News

The Mobile Economy Africa 2016

The mobile industry in Africa continues to deliver the required connectivity that enables access to a wide range of services addressing various social and economic issues. But with more than half of the population yet to subscribe to a mobile service, the challenge for Africa is to overcome the barriers to connecting the unconnected and unlock the economic potential of increased connectivity.

Executive summary

Almost half the population of Africa subscribed to mobile services in 2015

At the end of 2015, 46% of the population in Africa subscribed to mobile services, equivalent to more than half a billion people. The region’s three dominant markets – Egypt, Nigeria and South Africa – together accounted for around a third of the region’s total subscriber base. Subscriber growth rates are now beginning to slow and will increasingly converge with the global average, as affordability challenges become a key barrier. Over the next five years, an additional 168 million people will be connected by mobile services across Africa, reaching 725 million unique subscribers by 2020. Eight markets will account for the majority of this growth, most notably Nigeria, Ethiopia and Tanzania, which will together contribute more than a third of new subscribers.

Migration to mobile broadband is accelerating

Subscribers across Africa are increasingly migrating to mobile broadband services, driven by network rollouts and mobile operator device and data strategies. Mobile broadband connections accounted for a quarter of total connections at the end of 2015, but will rise to almost two-thirds by 2020. 4G network launches are gaining traction: by mid-2016, there were 72 live LTE networks in 32 countries across Africa, half of which have launched in the last two years.

The launch of new mobile broadband networks across the region coincides with the growing availability of low-cost devices. The number of smartphone connections has almost doubled over the last two years to reach 226 million, accounting for a quarter of total connections in the region. This reflects strong uptake in the established mobile markets, such as Egypt, Kenya, Nigeria and South Africa, as well as some relatively new 3G markets, notably Algeria, Cameroon and the Democratic Republic of Congo. Over the next five years, the region will add a further half a billion smartphone connections, taking the adoption rate to more than half of total connections.

The migration to mobile broadband and growing levels of smartphone adoption are expected to lead to a further boost in mobile data traffic growth, repeating the trend seen in other regions. Many operators in the region recorded data traffic growth of more than 50% in 2015. As a result, data revenue as a share of total revenue is rising rapidly across the region, reaching 15% on average but considerably higher for mobile operators in the more advanced markets such as South Africa and Egypt.

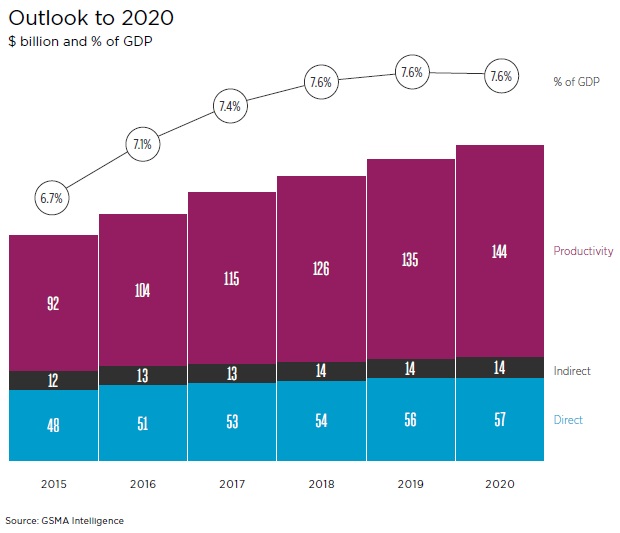

Mobile generated 6.7% of Africa’s GDP and 3.8 million jobs in 2015

In 2015, mobile technologies and services generated 6.7% of GDP in Africa, a contribution that amounted to around $150 billion of economic value. In the period to 2020 we expect this to increase to more than $210 billion (7.6% of GDP) as countries benefit from the improvements in productivity and efficiency brought about by increased take-up of mobile services.

The mobile ecosystem supported 3.8 million jobs in 2015. This includes workers directly employed in the ecosystem and jobs indirectly supported by the economic activity generated by the sector. The mobile sector also makes a substantial contribution to the funding of the public sector, with $17 billion raised in 2015 in the form of general taxation. The number of jobs supported will increase to 4.5 million by 2020, while the tax contribution to public funding will rise to $20.5 billion.

Mobile is the platform of choice for digital transformation in Africa

Mobile has emerged as the platform of choice for creating, distributing and consuming innovative digital solutions and services in Africa. Many local and global innovators and tech entrepreneurs are now using the expansion of advanced mobile infrastructure in the region and the growing adoption of smart devices to deliver mobile-based solutions that directly appeal to local interests and cultures.

The tech start-up ecosystem in Africa is increasingly active; there are approximately 310 active tech hubs across the region, including 180 accelerators or incubators. The range of tech start-ups funded in recent years and the size of deals reflect the accelerating development of the ecosystem. Moves by some mobile operators in the region to open up their APIs to third-party developers create significant opportunities for tech innovation and further development of the start-up ecosystem. Mobile operator APIs such as messaging, billing, location and mobile money enable start-ups to scale and extend their services to a broader customer base.

Mobile can help address social challenges and the UN Sustainable Development Goals

Mobile technology continues to play a central role in addressing a range of social challenges, including unregistered populations, the digital divide and financial inclusion. In September 2015, the UN introduced its Sustainable Development Goals (SDGs) to the world – a 17-point plan to end poverty, combat climate change and fight injustice and inequality by 2030. Mobile connectivity is essential to the achievement of the SDGs given the power of mobile technology to accelerate inclusive growth and sustainable development in a way no other technology can.

Mobile is addressing the challenge of unregistered populations in Africa, where more than 400 million people lack an official form of identification. Mobile technology is well placed to address the challenge of birth registration, given high penetration levels and geographic coverage, particularly in rural areas, with operators in countries such as Senegal, Tanzania and Uganda already tackling the issue.

Mobile internet adoption in Africa continues to grow rapidly; the number of mobile internet subscribers tripled in the last five years to 300 million by the end of 2015, with an additional 250 million expected by 2020. However, by 2020 60% of the population will still be unconnected. Significant barriers to adoption remain, particularly for underserved groups such as women, rural communities and young people.

Mobile money continues to improve financial inclusion in Africa. The region accounts for 52% of the 271 live mobile money services in 93 countries and 64% of all active mobile money accounts. Six new services were launched in Africa in 2015, with another four in the first half of 2016. Mobile money is having a significant impact in enabling efficient and convenient international money transfer.

Importance of spectrum in delivering greater connectivity

Africa is heavily dependent on mobile networks to deliver the connectivity that its hundreds of millions of citizens and companies need. The capacity and coverage of any wireless network is largely determined by the radio frequencies it is able to use. If policymakers across the region step up efforts to allow mobile operators to gain access to the spectrum they need, Africa will enjoy major social and economic benefits. Spectrum has no intrinsic value, but can be a very valuable resource when put to productive use.

Issues to be addressed include the shortage of appropriate spectrum for mobile operators, caused in large part by the slow progress of the switchover from analogue to digital terrestrial television. Most African governments failed to meet the International Telecommunication Union’s (ITU) deadline for the switchover (June 2015) despite the urgent need to release this spectrum for mobile broadband services. African governments also need to begin preparing for the World Radiocommunication Conference (WRC) in 2019, where they will identify bands to allocate for the next generation of mobile technologies. These 5G technologies will further increase wireless throughput speeds and network responsiveness, enabling a broad range of new services for businesses and individuals.

In Africa, as elsewhere in the world, governments cannot afford to let spectrum lie idle. Radio frequencies need to be employed as efficiently and effectively as possible. In practice, that means releasing spectrum in a way that ensures that the licence holder will invest in mobile broadband networks.

In particular, policymakers in Africa need to ensure that the low-frequency spectrum below 1 GHz is employed to extend mobile broadband coverage across their countries. Reducing the digital divide between urban and rural areas will boost economic activity, help to alleviate poverty, improve healthcare and education, expand financial inclusion and enhance agriculture. There is no time to lose.