Discussions

Anti-dumping investigation on chicken imports from the EU

JB Cronjé, tralac Researcher, discusses the initiation of an anti-dumping investigation on chicken imports from the European Union (EU)

South Africa is no stranger to the application of anti-dumping measures. Since the establishment of the World Trade Organization (WTO) in 1995, the country has initiated over 200 anti-dumping investigations most of which resulted in the imposition of anti-dumping duties. On 25 October 2013 South Africa’s International Trade Administration Commission (ITAC) has initiated an investigation into the alleged dumping of frozen bone-in chicken portions, classified under tariff heading 0207.14.90, originating in or imported from Germany, the Netherlands and the United Kingdom. ITAC is responsible for trade remedies, customs tariff investigations and import and export controls in the Southern African Customs Union (SACU).

Chicken imports into the SACU market have been the subject of anti-dumping and tariff increase investigations over the past few years. Imports of frozen bone-in pieces, classified under tariff heading 0207.14, from the United States of America have been subject to anti-dumping duties since December 2000. In June 2011 an investigation was launched into the alleged dumping of frozen whole birds, classified under tariff heading 0207.12.90, and boneless cuts, classified under tariff heading 0207.14.10, originating in or imported from Brazil. After completing a preliminary investigation provisional anti-dumping duties were imposed on both products. In its final determination ITAC found that dumping of the products was taking place; that the SACU industry was suffering material injury and that the material injury suffered by the SACU industry was casually linked to the dumped imports from Brazil. Following the imposition of the preliminary anti-dumping duties Brazil initiated a dispute against South Africa at the WTO system citing major flaws in the initiation and conduct of the dumping investigation. However, in March 2013, the South African Minister of Trade and Industry rejected ITAC’s recommendation to impose final anti-dumping measures on the imported products.

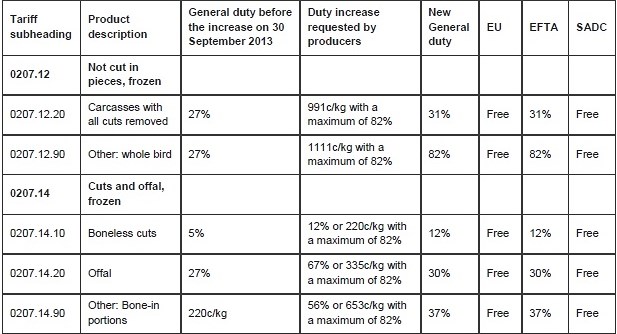

In April 2013, South African poultry producers responded by requesting general tariff increases on imported whole birds, boneless cuts, bone-in portions and offal. At the end of September 2013, following the finalisation of ITAC’s investigation, the Minister announced general tariff increases on all the products indicated in Table 1 below. However, South Africa has free trade agreements with the European Union (EU), Southern African Development Community (SADC) and the European Free Trade Association (EFTA) according to which products originating in or imported from the EU and SADC enter the SACU market free of any customs duty.

Table 1: Applied rate of duty on certain poultry products imported from the world, EU, EFTA and SADC

Source: Government Gazette No. 36358, 12 April 2013 and Government Gazette No. 36876, 30 September 2013

The initiation of an anti-dumping investigation on chicken imports from the three EU countries is the latest development in this on-going matter. ITAC accepted an application by the Southern African Poultry Association (SAPA) alleging that frozen bone-in chicken portions were being dumped in the SACU market between January and December 2012. SAPA represents 72 per cent of the SACU production by product volume. The application is supported by Grain SA, Animal Feed Manufacturers Association, Namib Poultry Industries, Swazi Poultry Processors, Botswana Poultry Association and Basotho Poultry Framers Association. Based on information submitted by the applicant, ITAC found that there was prima facie proof of material injury and of a further threat of material injury to the SACU industry, and that there is a causal link between the alleged dumping and the material injury suffered by the SACU industry. In particular, the applicant made reference to the free trade agreement with the EU, the Trade, Development and Cooperation Agreement (TDCA), stating “that it is expected that landed cost of imported product will be reduced even further as the import duties will be zero, and this threatens to significantly undercut the prices of the SACU producers, in the foreseeable future.” The rate of duty on the particular product was in terms of South Africa’s free trade agreement with the EU gradually phased down over a four-year period from 220c/kg to zero in January 2012. The applicant also indicated that there is likelihood that the volume of alleged dumped imports will increase in the foreseeable future. This is not surprising. The conclusion of a free trade agreement with the EU combined with the recent general tariff increases on chicken imports from non-EU countries will cause imports to shift from low cost countries to higher cost countries. The South African Association of Meat Importers and Exporters indicated that they are not surprised by the application; they expected such an application, but remains of the opinion that no dumping has taken place.

The recent tariff increases on certain poultry products will not affect the bulk of the frozen bone-in chicken portions imports which come from the EU. It is unlikely that tariff increases or trade remedies will solve the poultry sector’s problems; which derive rather from factors such as high input costs including labour, electricity and animal feed than from increased imports in recent years.