Blog

Blockchain-Driven Trade Technologies and the Potential Benefits for African Trade

Just over two years ago, tralac published a blog about the potential of blockchain (also referred to as distributed ledger technologies (DLT)) for trade in Africa[1]. This blog is an update to that article, showing how much has been achieved in just a short space of time, and how much can be achieved in the very near future.

New technologies such as DLT, which are disrupting existing ways of doing business, are sometimes the subject of fear and confusion. Certain new technologies, such as automation and artificial intelligence, do indeed threaten established markets and are poised to forever change the structure of modern economies. Disruption of this sort calls for proactive mitigating policy action, failing which it can be expected that there will be a high human cost to the new technology. The march of progress is not just inevitable when it comes to technology; it is also very rapid and threatens to catch labour unions, governments and traditional businesses off guard.

Recent research by Rodrik[2] and others have highlighted the ‘sting in the tail’ of technology-driven economics. While technology undoubtedly raises productivity, thereby improving the efficiency of resource use and contributing to rising wages and salaries, it does not easily raise both productivity and employment. More specifically, technology driven productivity gains hold almost no benefit for unskilled labour. This presents a dilemma for Africa’s developing economies, because their large, productive companies create few jobs and their smaller, job-creating companies enjoy few productivity gains.

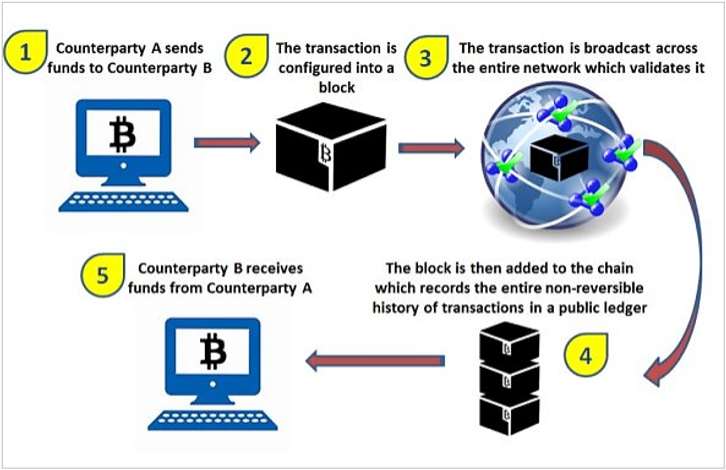

Distributed ledger technologies, on the other hand, are positive-sum technologies that offer large improvements in efficiency and cost saving with little downside to employment. The mechanism of a DLT implementation is stylised in Figure 1. In this case, a blockchain is used to record and validate a financial transaction between two parties. The payment details are stored in a ‘block’ of data before being transmitted to a network of peer to peer (P2P) machines on the internet. Each member of this network hosts the entire set of blocks – the ‘chain’ – which, since it is repeated multiple times, cannot be altered at any single point. Nor is this ledger secret, it is either publiclly accessible or is accessible by authenticated users in the case of a proprietary implementation.

Figure 1: Blockchain simply explained

Source: Goldman-Sachs Global Investment Research

It is said that DLT promotes ‘trust’ in transactions but this is something of a misnomer. Au contraire, DLT obviates trust because trust is needed when transparency is absent. The irreversible and indelible nature of DLT transactions means that fraud and misrepresentation are unlikely to be possible in the first place. Rather, the trustworthy nature of the system means that transaction parties do not have to trust each other if they trust the DLT implementation.

DLT-based systems also allow some obviation of human agency, in that they can feature what are called ‘smart contracts’. When delivery takes place and is verified, this usually triggers a payment process. Without DLT, human intervention is required in order to verify, approve and initiate payment. On the other hand, when both the product characteristics and delivery have been verified on the DLT, a preconfigured smart contract is fulfilled and payment is automated. Although smart contracts do not require DLT to operate, alongside the integrity of DLT, smart contracts are that much more confidence-inspiring. Smart contracts do not require human agency to feed them their data either, they can obtain data from automated feeds such as sensors or other management information systems.

There are specific trade-related implementations of DLT that hold much promise. These are, inter alia, shipment, trade finance, customs processing and certification and logistics (including warehousing). DLT offers much to international trade precisely because the transactions are complex and multiple, and because both the private sector and the trade authorities are involved. The large volume of documentation generated and required for cross-border goods trade is another motivation for DLT since it ensures a single repository of verified digital documents that are accessible by all parties to the transaction.

There is a particular motivation for DLT in the case of certificates of origin (CoO), which are part of the border-friction-creating origin verification process in preferential trade areas. Paper-based CoO, which have expiry dates and need to be obtained from bureaucratic entities, could be issued electronically and stored in the DLT. More than this however, the issuing authorities could use origin documentation already entered into the DLT by exporters, in the process of verifying origin. This process could also be far more automated given that the DLT documentation requirements are standardised and verified. There are therefore multiple possible sources of efficiency and cost-saving gains inherent in a DLT approach.

So much then, for the potential of the technology, which countries in Africa are actually already implementing DLT-based solutions? According to the Weetracker portal[3], South Africa, Nigeria, Kenya, Ghana and Côte d’Ivoire have all grown DLT-based firms in the recent past. However, most of these innovators are in the area of fintech and crypto, not in cross-border trade applications.

There are exceptions, such as a DLT-driven platform for freelancing - MobiJobs.Africa – that eliminates banking fees due to it being supported by an African crypto known as SAFCOIN. DLT-based portals that are developmental in nature are also appearing. In Tunisia, UNICEF has funded a startup called Utopixar, which aims to support communities through ‘tech for good’ applications and blockchain tools.

In Tanzania, a system has been developed that uses DLT to create a ledger of births of babies, to ensure newborns are registered with all relevant birth certificate details[4]. A system like this, which has been donor-funded and developed, will presumably eventually be integrated with the home affairs department’s backend system and become part of an e-government implementation.

The above examples are home-grown, for Africa’s unique developmental needs and challenges. However, it does not make sense for Africa to develop its own DLT-based cross-border trade solution when there already exist several cutting-edge solutions out there. For example, DLT Ledgers[5] is a South-East Asian based DLT- based trade finance solution. The system digitises trade documents and contracts and loads them into the ledger, thereby facilitating cross-border trade. A similar service is provided by EdoxOnline[6], which has offices in the Americas.

DP World[7] utilises a private blockchain to digitise trade documentation and certificates, including certificates of origin, thereby providing a ‘smart trade’ solution that involves importers, exporters and trade authorities.

These trade and DLT firms are all innovating in the area of DLT for trade, however, as private businesses, their services come at a significant cost. Perhaps of more relevance and interest to African economies, IOTA is an open-source DLT and cryptocurrency with a specific implementation for cross-border trade.[8] Their system is known as ‘Tangle’ and has all the elements of a cross-border trade and supply chain DLT system described above – the ability to integrate trade documentation from the source of the chain through the production process, customs processing and final distribution.

As IOTA puts it, a typical trade journey involves:

-

200 different types of communication

-

30 actors involved

-

$4 trillion per annum lost in global inefficiencies

These inefficiencies can be minimised through use of IOTA’s ‘permissionless’ DLT that allows access to the record of transactions and the documentation to all players involved in the trade process.

In fact, IOTA is already involved in Africa. Less than a year ago they began partnering with Trade Mark East Africa (TMEA) to improve the conditions for trade in East Africa[9]. The partnership will pilot IOTA’s Tangle system to move to paperless, DLT-based trade documentation. The aim will be to move traded goods more rapidly through the stages of transit, saving time and costs especially for the food/agri-processed sector which is so important to East Africa.

These DLT-driven trade platforms dovetail very well with ‘single window’ trade platforms. Single Windows (SWs) are platforms that simplify cross border trade by requiring only a single entry for each piece of documentation. DLTs are not required for a SW platform, but given their nature, basing SW platforms on DL technology is a logical progression. In fact, this is already being done in South East Asia. TradeNet, Singapore’s national single window (NSW) is being incorporated into a more comprehensive system DLT-driven platform, the Networked Trade Platform (NTP), which also incorporates a business-to-business (B2B) trade platform[10]. This ‘super’ single window will draw in documentation from business and government sources to create a repository of trade documentation and a single entry point.

The lesson for Africa is that the move to SWs should mean a move to DLT-driven trade platforms. The African Alliance for e-Commerce (AACE) is one organisation already pushing for the implementation of SWs in Africa, to facilitate intra-African trade and promote the African Continental Free Trade Area (AfCFTA)[11]. IOTA’s Tangle platform is DLT-driven and effectively a SW since blockchain requires only one copy of each document. The remaining challenge is to ensure a user-friendly experience and portability to mobile devices to ensure inclusivity for MSME traders.

The global economy is only now beginning to recover from the shock delivered by the Covid-19 pandemic. At time of writing, the commodity cycle has turned and the demand for Africa’s resource and resource-based exports will begin to climb. At the same time, the AfCFTA agreement is freshly inked and in effect. DLT-based systems can enter at this juncture, when both external and intra-African trade can be expected to resume growth. There is now scope for a reset in Africa; in how trade processes take place, what systems are used to facilitate them and how the multiple trade actors interact with the systems and each other. This will be a very strongly positive-sum technology-driven change.

[1] https://www.tralac.org/blog/article/13921-how-can-blockchain-support-intra-african-trade.html

[2] https://www.project-syndicate.org/commentary/poor-countries-technology-dilemma-by-dani-rodrik-2021-02

[3] https://weetracker.com/2020/03/25/leader-in-african-blockchain-adoption/

[4] https://weetracker.com/2019/02/27/proving-again-its-not-dollar-centric-blockchain-is-birthing-babies-in-tanzania/

[6] https://web.edoxonline.com/

[8] https://www.iota.org/solutions/global-trade-and-supply-chains

[9] https://www.businesswire.com/news/home/20200312005074/en/IOTA-Announces-Partnership-with-TradeMark-East-Africa-to-Bring-Supply-Chain-Transparency-to-Trade-Infrastructure

[10] https://mag.wcoomd.org/magazine/wco-news-87/going-beyond-the-single-window/

[11] https://africa-me.com/7th-single-window-conference-looks-to-boost-trade-links/

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...