Blog

South Africa-UK trade: comparing January-October 2019 and 2020

The United Kingdom (UK) is one of South Africa’s key trade partners. This remains so during the Covid-19 pandemic. Through cycles of social distancing measures (lockdowns) in both countries, the UK remains both a main destination and source market for South Africa. Although, the lockdowns have affected the value and composition of South Africa-UK trade.

This blog compares South Africa-UK trade for the first 10 months of 2020 with that of 2019. The data, sourced from the South African Revenue Services (SARS), is the customs valuation in domestic currency (millions of South African Rands).

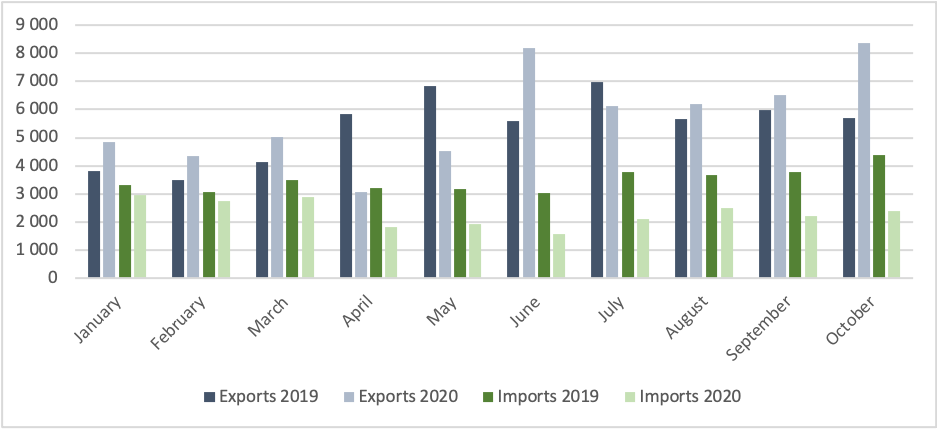

For 2019, the UK ranked the 5th destination market for South African exports and the 7th source market for imports. For 2020, the UK remains the 5th ranked destination but drops to the 10th ranked source market. Imports from Thailand, Japan, and Italy outperform imports from the UK. For January-October 2019 and 2020, South Africa shows a trade surplus (exports exceed imports) with the UK. For 2020, the trade surplus is double 2019’s – imports from the UK decreased by 34 per cent between 2019 and 2020, and exports increased by 6 per cent. While exports were able to recover post-South Africa’s lockdown, imports remain below 2019 levels. Monthly, South Africa’s UK exports for 2020 outperform 2019 in most months. The exception is after South Africa went into a hard lockdown in March 2020. For April and May 2020, exports were, on average, a quarter of corresponding 2019 exports. Imports from the UK for 2019 outperformed 2020 imports for all 10 months.

Figure 1: South Africa’s monthly exports to and imports from the UK; 2020 vs 2019

Source: SARS (2020)

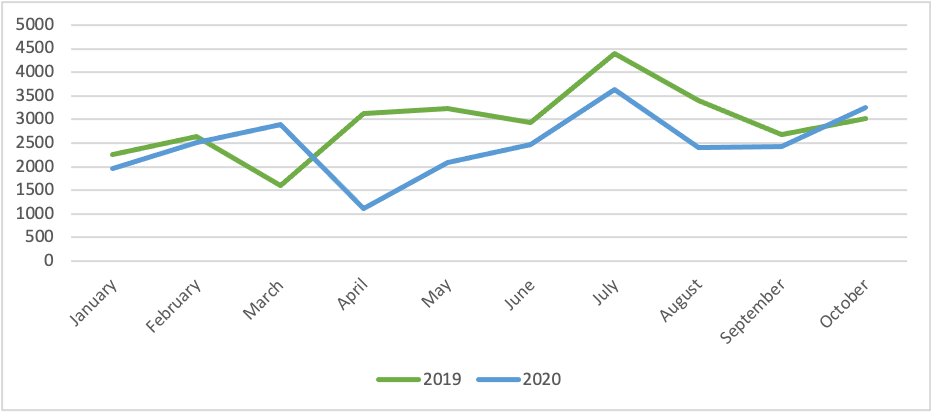

For 2020, the composition of South Africa’s exports to the UK changed. The top 10 exports for 2019 were platinum, vehicles, iron ores, grapes, and catalytic converters. Six of the top 10 export products for 2020 are base metals – platinum, rhodium, and palladium. 51 per cent of 2020 UK exports are base metals, it was 39 per cent for 2019. Exports of motor vehicles and iron ores show the biggest decline. Following South Africa’s hard lockdown, vehicle and iron ore exports reduced to zero and only started to recover from July onwards. The decline in these exports also directly relates to the sharp decline in maritime exports for the corresponding months.

Figure 2: South Africa's monthly maritime exports to the UK; 2020 vs 2019

Source: SARS (2020)

Imports of most products South Africa sources from the UK declined for 2020. The biggest decline is imports of motor vehicles and original motor vehicle components. On average, these imports decreased by a third and are still much lower than for 2019. Imports of whiskies were also negatively affected by South Africa’s alcohol ban. Imports of some products did recover post-lockdown and even outperformed imports for 2019. These include coiled steel, residual fuel oils, butter, live chickens, chocolate, machinery parts, and medicines.

Table 1: The change in imports of designated products

|

Imports

|

2019

|

2020

|

% change

|

|

Loading machines (belt type)

|

115.94

|

6.70

|

-94%

|

|

Passenger vehicles

|

2 301.04

|

1 317.89

|

-43%

|

|

Original motor vehicle components

|

1 865.30

|

1 171.71

|

-37%

|

|

Whisky

|

1 680.14

|

1 097.54

|

-35%

|

|

Live chickens

|

70.54

|

102.78

|

46%

|

|

Chocolate

|

67.02

|

98.20

|

47%

|

|

Electric generating sets

|

31.22

|

104.15

|

234%

|

|

Butter

|

0.00

|

136.90

|

1521117944%

|

|

Residual fuel oils

|

0.00

|

183.69

|

18368912800000000000%

|

|

Coiled steel

|

0.00

|

329.84

|

32984478800000000000%

|

Source: SARS (2020); tralac calculations

The data shows South Africa’s exports to the UK have so far been able to weather the impact of Covid-19 restrictions. Most imports have been unable to do the same, and 2021 might be more challenging. The Covid-19 pandemic is not over. Further cycles of lockdowns will continue to impact South Africa-UK trade. Also, the Brexit transition period ends 31 December 2020. On 1 January 2021, the SACU and Mozambique-UK Economic Partnership Agreement (EPA) (SACUM-UK EPA) comes into effect. Under this EPA, current market access conditions are set to continue. South Africa-UK trade will be governed by the SACUM-UK EPA and South Africa-EU trade by the SADC-EU EPA. Currently, there is no agreement between the EU and the UK for trade from 1 January 2021. The lack of an EU-UK trade agreement will have a knock-on effect for South Africa-UK trade. Especially, for transit traffic through the EU. Customs, clearance, and transit procedures will obstruct trade by delaying the movement, release, and clearance of goods at EU/UK border crossings.

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...