Blog

South Africa’s July 2020 trade data – exports recover while imports remain below 2019 levels

Between June and July of this year, South Africa’s total trade (exports + imports) increased by 12 percent.[1] Since May, South Africa has a trade surplus (global exports exceed imports) and although the trade surplus for July is lightly lower than the trade surplus recorded in June, it is almost three times the surplus recorded for May when South Africa’s economy started to re-open. This is opposite to June and July 2019 for which South Africa recorded a trade deficit for both months. The change from a deficit to surplus can be attributed to not only South Africa’s exports recovering in June and July, but also the inability of imports to recover to 2019 levels. Exports between April and May of this year doubled after which the average increase in exports were 9 percent over the next two months. Exports for June and July also surpass exports for the same months for 2019. However, import data shows a different picture – although month-on-month changes in the value of imports were minimal since January, imports have consistently remained at levels significantly lower than imports for 2019. In June and July of this year imports were close to half of imports for the same respective months in 2019.

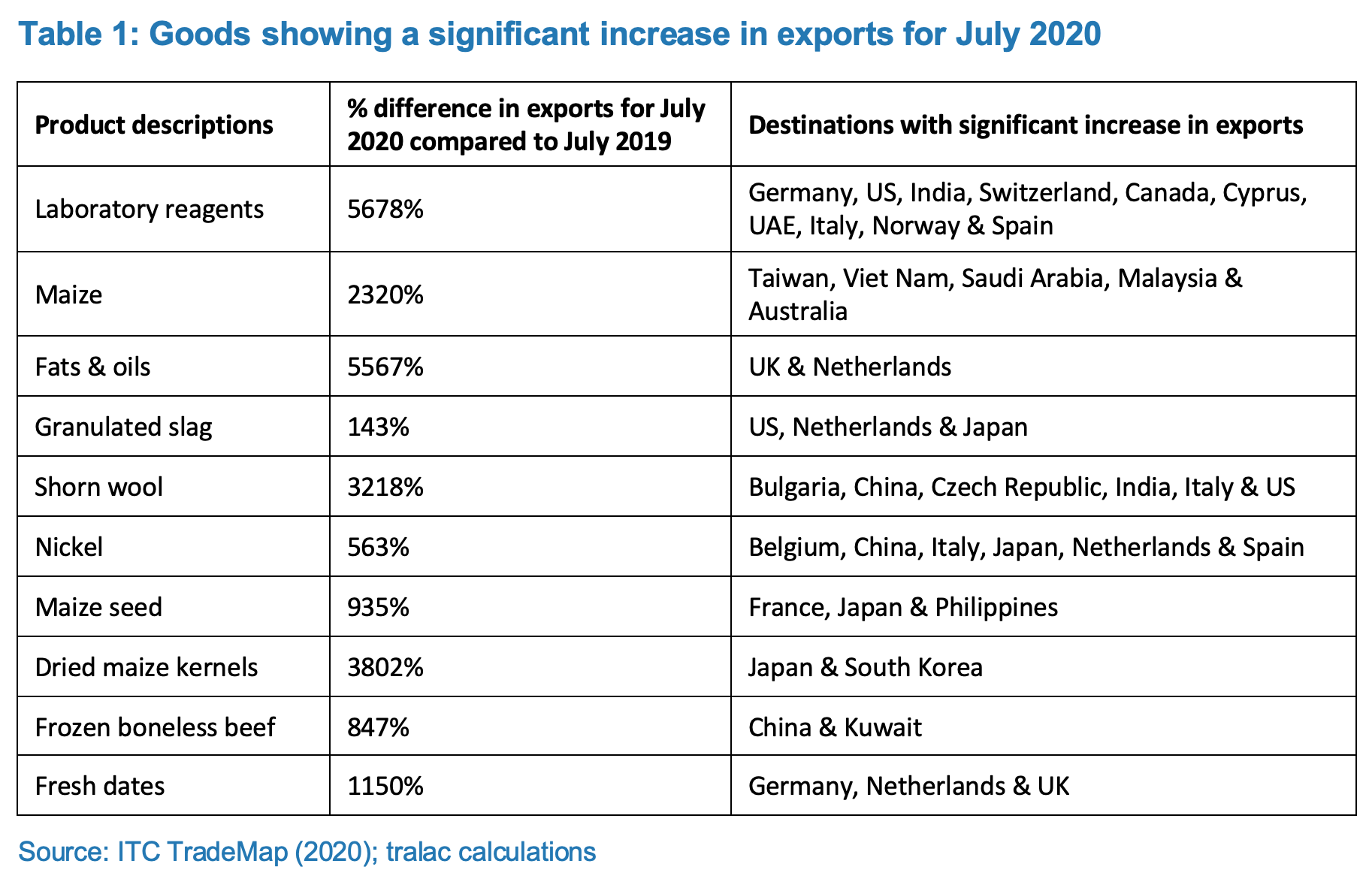

For July 2020, 78 percent of exports were to countries outside Africa (rest of the world (RoW)). Between June and July 2020 exports to the RoW increased by 7 percent and RoW exports for July 2020 were 15 percent higher than for July 2019. Traditional markets; China, Germany, US and UK kept their top positions as destinations although exports to China and the UK declined between June and July 2020 and exports to Japan, India, Belgium, Spain and France for July 2020 were on average 23 percent lower in comparison with exports for July 2019. The decline in exports can mainly be attributed to a decrease in exports of motor vehicles, but also products including sulphates, ferro-chromium, airplane parts and citrus fruits. Apart from motor vehicles, traditional exports (gold, ores and coal) have remained at the top while there was a significant increase in exports of some products which were not exported in significant quantities to the RoW in July 2019.

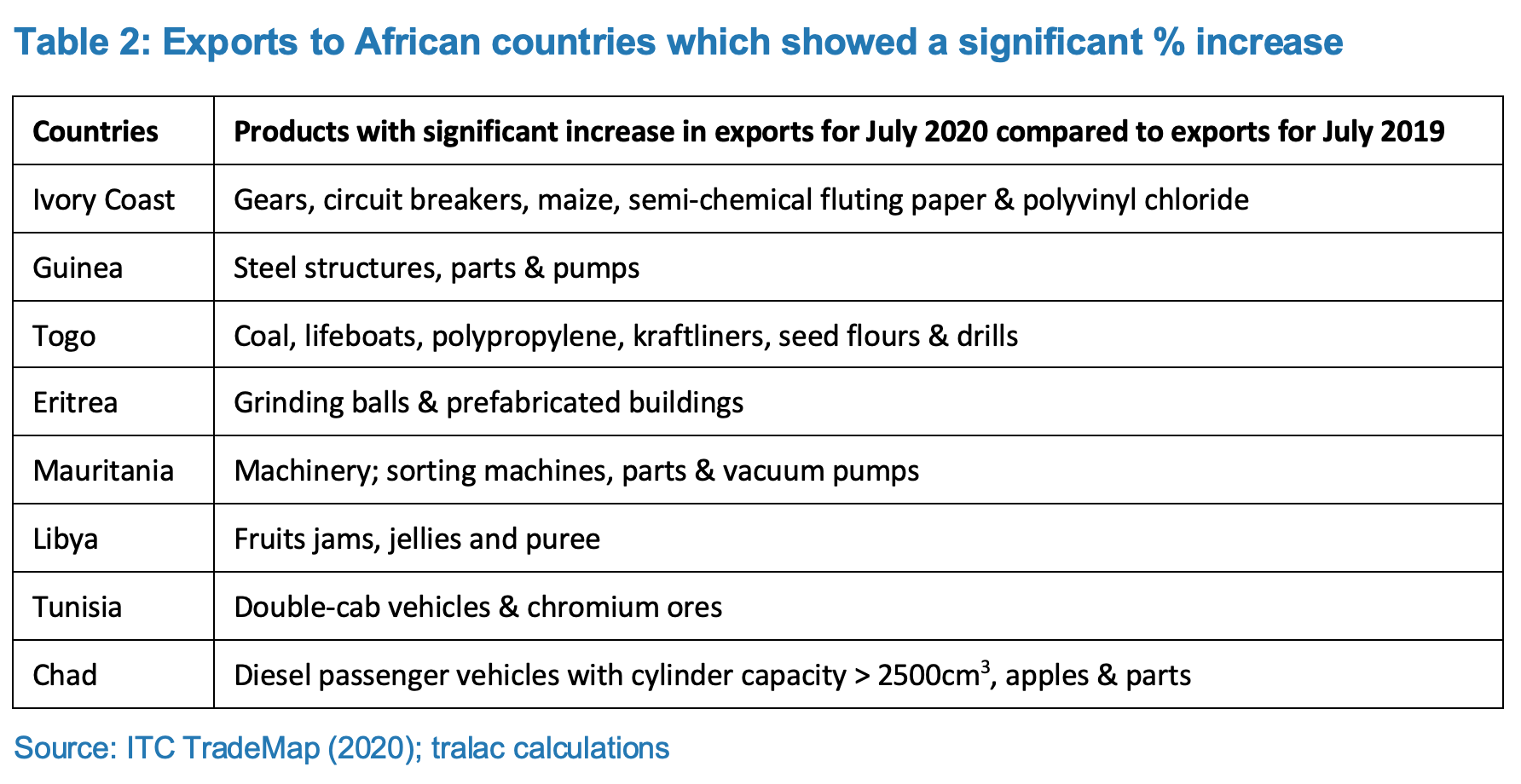

For July 2020, South Africa’s intra-Africa exports were 2 percent higher than exports for June 2020 but 5 percent lower than for July 2019. Exports are still mainly to other SACU and SADC FTA member countries with only DRC and Kenya among the main destinations countries which are not part of these two trade arrangements. However, exports to Mozambique (main destination), Botswana (ranked 2nd) and Zimbabwe (ranked 4th) declined between June and July 2020 while exports to the top ten destination markets except Zimbabwe, Eswatini and Malawi were lower for July 2020 in comparison with exports for July 2019. South Africa’s exports to numerous countries in north and west Africa increased between June and July 2020 with July 2020 exports being significantly higher than exports to these countries for July 2019 (although some starts from a very low base). Also, South Africa’s exports to Eritrea for July 2020 are four times exports for July 2019 and more than double the exports for June 2020.

For July 2020, South Africa’s intra-Africa exports were 2 percent higher than exports for June 2020 but 5 percent lower than for July 2019. Exports are still mainly to other SACU and SADC FTA member countries with only DRC and Kenya among the main destinations countries which are not part of these two trade arrangements. However, exports to Mozambique (main destination), Botswana (ranked 2nd) and Zimbabwe (ranked 4th) declined between June and July 2020 while exports to the top ten destination markets except Zimbabwe, Eswatini and Malawi were lower for July 2020 in comparison with exports for July 2019. South Africa’s exports to numerous countries in north and west Africa increased between June and July 2020 with July 2020 exports being significantly higher than exports to these countries for July 2019 (although some starts from a very low base). Also, South Africa’s exports to Eritrea for July 2020 are four times exports for July 2019 and more than double the exports for June 2020.

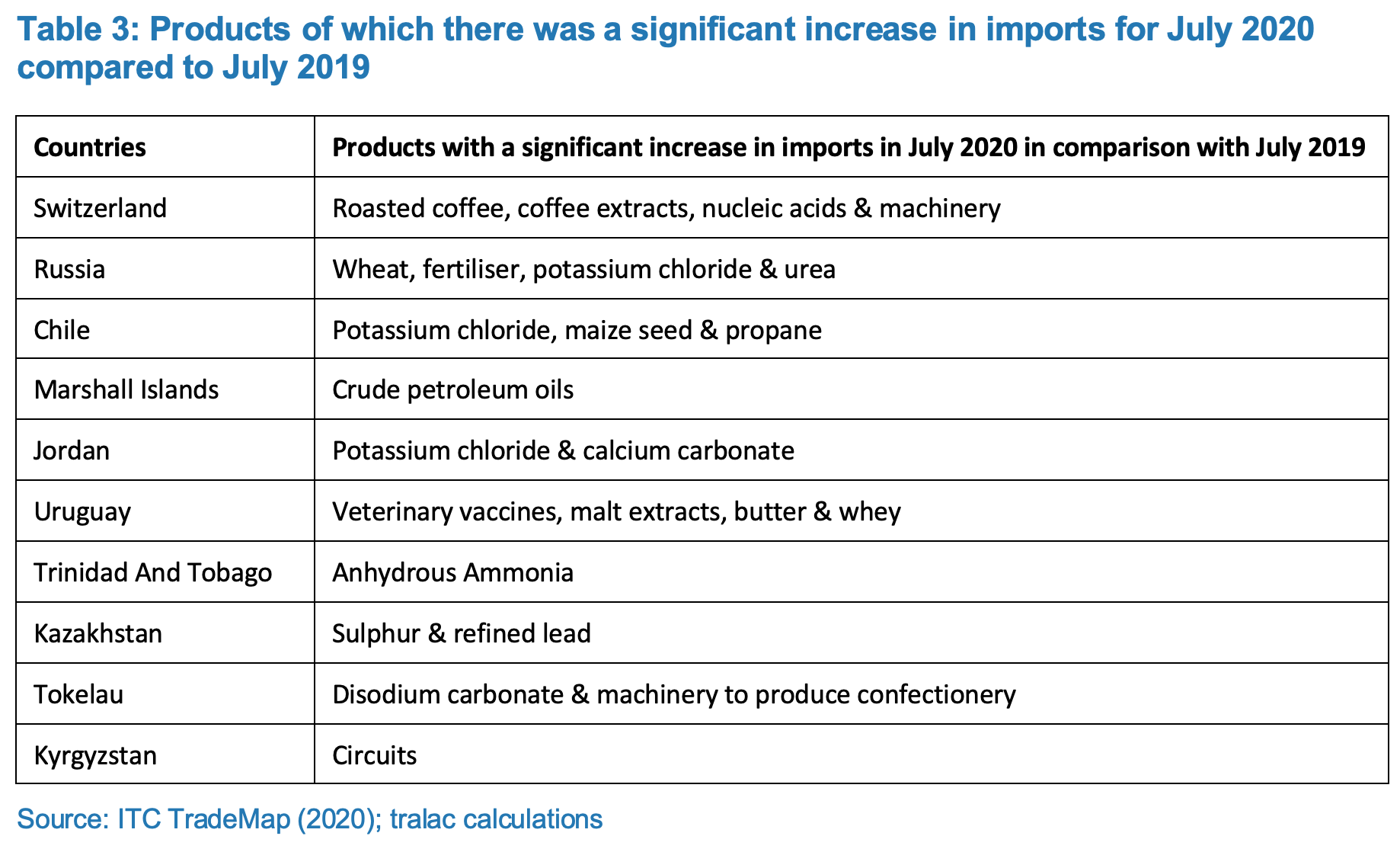

For July 2020, 89 percent of South Africa’s imports were sourced from countries outside the African continent, mainly from traditional sources including China, Germany, the US and India. Although RoW imports increased by 21 percent between June and July 2020 imports are still 27 percent below that of RoW imports for July 2019. This is mainly due to imports of vehicles and original vehicle component parts – although these imports are starting to recover after the hard lockdown in South Africa it is still far below 2019 levels. Apart from these products, imports of urea, residual fuels, track laying bulldozers and fertilisers also increased by June and July 2020 while imports of some medicines and medical equipment declined for the first time since March of this year. Although imports are still below July 2019 levels there was an increase in some import products sourced from countries in eastern Europe and South America.

Although South Africa’s intra-Africa imports for July 2020 are 42 percent higher than for June 2020, July 2020 imports are 22 percent below July 2019 levels. The increase between June and July 2020 are mainly due to an increase in imports from Nigeria (crude petroleum oils), Mauritius (clothing), Togo (distillate fuel), DRC (cathodes), Madagascar (clothing), Tunisia (petrol, monocalcium phosphate and trousers) and Ethiopia (Arabica coffee and kidney beans). However, imports of some of the main intra-Africa import products have remained below July 2019 levels – crude petroleum oils, food/beverage additives, cathodes, coal, ignition wire sets, cotton shirts and trousers. On the contrary, imports products like gold, lifeboats, distillate fuel, white chocolate, coke of coal, cotton and whole ginger were significantly higher than intra-Africa imports for July 2019.

[1] pdf South Africa Merchandise Trade Statistics: July 2020 including BELN (263 KB)

See a related tralac Blog: January-June 2020 trade data: intermediates destined for African countries in transit through South Africa

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...