Discussions

Customs duties set to increase on imported chicken

JB Cronjé, tralac Researcher, discusses South Africa’s application to increase customs duties on imported chicken

South African poultry producers recently applied for increases in the rates of customs duties on frozen chicken meat. Local producers have been seeking protection against imports for a long time. Almost two years ago, the South African Poultry Association, on behalf of major producers in the Southern African Customs Union (SACU), applied for an investigation into the alleged dumping of whole chicken and boneless chicken cuts originating in or imported from Brazil. Following a preliminary investigation by the International Trade Administration Commission (ITAC), provisional anti-dumping duties of 62.93% on whole birds and 46.59% on boneless cuts were imposed on Brazilian imports for the main part of last year. The Brazilian Government responded by filing a dispute under the World Trade Organization’s dispute settlement system citing major flaws in the initiation and conduct of the dumping investigation. Domestically, similar concerns have been raised about the quality of trade remedy and tariff investigations done by ITAC. The matter ended when the Minister of Trade and Industry rejected ITAC’s final determination that anti-dumping duties should be imposed on the specific products. Despite wide speculation that South Africa’s turnaround was influenced by geopolitical considerations, the Minister rejected ITAC’s recommendation, arguing that there were “increased imports of the subject products from several countries; that the domestic industry requires a comprehensive response to deal with the intensified competition; and that as part of the comprehensive strategy, an investigation into the appropriate level of the most favoured nation (MFN) applied rate of duty on the subject products would be more appropriate to address the difficulties confronting the domestic industry in respect of imports from these countries, including Brazil”.

Between 2008 and 2012, the volume of total imports of frozen chicken not cut in pieces and frozen chicken cuts increased 126% and 4%, respectively. Imports from the EU of these products increased by 116% and 129%, respectively, during the same period. For example, in 2012, whilst applying anti-dumping duties on chicken meat imports from Brazil and the United States, imports of frozen chicken cuts from the EU increased 72% from the previous year. Products imported from the EU will not be affected by the proposed increases due to the free trade agreement it has with South Africa. However, a real prospect exists that agricultural products from the EU may in future be targeted for the application of agricultural safeguard measures. According to media reports, it was an ‘engagement’ between government and representatives of the poultry industry that led to the development of the recently published guidelines for agricultural safeguard action applications in terms of Article 16 of the Trade, Development and Co-operation Agreement between the European Union and South Africa (Legalbrief Today, 16 April 2013).

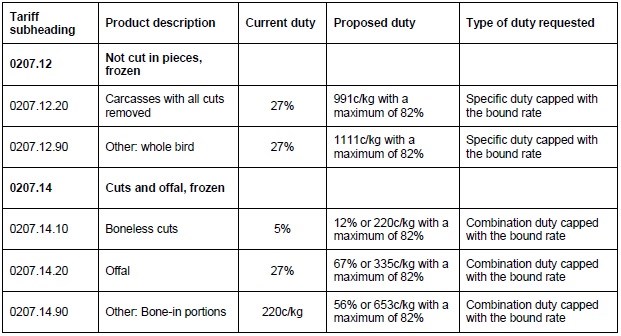

South Africa applies a general customs duty of 27 % on whole chicken and 5 % on boneless cuts. In its tariff application, the South African Poultry Association requested the following increases:

Source: Government Gazette No. 36358, 12 April 2013

The stated reasons for the application include “a large and rapid increase in the volume of imports of extremely low priced frozen poultry meat” that will “negatively impact on further investment in the poultry industry”, “SACU production capacity” and “SACU food security”. In addition, some small and medium sized producers have been forced to close whereas certain large producers have reduced their workforce and forecast further job losses. According to media reports, in a written reply to a parliamentary question, the Minister of Economic Development confirmed that a comprehensive strategy is set to be finalised by the end of May to protect the domestic poultry industry from chicken imports and to address a range of constraints; from improving the industry’s competiveness to drawing small businesses into established value chains. Government has reportedly designated the poultry sector as “a sector in distress”, allowing ITAC to fast-track the tariff increase investigation (Legalbrief Today, 2013).

South Africa has adopted a strategic approach to tariff setting in terms of its Trade Policy and Strategy Framework (launched in May 2010, followed by updates in October 2012) in which tariff determinations are decided on a sector-by-sector basis, dictated by the needs and constraints of sector strategies. The rationale for this strategic approach to tariff reform and tariff-setting is supposedly to support industrial development, employment, investment, productivity growth and food security. Tariffs on agricultural products should find a balance between addressing supply-side constraints and competition issues and the effects of higher duties and their impact on food prices, especially for the poor. It is unlikely that tariff increases will solve the poultry sector’s problems; which derive rather from factors such as input cost increases such as labour, electricity and animal feed than from increased imports in recent years.

Source:

Legalbrief Today, 2013. Domestic poultry a ‘sector in distress’ [Online]. Available from: http://www.legalbrief.co.za/article.php?story=20130416052910703 [Accessed 02 May 2013].