Discussions

Development of Tourism value chains in the SADC region

JB Cronjé, tralac Researcher, comments on the recently-published World Trade Report 2014 and the development of tourism value chains in SADC

The World Trade Report 2014 (click here to download) of the World Trade Organization looks at four main recent economic trends. These trends are: the economic rise of developing countries, the growing integration of production through supply chains, higher prices for agriculture and natural resources, and the increasing interdependence of the world economy. The importance of global value chains and the potential opportunities it can offer to developing countries to integrate into the global economy have grown steadily over time.

In southern Africa, there is a growing focus on beneficiation and value addition to the region’s wealth of natural resources as a basis for industrial development, economic diversification and regional value chains. Although the fragmentation of production is nothing new, technological changes in transportation and communication have lowered logistics costs and allowed countries to specialise in the production of tasks and components.

Services play an important role in global value chains and can be directly traded across borders (e.g. services offshoring) or indirectly traded where services are embodied in manufacturing exports. According to the Report, trade in services within global value chains accounts for more than 10 percent of developing country exports. For most economies, trade in manufacturing goods still accounts for the bulk of global value chain trade in mainly electrical equipment and in the chemicals and minerals sectors. The Report shows that manufacturing value added trade within global value chains constitutes 21 percent of developing countries’ exports compared with 17 percent in the case of services value added.

The Report also shows that the participation of Least Developed Countries (LDCs) in value chains and services exports remains limited. The share of LDCs in world exports of commercial services is a mere 0.65 percent of which transport services (22 percent) and communication services (8 percent) constitute the second and third biggest components, respectively. In turn, transport services are dominated by travel services, i.e. tourism. The development of the tourism value chain can play an important role in the economic development and growth of LDCs. This should be of particular interest to the Southern African Development Community (SADC) with over half of its membership classified as LDCs.

The World Travel and Tourism Council (WTTC) estimates that for every US Dollar spent on travel and tourism, USD 3.2 is generated in GDP across the entire economy. According to the WTTC, the direct contribution of travel and tourism services to GDP in 2013 was USD 19.2 billion (2.9 percent of GDP) for the SADC region. This mainly reflects services such as hotels, travel agents, airlines, other passenger transport services and other services such as restaurants and entertainment services directly supported by tourists. Tourism indirectly benefits other economic sectors such as agriculture, construction, communications and conference and event management.

In 2014, the SADC region is expected to attract 24.5 million international tourist arrivals and capital investment in the sector is expected to rise by 2 percent from USD 9.2 billion the previous year. In 2013, the travel and tourism industry directly employed 2 million workers (3 percent of total employment) and generated 5.2 million indirect jobs (7.4 percent of total employment) in the SADC region. The tourism sector is a labour intensive industry, demanding different skill sets from unskilled labourers (housekeeping, food service and groundskeepers) to managers. Tourism includes a range of personalised products and services. Workforce development (hospitality training, foreign language capabilities, time management, customer service, communication skills) is therefore very important to support any upgrade initiative.

The SADC Protocol on Tourism aims to contribute to human resource development through the development of skills at all levels of the tourism industry. SADC Members decided to coordinate and harmonise training at tourism training institutions and to harmonise training standards in the region. They have also decided to establish a regional quality and standards control mechanism and to harmonise the standards for registration, classification, accreditation and grading of service providers.

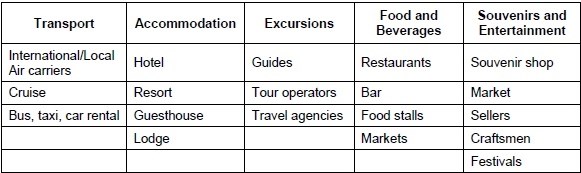

The tourism value chain includes services related to international travel organisation such as travel agents and tour operators, international transport and a variety of services in the destination country. The tourism global value chain in figure 1 presents a broad classification of the types of activities in the tourism industry. Tourists may decide to bypass some activities and some tourism-related services such as financial services and computer reservation services are imbedded in other activities and are not visually presented.

Figure 1: A tourism value chain

Source: World Trade Report 2014

Christian (2011) says that international airline carriers, cruise lines, global tour operators, and multinational hotel brands are the lead firms in the tourism global value chain. These firms play an important role in shaping tourism trends through aggressive marketing campaigns. With changes in internet technologies came virtual travel agencies providing a shared platform for information regarding airlines, hotels, tour scheduling and prices with online booking and reservation services.

The ability of countries to capture the gains from tourism growth depends on the development of linkages between the local and global industries. Christian (2011) argues that economic upgrading within the tourism global value chain can occur simultaneously in different market segments and in four key ways.

First a country can facilitate the establishment of foreign firms (airlines, tour operators, travel agents and hotels) to establish it as a tourist destination. Opening market access to foreign services suppliers provides opportunities to enter into new value chains and potential technology and skills transfers. Increasingly, for example, airports such as Johannesburg, Nairobi and Addis Ababa find themselves competing with each other as hubs or transit airports that act as links to other destinations in the region and beyond. In the absence of implementation of the Yamoussoukro Decision of 1999 which provides for the liberalisation of air transport on the continent, airports increasingly need to differentiate themselves (this can be achieved by countries abolishing visas and transit visas, and providing streamlined arrival and customs procedures but also by offering airport facilities, shopping, accommodation) by acting as enablers for the tourism sector to attract passengers.

Second, tour operators can functionally upgrade their services to offer increasingly complex logistic and coordination services from local guides to excursion operators. Third, tourism firms adopting IT business functions, allowing for direct online booking and reservation, is a process upgrade strategy and cuts out international intermediaries. Finally, product upgrades in, for example, accommodation can occur when hotels move to a higher level of service, luxury or size. Another common form of product upgrade in the tourism sector is when one or more tourism product such as adventure, event, medical, or sand, sea and surf tourism is deepened or expanded. The ongoing negotiations under the SADC Protocol on Trade in Services on the liberalisation of trade in services, including tourism, provides an opportunity for SADC Members to offer market access to tourism services suppliers to exploit the region’s natural assets (fauna/flora, environment, historical sites, cultures) and to upgrade within the tourism value chain.

Sources:

Christian, M., Fernandez-Stark, K., Ahmed, G., Gereffi, G., 2011. The Tourism Value Chain: Economic Upgrading and Workforce Development. Duke University: Center on Globalization, Governance and Competitiveness (Duke CGGC).

WTO, 2014. World Trade Report 2014 - Trade and Development: recent trends and the role of the WTO. Geneva: World Trade Organisation.

WTTC, 2014. Travel and Tourism: Economic Impact 2014 SADC [Online]. Available: http://www.wttc.org/focus/research-for-action/economic-impact-analysis/regional-reports/