Blog

A gender agenda: South Africa’s tourism trade

South Africa has a sophisticated framework for gender equality. Equality is enshrined in the constitution, and legal protections and institutions are in place. Despite this, gender inequality persists. Female-headed households are consistently poorer than male headed households, women spend more time on unpaid work,[1] the gender-wage gap is 23%[2] and one in five women are subject to partner violence.[3]

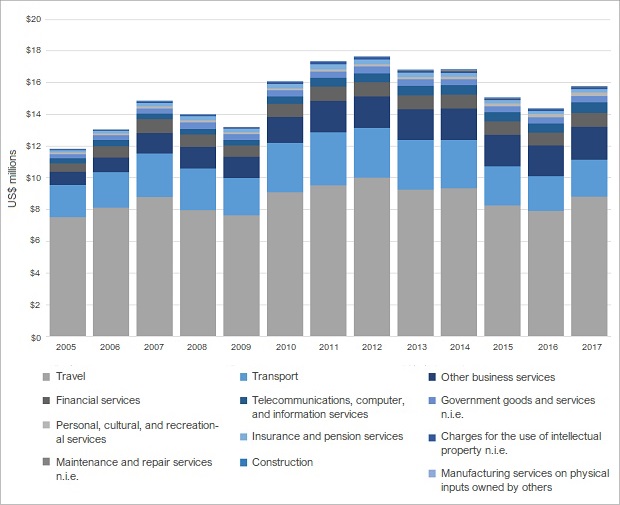

Services contribute 61% of South Africa’s GDP[4] and are an increasingly important part of international trade. Services account for 6% of South Africa’s total exports, but 47% of exports by value added.[5] Services sector employment has increased significantly since democracy in 1995, and in 2017 84% of female employees were in the services sector.

In this context, South Africa is negotiating the African Continental Free Trade Area agreement (AfCFTA) with the other 54-member states of the African Union. A services protocol has been agreed covering the overarching aspects of services trade, which is the basis for negotiations in five priority services sectors: telecommunications, business services, tourism, transport and financial services.

All of these sectors will be important for South Africa, however, this tralacBlog will focus on one sector where South Africa has natural endowments, significant trade and where we typically find a concentration of female employment – tourism. Tourism involves many service providers – hotels, tour operators; but also, related sub‑sectors such as local retail, restaurants and transport. Tourism employs 4.5% of South Africans (more than mining) and contributes around 3% to South Africa’s GDP (more than agriculture). More women than men are employed in tourism subsectors including food and beverage service and accommodation.[6]

South Africa’s commitments on the tourism sector under the General Agreement on Trade in Services (GATS) indicates a sector largely open to foreign trade and investment, albeit with some exceptions.[7] South Africa has not committed to market access or national treatment for tour guide services operating cross-border, or for hotels and accommodation and has only made general commitments on the movement of persons for tourism services. South Africa is also a member of the Southern African Development Community and has acceded to the SADC tourism protocol.

Source: ITC Trademap, 2018

Given its prioritisation, South Africa may further open the tourism sector as part of AfCFTA negotiations, meaning increased investment in South African tourism infrastructure, or more providers from across the continent delivering services in South Africa. The AfCFTA also encourages sector development and regulatory improvements. This, plus improved trade facilitation and other complementary services, as well as concurrent efforts on the movement of persons and air services, could lead to increased tourist numbers from other parts of Africa.

Given that more women than men are employed in this sector, the increase may have a disproportionately positive impact on female employment. Increased tourism may also create opportunities for female entrepreneurs, and indeed, some research from one South African province suggests that ‘female-owned businesses access international markets mostly through the services sector’.[8] Although women still tend to be more likely to be working in tourism, rather than owning tourism businesses.

To maximise the opportunity for women, at the domestic level South Africa should invest in infrastructure, improve visa facilitation, focus on destination branding, promote inward foreign investment in infrastructure, and commit to public infrastructure development (such as airports). With South Africans’ experience in tourism, South Africa should also seek access to enter tourism services markets in other member states.

While increases in tourism and further domestic tourism-increasing policies may create more jobs and opportunities for South African women, like other sectors, tourism tends to be characterised by occupational gender segregation – women tend to be housekeepers and waitstaff, while men tend to take on higher paying roles such as guides. Within the occupations, there is also vertical segregation, with men more likely to hold senior, managerial positions.

Women are less likely than men to own services businesses, with only 26.1% of services sector firms (excluding retail) having female participation in ownership[9], so women are less likely to benefit from this opportunity. In addition, by opening the tourism sector to more continental entrants, the AfCFTA may bring increased competition to women entrepreneurs. While this can have a positive effect for consumers, it may force out less competitive women-led businesses.

In addition, tourism, by its nature is a seasonal industry, resulting in insecure employment and business income that can increase women’s vulnerability. Tourism can also be a volatile industry – it is severely affected by exchange rate fluctuations, and socio-political developments (e.g. unrest, political change), and weather (e.g. Cape Town drought).

This means that in order for increased tourism to support gender equality and women’s economic empowerment, other policy measures must accompany the trade measures.

Along with the issues specific to tourism, other areas of gender equality impact on women in this sector. Gender-based violence increases women’s vulnerability and has a negative impact on employment by increasing absenteeism and decreasing productivity. On the other side, reducing the gender wage gap can contribute to addressing gender-based violence by increasing bargaining power in relationships.[10] In addition, the burden of unpaid care can mean women have less time to participate in formal employment, start or grow their businesses. While these problems affect more than just women’s employment and entrepreneurship, and require structural societal change, trade interventions should accommodate or address aspects of these issues.

Trade support measures should include training that is flexible in delivery and easy to access – perhaps inside the home, or nearby. Management, leadership, language and entrepreneurship training should be specifically directed towards women. The provision of childcare and schools close to places of work will also support women involved in tourism. Employers should be encouraged to be flexible and provide appropriate paid leave. Women owners can also be supported by accreditation, and promotion via trade fairs. There is also opportunity to develop niche tourism markets – such as community‑based tourism, voluntourism and eco-tourism that support and empower women owners and workers. Particularly in high-end tourism, marketing efforts could target conscious consumers who want to spend their money in a way that will be beneficial for women, thus encouraging employers to improve conditions. Given the seasonality and volatility of international tourism, the domestic tourism market should also be developed. Finance for business development should be directed at those areas where women are more likely to be owners or senior workers.

Increased tourism in South Africa stemming from the AfCFTA represents an opportunity for South African women, but if women are to really benefit from this, policy makers must understand the challenges facing women, and carefully target trade support measures towards women.

http://www.statssa.gov.za/publications/Report-02-02-00/Report-02-02-002010.pdf

[2] Median wage gap (2015), StatsSA

[3] StatsSA, 2016. South Africa Demographic and Health Survey 2016: Key Indicators Report, accessed at: https://www.statssa.gov.za/publications/Report%2003-00-09/Report%2003-00-092016.pdf

[4] World Bank World Development Indicators, 2018, accessed at https://data.worldbank.org/indicator/NV.SRV.TOTL.ZS?locations=ZA&view=chart

[5] OECD South Africa, accessed at https://data.oecd.org/south-africa.htm

[6] ILO reports that for 2015 (the latest year of data) 75 000 men and 98 000 women were employed in the accommodation sector in South Africa and 146 000 men and 238 000 women were employed in food and beverage service. StatsSA does not publish sex disaggregated data on tourism employment.

[7] WTO GATS Schedules, accessed at: https://www.wto.org/english/tratop_e/serv_e/serv_commitments_e.htm

[8] Bossuroy, T., Campos, F., Coville, A., Goldstein, M., Roberts, G. and S. Sequeira. 2013. ‘Shape Up and Ship Out? Gender Constraints to Growth and Exporting in South Africa.’ In P. Brenton, E. Gamberoni and C. Sear (Eds), pdf Women and Trade in Africa: Realizing the Potential (3.64 MB) . World Bank.

[9] World Bank Enterprise survey.

[10] Aizer, A. 2010. ‘The Gender wage gap and domestic violence’. American Economic Review, 100(4): 1847-1859, accessed at https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4123456/

About the Author(s)

Leave a comment

The Trade Law Centre (tralac) encourages relevant, topic-related discussion and intelligent debate. By posting comments on our website, you’ll be contributing to ongoing conversations about important trade-related issues for African countries. Before submitting your comment, please take note of our comments policy.

Read more...