Discussions

South Africa’s competitiveness and the role of declining international trade

Willemien Viljoen, tralac Researcher, comments on South Africa’s performance in the just-released IMD World Competitiveness Yearbook 2016

On 30 May 2016 the IMD World Competitiveness Centre released its World Competitiveness Yearbook. The IMD evaluates 61 countries, as places to conduct business, taking into account over 300 criteria which measures competitiveness. South Africa is the only African country included in the assessment. Other countries evaluated include some of South Africa’s major trading partners, including mainland China, the United States, countries in the European Union and India. The criteria used include Gross Domestic Product (GDP), real GDP growth, exports and imports, direct investment flows, employment growth, food costs, government debt, cots of capital, transparency, bribing and corruption, tariffs, subsidies, ease of doing business, agricultural productivity, telecommunications investment and high-tech exports. These criteria are grouped together into four competitiveness factors; economic performance, government efficiency, business efficiency and infrastructure.

According to the competitiveness scoreboard the countries ranked as most competitive are China Hong Kong, Switzerland, United States, Singapore and Sweden; while Brazil, Croatia, Ukraine, Mongolia and Venezuela are the least competitive. South Africa has been ranked as the 10th least competitive country; ranking 52nd out of the 61 countries evaluated.

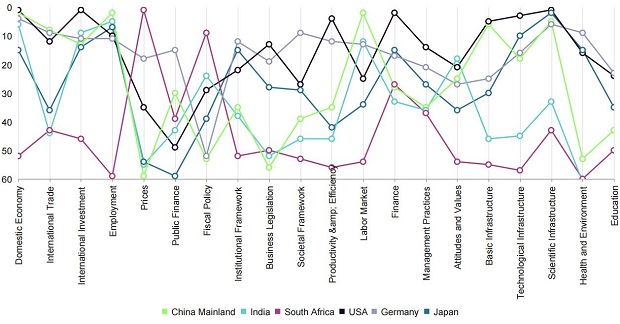

Figure 1: South Africa’s competitiveness versus its major trading partners

Source: IMD World Competitiveness Centre, 2016

When compared to its major trading partners (in terms of total trade), South Africa is ranked the least competitive country; the most competitive being the United States (3rd) followed by Germany (12th), mainland China (25th), Japan (26th) and India (41st). Out of the 20 aggregated criteria used, South Africa performed more poorly than its major trading partners in 14 of these areas, including international investment, employment, labour market conditions, basic infrastructure, technological infrastructure and education.

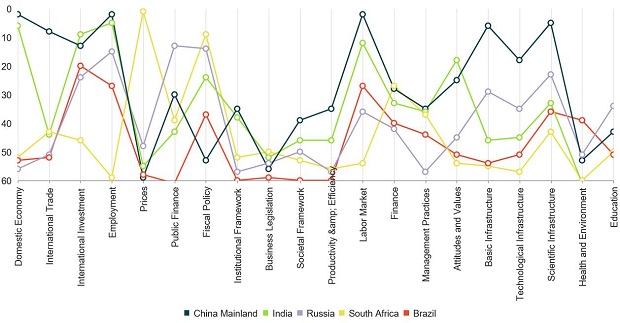

Compared to the rest of the BRICS countries, mainland China is by far the most competitive, followed by India (41st), Russia (44th), South Africa and Brazil (57th). Out of the 20 aggregate criteria South Africa only outperforms the rest of BRICS in the area of prices, fiscal policy and finance, but is ranked lowest in 35 percent of the criteria (including international investment, employment, labour market conditions, attitudes and values and infrastructure).

Figure 2: South Africa’s competitiveness versus the rest of BRICS

Source: IMD World Competitiveness Centre, 2016

In terms of economic performance, government efficiency, business efficiency and infrastructure in South Africa is ranked 54th, 40th, 47th and 54th respectively. All but economic performance have either stayed the same or improved from the previous year. South Africa’s economic performance slipped 5 positions in the rankings (from 49th in 2015). Between 2014 and 2015 South Africa’s GDP declined by 10.6 percent; while GDP per capita showed a slight increase of 0.9 percent. However, between 2012 and 2016 the factors where increasingly weak performance is recorded were for government efficiency (from 29th position to 40th) and business efficiency (from 37th to 47th). One of the factors which has contributed to South Africa’s decline in economic performance is South Africa’s performance on the international trade scene. Between 2014 and 2015 South Africa’s total goods trade declined by 12.2 percent; exports decreased by 10.02 percent and imports by 14.21 percent. Exports to major trading partners Japan, China, India and the United States declined by 18 percent, 14 percent, 13 percent and 3 percent respectively during this time period. Exports of the majority of South Africa’s main export products declined significantly, including ores, slag and ash (HS 26)(-26.54%); iron and steel (HS 72)(-20.35%); aluminium (HS 76)(-16.40%); mineral fuels (HS 27)(-15.65%); and electrical and electronic equipment (HS 85)(-14.16%). However, exports as a percentage of GDP increased slightly, by 0.6 percent to 26.07 percent at the end of 2015. However, this is relative to South Africa’s poor growth performance last year; South Africa’s exports declined at a slower rate than GDP. During 2015 South Africa’s contribution to world goods exports remained negligible, South Africa contributed only 0.49 percent to total world exports and at the end of 2015 South Africa’s balance of trade deficit was approximately US$ 4 billion. In terms of services trade South Africa’s services exports declined by 10.6 percent and imports by 8.9 percent from 2014 to 2015. However, services exports as a percentage of GDP remained constant during this time period at 4.81 percent. At the end of 2015 the services trade balance for South Africa was approximately negative US$ 477 million.

Apart from a decline in international trade, the results identify South Africa’s major challenges for 2016 as a lack of commitment to skills development, poor public sector service delivery, perceived corruption, climate change, declining consumer demand and water scarcity threaten the sustainability of growth, contribute to poor and uneven education outcomes and low business confidence. The key factors the business community perceived to be attractive in South Africa are an effective legal environment, quality of corporate governance, cost competitiveness, reliable infrastructure and access to financing. Factors identified as a hindrance include ineffective labour relations, lack of a strong research and development culture and the incompetency of government.

Sources:

IMD World Competitiveness Centre (http://www.imd.org/wcc/);

Fin24 (http://www.fin24.com/Economy/sa-in-bottom-10-of-world-competitiveness-rankings-20160531);

ITC TradeMap (www.trademap.org)