News

Swaziland in SACU funds shocker

The ministry of finance says member states revenue shares for 2015/16 will be concluded in December after South Africa, being the manager of the pool has provided the forecast of the size of the pool for the next (2015/16) financial year and has provided the audited size of the pool for the previous year (2013/14)

Revenue receipts from the Southern African Customs Union (SACU) for the next financial year (2015/16) might drop.

They are expected to fall below the E7.4 billion that the government received during the current financial year, the ministry of finance has reported.

This could spell disaster for the country as it is likely to relive challenges the country faced in 2011 when it had to freeze salary increases for it to cope with the cash-flow problems the country faced.

The possible SACU money drop is according to the second quarter performance report for the ministry tabled by Minister Martin Dlamini in Parliament on Monday.

The second quarter of the government financial year covers three months, from July to September.

The major cause for concern is the performance of the economy of South Africa, being the major contributor into the Southern African Customs Union revenue pool. The ministry of finance says member states revenue shares for 2015/16 will be concluded in December after South Africa, being the manager of the pool has provided the forecast of the size of the pool for the next (2015/16) financial year and has provided the audited size of the pool for the previous year (2013/14).

The ministry further stated that the modest growth of the South African economy of 1.9 percent in 2013 from 2.5 perecnt in 2012, the protracted mining sector strikes and a decline in that country’s manufacturing sector output remained a cause for concern as they may translate to a decline in extra-SACU imports. Such could lead to a reduction in the size of the revenue pool.

The ministry further noted that recent estimates put the 2014 South African Growth Domestic Product (GDP) growth at 1.4 percent and if the audited size of the revenue pool is below the forecast which was provided in 2012, then, the country would be required to pay more money back into the pool.

It says such a situation could further diminish revenue for the next financial year (2015/16).

“Considering all the above factors, particularly the level of intra-SACU imports for Swaziland and the economic performance of the South African economy, SACU receipts for the country for 2015/16 might fall below the 2014/15 level of E7.4billion,” the ministry reported.

In September, finance ministers from the union’s member states participated in the SACU Task Team on Trade Data reconciliation.

The purpose of the meeting was to finalise the process of reconciling intra-SACU trade data for 2012/13 which would be used to determine their revenue shares for the next financial year (2015/16).

In the meeting, member states further presented and confirmed their GDP and population data for 2012, in line with the SACU Agreement which requires member states to submit their data GDP, population and intra SACU imports and exports for the most recent financial year for purposes of sharing.

This finalised intra-SACU trade data for 2012/13, GDP and population levels would be used to determine revenue shares for 2015/16.

Revenue receipts from SACU finance about 60 percent of the national budget.

Last week, South Africa’s Finance Minister Nhlanhla Nene announced that his country’s economic growth was much slower than anticipated.

According to a report from SAPA, the minister said the GDP growth was expected to be half of what was forecast in February, at 1.4 percent. Nene warned that South Africa has reached an economic turning point.

He announced firm measures to check South Africa’s worsening debt outlook, warning that the country had reached an economic turning point. Nene said GDP growth was now anticipated to be 1.4 percent this year (2014/15), almost half of the 2.7 percent forecast in February. He said growth was expected to reach three percent in 2017.

Expenditures growing twice more than revenue

Government expenditures are growing more than twice as fast as revenues.

This has been the trend from the last financial year, 2013/14 and the situation is still the same even in this financial year.

During the 2013/14 financial year, revenue grew around E700 million while expenditures increased by E2.3billion. This financial year, expenditure is projected to increase by E2.2 billion while revenues are projected to grow by only El billion. The finance ministry said this is despite an outstanding revenue collection performance on the part of the Swaziland Revenue Authority (SRA). It said the recent expenditure-revenue divergence will affect available financing over the medium term. The finance ministry further stated that line ministries are failing to mitigate high expenditures in the medium to long term. However, the ministry is positive that in the next two quarters, budget execution would materialise as planned.

It says over-expenditures related to the wage bill and other unbudgeted decisions may or may not be contained under the existing 2014/15 budget.

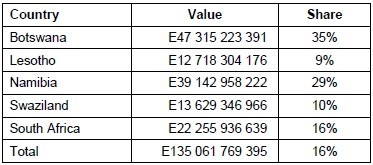

The intra-SACU trade data for the countries was presented as follows:

Member states’ presentations of GDP and Population levels:

What it would mean if SACU money drops

It would be not the first time Swaziland is faced with such woes with the SACU money drop.

Swaziland’s SACU receipts dropped to E1.9billion in 2011. This followed a global economic meltdown which hit the world hard around 2010. Swaziland encountered serious financial challenges then.

Recap of 2011 challenges

-

Government could not cope with some of its responsibilities. It struggled to pay civil servants’ salaries which accounted for over 40% of its expenditure.

-

In light of the low SACU revenue, the International Monetary Fund (IMF) proposed various fiscal adjustment strategies for the government.

One of the key recommendations for Swaziland was to reduce the huge public sector wage bill.

-

Government announced that 7 000 public service jobs would be cut in 2011 a move that was expected to save money but also came with fears that such could compromise public service delivery and further contribute to an unemployment rate that already stood at 40 percent at the time.

-

Government suspended new recruitments into the civil service, froze salary increases and short-term borrowing.

-

The IMF predicted that if government did nothing to confront its economic problems, public debt would hike from 19 percent of GDP in 2010 to 31 percent in 2011, eventually constituting 75 percent of GDP by 2015. However, the public debt stock currently stands at E6.9billion, which amounts to 16.7 percent of GDP.

SD granted E8m from COMESA

Swaziland has been granted E8million for funding of national programmes related to regional integration.

However, the ministry of finance is required to submit projects that are regional integration related to be considered for the funding.

While the country gets the funding offer, it has still not been able to adopt any COMESA harmosined standards.

The ministry of finance says this is due to inconsistency in the procedures for harmonisation between COMESA and the Southern African Development Community (SADC) as Swaziland is affiliated to both regional organisations.

It says the situation has historically put the country in a position where it can only focus on standards harmo0nisation under SADC given her deeper integration within SADC and her stronger industrial and economic ties to South Africa.