structural transformation in African countries, but rapid full liberalisation also risks reducing the competitiveness of some local producers, potentially undermining efforts to industrialise, diversify and transition out of developing economy status if the necessary adjustments are not managed well. West Africa and ESA’s export gains to the EU would be concentrated in just a few agricultural sectors and benefit non-LDCs which currently have less access to EU markets. LDCs instead see quasi-null or negative export variations due to increased competition with West African and ESA’s non-LDCs, which risks undermining LDCs’ poverty-reduction efforts.

Reducing Non-Tariff Trade Costs

Preferential market access is important, but reducing the non-tariff trade costs faced by importing and exporting African firms is an even more important policy challenge. These costs inhibit firms from importing the inputs needed to be competitive, reduce the returns they reap from engaging in exports and reduce their ability to create employment. They also increase average consumption costs for the poor, constraining improvements in food security, health and productivity.

Trade costs are much higher than prevailing tariff rates and are particularly high in Africa excluding North Africa. Africa’s cost of trading with the world was 283 percent in ad-valorem tariff equivalent in 2013, higher than that of all other regions except Central Asia, which has a higher share of landlocked countries. These high trade costs reflect cumbersome domestic customs requirements and inadequate internal and cross-border infrastructure. The average African country ranks in the worst-performing 25 percent of all emerging and developing countries in terms of costs of border processing and document requirements.

Cross-border collaboration to design and implement regional energy and transport infrastructure projects has increased but falls short of what is needed to fill Africa’s deficit. The 51 projects identified under the Priority Action Plan as part of the African Development Bank’s Programme for Infrastructure Development in Africa (PIDA) were considered technically and financially achievable – the cost of annual outlays representing 1 percent of Africa’s GDP up to 2020. Implementation progress has been slow, however, due to a lack of clarity on the institutional architecture and the responsibility of different parties for execution, and inadequate discussion of public-private partnerships (PPPs) and private investment options, despite these being a priority of the programme.

Over half of exporting and importing firms in African countries covered in a recent survey were affected by non-tariff measures (NTMs). The most affected are small companies and companies in the agrofood sector which are impacted by sanitary and phytosanitary regulations. This is important because understanding and managing the business environment and NTMs is particularly difficult for SMEs, and SMEs are key to channelling trade and growth into jobs for poor people.

The costs of trading in services are also high. Most African countries for which data are available rank in the top (more restrictive) half of World Bank’s 104-country Services Trade Restrictions Index. Ethiopia, Zimbabwe, Egypt and the Democratic Republic of the Congo rank in the top 10 (UNECA 2016). Reducing these costs is important because research has shown the services sector to have a strong poverty-reducing effect across 60 countries, including 29 in Africa excluding North Africa.

Building Productive Capacities for Value Addition

Africa’s exports of primary commodities as a share of total exports increased in recent years – from 76 percent a decade ago to 82 percent in 2010-2012 – partly driven by the global commodities boom. Domestic value addition is still limited by an inadequate supply of productive capacities. Africa contributed only 2.2 percent to global trade in value added in 2011 and mainly participates in global value chains (GVCs) at lower rungs of the ladder. Low levels of value addition and Africa’s reliance on commodities constrain poverty reduction through reducing aggregate income, creating a more unequal income distribution (favouring commodity owners), and reducing the returns to labour supply.

The continent’s export structure will need to change to ensure productive jobs and poverty-reducing trade. Global and regional reductions in trade costs, new technologies and the emergence of GVCs and trade in tasks have created a wide range of industrial products and services that are now tradeable. This provides a crucial opportunity for labour-abundant Africa to attract investment in higher value-added export sectors such as agro-processed goods, textiles, leather, wood furniture and financial services.

Africa will find it difficult to harness these trading opportunities without investments in human capital and technological capabilities. A recent African Capacity Building Foundation study highlights the need for critical, technical and sector-specific skills for the implementation of Agenda 2063 and estimates that the Agenda’s first Ten Year Implementation Plan period will require 1,611,042 more agriculture scientists and researchers and 7,441,648 more engineers to support the work required. A poorly skilled and educated labour force is the top supply bottleneck underscored by global executives when considering manufacturing investments in Africa and constitutes a barrier to investment in skills-intensive service sectors. Investments in human capital are key to addressing multidimensional poverty, through productive employment creation, enhanced returns to labour and improved education outcomes more generally.

Ensuring Equal Opportunities to Benefit from Trade

Trade impacts different population groups differently, not least because it can result in the contraction of some sectors and the expansion of others. Without redistributive mechanisms or sufficient labour mobility and options for redeployment and re-skilling, adjustment costs can be large and the gains from trade severely skewed. The poor face constraints that make mobility difficult, and this at the same time reduces their ability to benefit from new poverty-reducing trade opportunities. Among these constraints are limited access to land, capital, markets and education and training, which are crucial to investing in activities for trade, particularly at higher levels of the value chain. Rural dwellers, informal workers and women are disproportionately affected by these constraints, which are inefficient and reduce the total gains and poverty-reducing effect of trade. It is no coincidence that poverty rates among these groups are significantly higher than national averages in Africa. Creating the conditions for mobility to be achieved will be a crucial challenge for policymakers seeking to harness trade to contribute to poverty reduction (World Bank Group and WTO 2015).

The 2030 Agenda and the Potential Contribution of Trade to Gender Equality

The ambitious goals laid out in the United Nations 2030 Agenda for Sustainable Development capture the intrinsic importance of gender equality and women’s economic empowerment. The challenge is steep. Women are less likely to participate in the paid and formal economy, and when they do they are largely concentrated in vulnerable and low-paying jobs and sectors. Women generally earn less than men for the same jobs and skill levels and they disproportionately bear the burden of unpaid household work and care. These disparities matter, including for growth prospects. Women’s economic empowerment and gender parity influence national competitiveness. Ultimately, gender equality is fundamental to whether societies thrive.

While gender gaps in economic opportunities are well established and there is an accepted understanding of trade and gender issues, with some evidence from case studies, there is very little generalised evidence about the trade-gender inequality relationship. The challenges that women face in economic activity are also extremely varied. Women entrepreneurs run around 31 percent of firms, but these are predominantly small in scale and so disproportionately affected by burdensome non-tariff barriers to trade. Women operating as informal cross-border traders often face opaque and inaccessible regulations, as well as corruption and abuse at border crossings. Small enterprises in general, and particularly women, often face difficulties accessing finance, including finance for trade. As employees, sectoral patterns of trade determine whether trade increases opportunities for female workers relative to male workers. Women have gained from employment in export-oriented labour-intensive manufacturing (for example, garments and textiles) and from trade in services (like tourism), although under working conditions that may not be better than other sectors of the economy. Competition from trade can, but may not always, lead companies to invest in technology that benefits women, and to reduce wage dis crimination.

The challenge of meeting the 2030 Agenda’s gender equality goal applies as much to wealthy as to poorer countries. Policymakers seeking to use trade policy to enhance women’s economic opportunities and gender equality face a range of further challenges and options. In the short term, governments could prioritise assessing the impact of trade liberalisation on women’s participation in trade-exposed sectors and could shape trade adjustment assistance to expand women’s economic opportunities. In the medium term, government procurement, within the bounds of international obligations, could be oriented to source from women entrepreneurs within and outside traditional sectors, boosting demand at scales that could enable women to trade internationally. Importantly, governments could prioritise trade facilitation efforts that would reduce the fixed costs of trade that disproportionately affect small businesses and therefore women’s businesses. Regional trade agreements are opportunities for encouraging cooperation around gender equality. In parallel, governments will also need to address key structural barriers to gender equality, including eliminating legal constraints and barriers to access to finance.

Introduction

International agreements to ensure gender equality are not new. The United Nations Convention on the Elimination of All Forms of Discrimination against Women includes Article 3 on ensuring the “full development and advancement of women,” and there are several relevant International Labour Organization (ILO) Conventions, dating from the 1950s through to the Maternity Protection Convention (2000, No. 183), and the Decent Work for Domestic Workers (2011, No. 189).

The SDGs provide a catalyst for action. Goal 5, to achieve gender equality and empower all women and girls, and the associated targets capture significant global consensus around an ambitious agenda. The concrete targets, listed in the Annex, include commitments to recognise unpaid work, to give women equal rights to economic resources, and to enhance the use of enabling technology. Women’s economic empowerment is also part of other goals, including the achievement of “full and productive employment and decent work for all women and men” (Target 8.5) and doubling the “agricultural productivity and incomes of small-scale food producers, in particular women” (Target 2.3). It is thus a crucial means of achieving a range of sustainable development objectives. Similarly, progress towards other SDG targets, like achieving universal access to safe and affordable drinking water (Target 6.1) and ensuring equal access for women and men to technical, vocational and tertiary education (Target 4.3) could help to enable women to participate in economic opportunities.

Trade is a recurring theme in the 2030 Agenda, even if there is no specific goal directed at trade per se. Several areas relate to trade, including increasing Aid for Trade support for developing countries and significantly increasing developing country exports, in particular with a view to doubling the share of least developed countries by 2020 (SDG 17) (WTO 2016; see also Tipping and Wolfe 2016). The Addis Ababa Action Agenda, which is integral to the 2030 Agenda, explicitly links trade and gender equality in paragraph 90: “Recognising the critical role of women as producers and traders, we will address their specific challenges in order to facilitate women’s equal and active participation in domestic, regional and international trade.” This paper addresses some of these challenges.

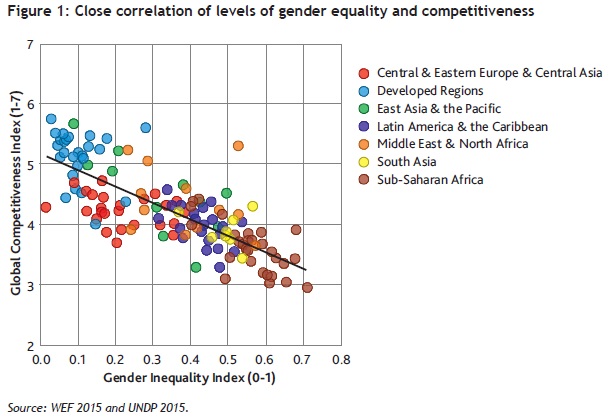

Trade can contribute to gender equality and sustainable development. The relationship may also work in the other direction. Levels of gender equality affect how competitive a nation is. We can broadly map this relationship using the World Economic Forum’s Global Competitiveness Index and the United Nations Development Programme’s Gender Inequality Index. Figure 1 highlights the strong correlation across countries – such that higher levels of gender equality are associated with higher levels of national competitiveness – suggesting potentially positive synergies, as well as negative relations at lower ends of the spectrum.

At the same time, there is intense debate about the distributional effects of trade. Academic investigations into the labour market impacts of international trade typically differentiate workers by their educational attainment or skills. Gender is a further dimension in which the impacts of trade liberalisation can be expected to differ, given the systematic differences in whether and where women and men tend to work. International trade may amplify or work to offset existing patterns of inequality in women and men’s participation in economic activities. Understanding such linkages is complex, as underlined by Bussolo and de Hoyos (2009) and others. More broadly, gender inequality intersects with other inequalities – such as poverty, geography, ethnicity and race or caste – in shaping economic opportunities. While it is important to recognise and take account of these different factors where possible, the focus of this short piece is on gender.

This piece focuses on women’s economic empowerment. Women’s economic opportunities are of course only one dimension of the gender agenda – there are major challenges on various other fronts, including freedom from violence, health, and participation in decision-making. Economic opportunities are nonetheless integral to gender equality and women’s empowerment, given the evidence of how access to good paid work can expand the well-being and choices not only of women themselves, but also their families. There are also major gains associated with expanding women’s economic opportunities which can accrue to firms, communities and economies as a whole. Woetzel et al. (2015) recently estimated these gains to amount to some US$28 trillion globally.

It is therefore important to understand whether and how trade policy can contribute towards greater equality of opportunities in the labour market. This note explores ways in which trade and trade policy can enhance gender equality in economic opportunities, and help to overcome such structural barriers as discrimination and occupational segregation. Evidence shows that while increased trade can increase economic opportunities, existing inequalities, including in terms of pay and conditions, persist. We therefore also look at ways in which complementary policies can help to maximise the potential gains from trade, and minimise its potential costs.

The above think pieces are part of a series of papers developed by ICTSD that explore the contribution that trade and trade policy could make to key objectives of the 2030 Agenda for Sustainable Development adopted by members of the United Nations in September 2015. The series is designed to help policymakers, in particular, to think through the role of trade policy in the implementation of this ambitious global agenda.