Discussions

Southern Africa and the latest Global Information Technology Report

JB Cronjé, tralac Researcher, discusses the findings of the recently-published Global Information Technology Report 2014

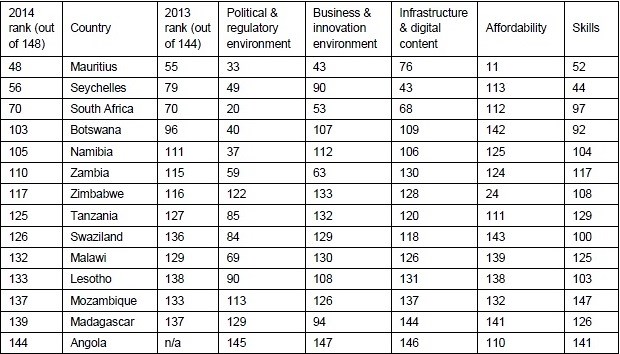

The recently released 13th edition of the World Economic Forum’s Global Information Technology Report 2014, places the spotlight on the importance of Information and Communication Technologies (ICTs) as an important means to facilitate and stimulate economic activity and create employment and new business opportunities. ICTs are key inputs in the production of goods and services. The cost, quality and reliability of ICTs influence the competitiveness of businesses. The Report provides an overview of the state of current market conditions and connectivity in the world. It features the latest global rankings of the Networked Readiness Index (NRI) for each of the 148 economies included in the Report. The NRI consists of 4 sub-indices measuring the environment for ICTs (political and regulatory environment, and business and innovation environment), the readiness of a society to use ICTs (infrastructure and digital content, affordability, and skills), actual usage by all major stakeholders (individual, government, business), and the impact that ICTs generate in the economy and in society. Table 1 below shows that countries in southern Africa generally rank low on the NRI. The region has poor ICT infrastructure, which is prohibitively costly to access. Despite an above average political and regulatory environment, weaknesses in the region’s business and innovation systems and poor skills sets result in ICTs making low positive economic and social impact.

Table 1: Networked Readiness Index ranking by year by country and selected sub-index

Source: WEF Global Information Technology Report 2014

In the case of South Africa, inadequate ICT infrastructure (68th) contributes to the very high ICT costs (112th). A lack of internet and telephony competition (125th) and infrastructure including electricity production (kWh per capita), mobile network coverage (percentage of population), and international internet bandwidth (kb/s per user), make ICTs uncompetitive and less affordable when measured in terms of prepaid mobile cellular tariffs (128th) and fixed broadband internet tariffs (91st). The Report suggests that weaknesses in the business and innovation environment (53rd), especially in skills development (97th), negatively affect the country’s economic potential despite the relatively robust regulatory environment (20th). The country’s dismal rankings, as derived from the World Economic Forum’s Executive Opinion Survey, on the quality of the educational system (146th) and that of math and science education (148th) stand in stark contrast with business executives’ perceptions of the efficiency of the legal system in settling disputes (12th), judicial independence (22nd), intellectual property protection (18th), availability of venture capital (28th), and quality of management schools (23rd). Other indicators in the Report show that the business community vigorously uses ICT for interaction with other businesses (30th) but to a lesser extent with consumers (62nd). The Report also notes that the South African government is providing few online services (80th) which results in ICTs having a low social impact (113th) on communities.

In 2012, the Southern African Development Community (SADC) adopted an ICT Sector Plan as part of its Infrastructure Development Master Plan. The Plan acknowledges that ICTs cuts across almost all social and economic sectors and can enable the region to reach its integration goals. The Plan emphasises the need to address policy and regulatory gaps and constraints both at Member State and regional level. In particular, the Plan highlights the need to reduce the market dominance of incumbents. This requires regulation that would ensure cost-based access to essential facilities, infrastructure sharing (duct and mast sharing, active equipment sharing, deployment and maintenance sharing costs) and tariff (interconnection, call-termination, wholesale and retail broadband price) setting. Competition authorities to ensure competition and regulatory authorities to enforce rules and resolve disputes lack in many cases the capacity to perform their functions. The key role for national regulatory authorities and the Communication Regulators’ Association of Southern Africa (CRASA) are to ensure the enabling environment is in place and maintained. The Plan suggests that the extent of market liberalisation needed in the sector is not fully appreciated. Competition in the mobile sector can make policy-makers believe that the sector is more open to participants than it really is. SADC Member States have adopted a Protocol on Trade in Services and are currently negotiating the liberalisation of trade in services, including communications services. The opening of communication markets to competition will go a long way to contribute to the achievement of the region’s integration and development goals but it will need to be complemented with the necessary pro-competition policies and adequate regulatory and governance frameworks.

South Africa and the rest of the region’s inability to develop and leverage its ICT potential prevents it from reaping the economic and social benefits such as increased competitiveness and creation of a knowledge-based society that ICTs could bring.